New Evidence That Obamacare Is Working?

Obamacare supporters are excited by a research article suggesting Obamacare is working to increase access to care. In an article published in JAMA: The Journal of the American Medical Association, researchers followed up respondents to the Gallup-Healthways Well-Being Index (which I’ve discussed previously.)

Yes, in an absolute sense, their access to care improved. According to the Huffington Post’s Jonathan Cohn, this means “Another Argument From Obamacare Critics Is Starting To Crumble.”

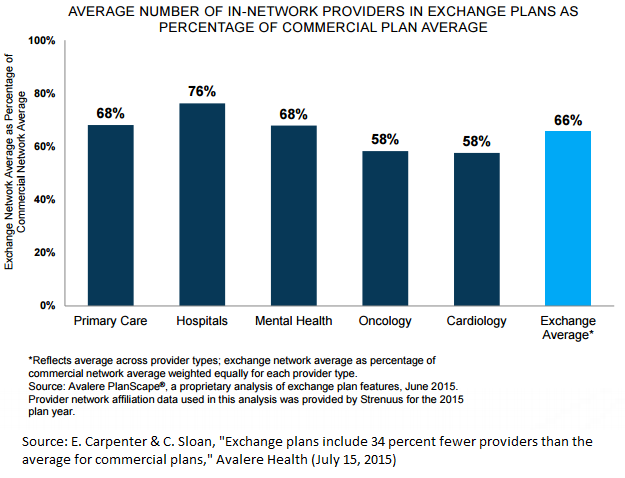

Oh dear. Even Citizen Cohn admits “The picture from the raw data is a little muddled” and “like all academic studies, this one will be subject to scrutiny that, over time, could call its findings into question.” Well, I won’t call them into question, just point out what is obvious from the abstract itself: Obamacare is dong a terrible job increasing access to care.