Health Construction Declined in January, Robust Year on Year

The construction market was weak overall in January, especially in health facilities, where construction starts declined 1.6 percent from December. Other construction starts declined only 1.0 percent. Health facilities construction accounted for just under six percent of the value of all new nonresidential construction.

The construction market was weak overall in January, especially in health facilities, where construction starts declined 1.6 percent from December. Other construction starts declined only 1.0 percent. Health facilities construction accounted for just under six percent of the value of all new nonresidential construction.

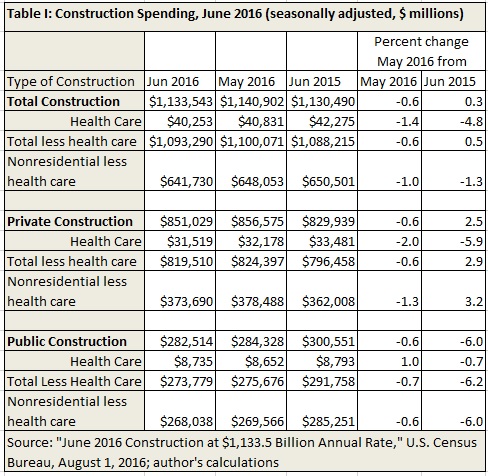

Construction of private health facilities dropped 0.2 percent, versus an increase of 0.3 percent for private non-health facilities. Private health facilities construction starts accounted for over seven percent of private nonresidential construction starts. Construction of public health facilities dropped by 6.6 percent. However, construction of other public facilities dropped by 4.9 percent. In other words, the decline in health facilities construction was 0.4 percentage points worse than the change in non-health private construction, versus 1.7 percentage points worse than non-health public construction (Table I).