GDP: Strong Health Spending In Weak Report

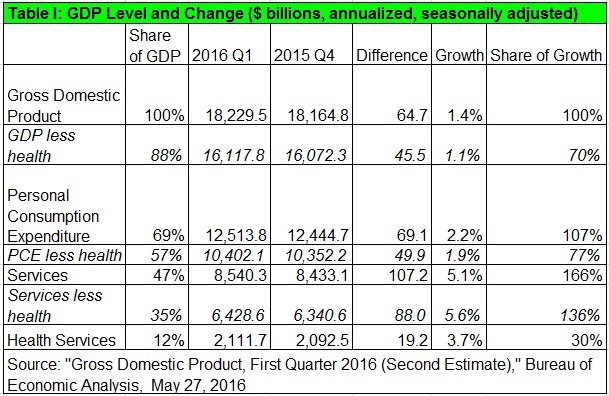

For those (like me) concerned about how much health spending continues to increase after Obamacare, today’s second report of fourth quarter Gross Domestic Product shows concern is still warranted. Because of revisions to the advance estimate, health spending accounted for a greater share of GDP than we had thought.

For those (like me) concerned about how much health spending continues to increase after Obamacare, today’s second report of fourth quarter Gross Domestic Product shows concern is still warranted. Because of revisions to the advance estimate, health spending accounted for a greater share of GDP than we had thought.

Overall, real GPD increased 1.8 percent on the quarter, while health services spending increased 5.6 percent, and contributed 36 percent of real GDP growth. Growth in health services spending was much higher than growth in non-health services spending (0.3 percent) and non-health personal consumption expenditures (2.4 percent). However, the implied annualized change in the health services price index increased by just 1.6 percent, lower than the price increase of 2.4 percent for non-health services, 2.0 percent for non-health PCE, and 2.1 percent for non-health GDP.

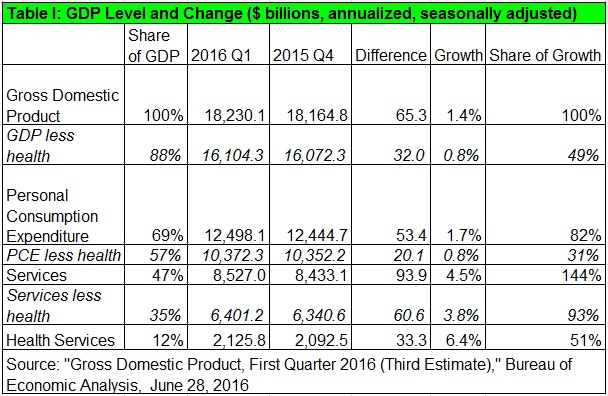

(See Table I below the fold.)