73 Million Would Lose Employer-Based Benefits if Tax Exclusion were Eliminated

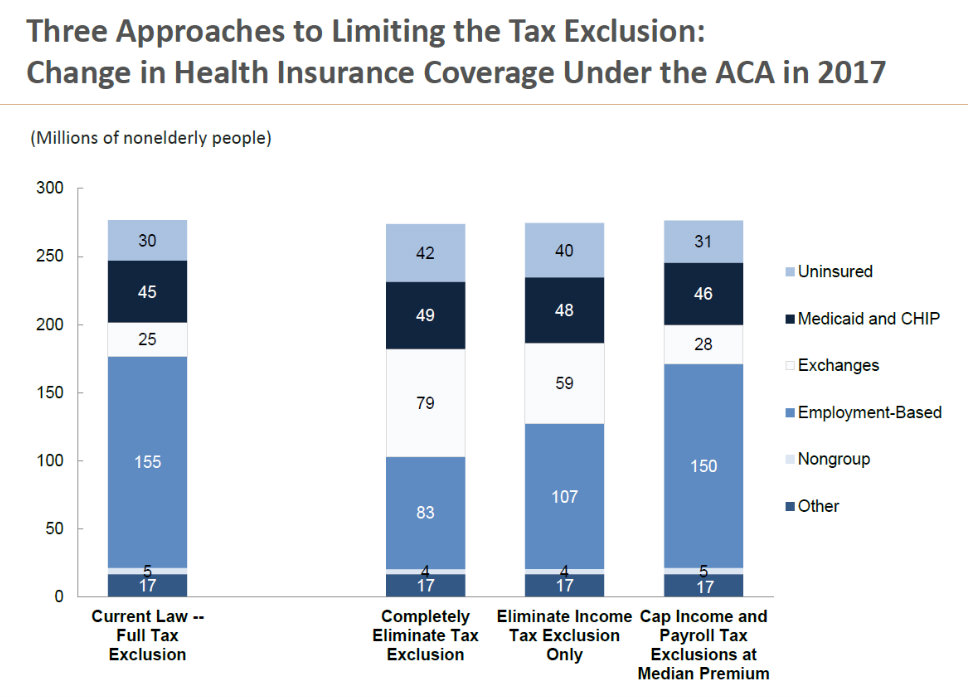

Allison Percy of the Congressional Budget Office has published estimates of what would happen if employer-based health insurance was taxable to employees. Currently, employer-based health insurance is excluded from both income tax and payroll taxes for Medicare and Social Security. According to Percy, 73 million would lose employer-based benefits by 2017, of which 54 million would get their coverage from Obamacare exchanges. The number of uninsured would increase by 12 million. Percy also shows the distribution of this effect by household income. This is an important estimate for post-Obamacare reform, because Percy’s model simply taxes the value of employer-based insurance without returning any of those tax dollars to the people as a tax credit for the purchase of individual health insurance. (Of course, some of those 54 million getting health insurance from Obamacare exchanges will have lower premiums because their health insurers receive subsidies in their names.) Those of us who advocate reforming the tax code to give individuals tax credits for health insurance have always been beaten back by anxiety over losing employer-based benefits. Percy’s conclusions help us understand how much money we would have to allocate to tax credits to overcome the loss of employer-based benefits after including them as taxable income.

Allison Percy of the Congressional Budget Office has published estimates of what would happen if employer-based health insurance was taxable to employees. Currently, employer-based health insurance is excluded from both income tax and payroll taxes for Medicare and Social Security. According to Percy, 73 million would lose employer-based benefits by 2017, of which 54 million would get their coverage from Obamacare exchanges. The number of uninsured would increase by 12 million. Percy also shows the distribution of this effect by household income. This is an important estimate for post-Obamacare reform, because Percy’s model simply taxes the value of employer-based insurance without returning any of those tax dollars to the people as a tax credit for the purchase of individual health insurance. (Of course, some of those 54 million getting health insurance from Obamacare exchanges will have lower premiums because their health insurers receive subsidies in their names.) Those of us who advocate reforming the tax code to give individuals tax credits for health insurance have always been beaten back by anxiety over losing employer-based benefits. Percy’s conclusions help us understand how much money we would have to allocate to tax credits to overcome the loss of employer-based benefits after including them as taxable income.

“73 Million Would Lose Employer-Based Benefits if Tax Exclusion were Eliminated”

If this happened, then everyone would need to go to the exchanges in order to receive health insurance. Are we predicting that this is the next step in ObamaCare?

Speaking as an ACA supporter, I’d say yes … eventually. But I’m inexpert in these considerations, so I appreciate posts like this one that shed light on what it would take to get there. I should add also that, again as ACA supporter, I’d love to see one national exchange and a public option first.

But then, I’d also like a pony.

The question is that if people were to get off of employer coverage and accept ObamaCare insurance, along with tax subsidies which many people are sure to get, will they be better off?

Also, by having more people enter the marketplace, it should theoretically lower premiums as well, as more people are able to be apart of the cost sharing.

As for people being better off, that’s up for debate.

Currently the law allows companies to deduct premiums as payroll expense and exempts employees from taxation on the value of those same premiums. The question is really how many employees would forfeit benefits if they had to pay taxes on those benefits. They are not losing benefits but faced with a choice to forfeit benefits because the cost went up after tax.

In my own case, the premiums are 18000 per year, in a company that is rated a little heavily towards middle-aged employees. That would mean my wife and I might be on the hook for another five grand in taxes, at most. That’s a reduction in salary of, maybe, four hundred a month. I don’t know why we would necessarily give up our coverage because of a loss of income of four hundred a month. It would depend on a host of other factors: the cost of ACA coverage?, whether the employer would pay an increase in salary, in lieu of insurance?, et al.

I don’t know what kind of methodology the CBO could come up with to make the determination that 73 million would forfeit their employer based benefits because they suddenly have to pay taxes on those benefits. The formula they use on page 13 is pretty vague with price elasticity given as X. I would really like to know how they came up with X, since there is not a lot of real world data(not any really) on the price elasticity of demand for employer provided health insurance ex-post ACA implementation. I take their estimate of 73 million forfeiting insurance with a grain of salt.

It is interesting to see where he thinks people will go towards if employer based coverage becomes more scarce. More people will certainly go to the exchanges, but more will also be uninsured. The key is how to provide incentives for those uninsured to go to ACA plans.

It looks like by eliminating the tax exclusion, there will be more people on the exchanges or uninsured. By limiting the exclusion, more people remain on their employers plan and not uninsured.

It is a trade off and the transition to the tax exclusion may be the less painful way to go.

Walter:

I agree with you.

Part of the reason for the employer mandate was so that the exchanges would not be flooded with millions of people looking for premium subsidies.

As a new insurance company part owner, I want to eventually provide individuals in the eXchanges with a permanent affordable plan.

For the next year, we will be focUsed on the self-funded employer market of 200 employees or more.

However, our goal is to provide a permanent conversion policy for those employees who go to another employer.

The vision is that they will be continuing their prior coverage, which functions like an HSA, but has many times more coverage that is paid for compared to a savings account.

This is because the contributions are not credited with traditional interest we would earn on our reserves,, but with pooling the thousands of people on our plan.

In effect, those not making claims add to our reserves, and we are sharing a portion of those reserves through pooling.

Pooling means that people are credited 8% “interest” on their contributions in month 2, increasing by 8% a month until it caps at 3 in month 34.

For example, an employee pays $300 and is in month 34, he will be credioted with $900 of “interest.” for a total of $1,200 coverage that month which is PAID FOR.

WHAT SAVINGS ACCOUNT CAN DELIVER 300% INTEREST IN ONE MONTH?

Don Levit,CLU,ChFC

Treasurer of National Prosperity Life and Health

This prediction is not realistic. The actual figure is likely closer to 173 million. Without the tax exclusion, why would an employer offer health coverage? Their workers wouldn’t necessarily want coverage through work if there was no tax benefit.

The employer would would still write off the insurance as a payroll expense. No change for the employer. The difference is that the employee would now pay taxes on the benefit. The question is what would the employee do when faced with a reduction in after tax income?

While I’m not at all a fan of tying insurance to one’s employer, I would much rather have individuals retain their current employer-based insurance than be dumped into the exchanges involuntarily. Such people forced to look in the exchanges may receive lower premiums, but this is not the way to go because it ultimately takes choices away from the consumer and gives greater control to the government bureaucracy…and closer and closer to a single-payer system.

Seems to me that making employer premiums into taxable income — however fair this might seem — would cause a monster recession.

Employees with dependents, plus any employee over 50, would probably keep their employer coverage even though doing so lowers their after tax income.

If millions of families like Jardinero’s suddenly saw their spendable income drop by $5,000 a year, I can see many thousands of health clubs and vacation resorts and restaurants going stone broke in less than a year. Tax revenues would plummet and unemployment benefits would soar.

To move away from dependency on employer-sponsored insurance, there first needs to be an alternative. Emphasis on “first”, as opposed to “simultaneously”.

Grandiose plans to reform everything in one go, even if they manage to gain acceptance, are extremely risky whether coming from the left or the right.