The Obama Recession

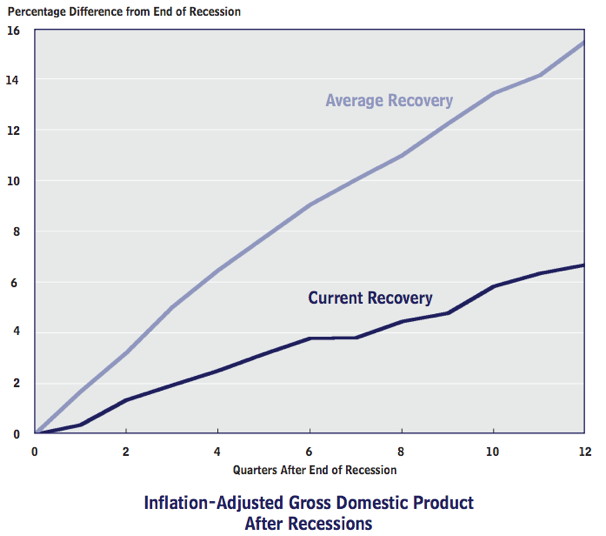

This graph is from a new study from the Congressional Budget Office:

Here is Neil Irwin at the Ezra Klein blog:

This economic recovery has been a big disappointment relative to what the United States has usually experienced after a recession. Growth has been 9 percent below what was seen in past recoveries on average in its first three years…The new CBO report claims that two-thirds of the underperformance of the economy over the past three years compared to a typical recovery is due to a slower rate of growth in potential GDP. Only one-third, in this analysis, is due to factors related to this recession.

Lets go Obama,

Lets go

(Clap clap)

Lets go Obama,

Lets go,

(Clap clap)

Lets get out of this recession,

Lets go,

(Clap clap)

No more recession OBAMA

NO MORE…

(Silence)

This is interesting. I wonder if the length of the last boom didn’t prolong the recession and slow the subsequent turnaround. When business investment and consumer spending gets out of synch with reality, the longer this goes on, the longer it will take to dig our way out of the mess. Obama isn’t making it any better — uncertainty has an effect on business formation.

So it’s not just me that this is taking forever? I’d love to see some more significant turnaround, but with the fiscal cliff I think I may be waiting a long long time.

What a depressing recovery. I hate to be a pessimist, but I just hate swallowing that slow growth may be the best we can hope for.

This is slower than normal recovery and it’s all Obama’s fault.

This is a crisis, it’s different from a recession.

This is looking exactly how it should.

This is better than people realize.

Everyone is full of it and everyone drinks the same Kool-Aid, the only difference is the flavor. I present:

The U.S. Economy’s Recovery Is Stronger Than People Think

The US economy is still in a sorry state

The Economic Recovery: Fast, Slow or Neither

Five Years After Crisis, No Normal Recovery

I could go on and on, who wants to talk Bernake and QE3? Maybe that’s best left to Pam…

When a picture is worth a thousand words…

If we call that growth at all, then we might as well call ourselves a mediocre nation.

First, this recession was accompanied by a major liquidity shock; historically recoveries after such shocks have been slower.

Second, fundamental problems like rising healthcare costs and an unsustainable medicare program were there before.

Third, there is plenty of blame to spread around. I’d like to think of it as America’s recession and get back to fixing it. Hopefully the fiscal cliff will give politicians the incentive to get their stuff together.