ObamaCare: The Perfect New-Keynesian Policy Prescription?

University of Chicago finance professor John Cochrane believes that slow economic growth “trumps every other economic problem.”

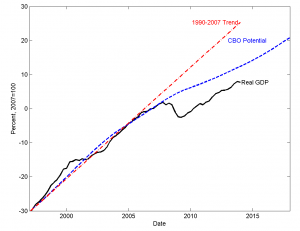

He and a number of macroeconomists believe that the Keynesian model drilled into your head in Econ 1 has a number of shortcomings that make it produce lousy economic policy, even in its New-Keynesian version. Shortcoming number one is that the New-Keynesian models do a very poor job of explaining reality. Just how poor a job is shown in the graph below.

In a July 2, 2014, Wall Street Journal op-ed he explained that the New-Keynesian models have a number of possible solutions. The ones most attractive to those in power produce “attractively magical policy predictions” in which “government spending, even if financed by taxes, and even if completely wasted, raises GDP.” Even if the assumptions were made more realistic, it might not be a good idea to use their untested predictions to drive “trillions of dollars of public expenditures.”

Paul Krugman is apparently so entranced by the magic that he believes that forcing firms to replace capital, even if it makes them poorer, “can stimulate spending and raise employment” and “the broken windows fallacy ceases to be a fallacy.” In this alternate universe, hurricanes Katrina and Sandy could do more for U.S. economic growth than the development of the petroleum industry, the refinement of the internal combustion engine, the development of the electric power industry, or the development and use of the semiconductor transistor.

Professor Cochrane writes that macroeconomists looking at new ways to explain the slow growth disaster are considering the uncertainty introduced by arbitrary policy changes, large distorting taxes, intrusive regulations, and the “unintended disincentives of social programs.”

If these new approaches are correct, and one’s goal is to inflict maximum economic damage on Americans, ObamaCare is a smashing success. It affects the whole population, generates huge uncertainty from arbitrary policy changes, imposes large distorting taxes, generates exponentially expanding intrusive regulations, and has already resulted in a veritable mother lode of unintended disincentives to work, employ people, provide medical care, start new businesses, and continue to operate existing ones.

“If these new approaches are correct, and one’s goal is to inflict maximum economic damage on Americans, ObamaCare is a smashing success.”

So Obamacare has been the policy solution to boost the U.S. economy all along! Good thing Keynesians spelled that out for us, I can’t wait to see the job growth!

“Shortcoming number one is that the New-Keynesian models do a very poor job of explaining reality.”

I wish they could explain that to our policy-makers. Government spending is not the answer in reality.

I thought throwing money at every problem was always the answer?

Are you saying our government is not always right in all things? Harumph, good sir!

Keynesians have always been wrong, and whenever their policies inevitably fail, they simply blame others and claim that they need even more intensive (and wrong-headed) Keynesian programs to fix the messes they got us into. Liberals/progressives like Paul Krugman simply have no understanding of how a free market economy really works because they somehow fail to realize that every dollar taken from the taxpayers is another dollar that cannot be spent to increase aggregate demand.

They will say that governments will now how to spend the money more effectively than will the general public, but they ignore the basic fact that nobody values his money (and therefore spends it more wisely) than the person who earns it. The politician simply gets to spend your money, create all sorts of economic distortions, make people dependent upon his “help”, and then blame their failures on the people who actually work and believe in fiscal responsibility.

Don’t you just love these Keynesians?

I’ve studied development economics. My criticism about Keynesian economics (besides the fact that not even Keynes would approve of the new version) is that much of the surplus spending is on unsustainable, non-valuable activities. To put it another way, the spending is mal-investment; not investment. For example, excess spending on bridge building may employ construction workers. It may even help trucking firms if the bridge is needed. But an extra government office building filled with 100 new federal jobs wouldn’t produce anything in the economy that boosts societal wealth. A new fighter plane may help Boeing, and workers in the city where it builds planes, but it’s not the same as spending $75 million on 400 new houses. Neither is it the same as creating a factory that employs 100 people who build things Americans willingly buy.

Excellent point Devon. Government spending ought to be based on the merits of the spending instead of the fallacious view that all government expenditures will have equal effects. It seems as though Keynesians believe that taxpayer money spent by the government always results in a product that leaves society better off than how the people who actually earned the money would have spent or invested it under their own direction. This happens extraordinarily rarely, if ever.

The reason “income inequality” and “living wage” mantras are headlines right now is purely political. It is a distraction from the poorly performing economy under an administration in which 10,000,000 people have quit looking for work, the number of people on food stamps has skyrocketed, annual deficits have surpassed $1 trillion, and the national debt is climbing to $18 trillion.

Obamacare is rightly pointed out in this post as one of the leading contributors to the increased costs and uncertainty that is hampering economic growth. Case in point: -2.9% GDP last quarter.

In North Dakota, Wall-Mart pays over $17/hour to newly hired floor staff. It’s the knock-on effect of the natural-resource boom, which the Administration would like to stop.

Economic freedom, not government diktat, leads to “living wages”.

Right on, John! I’ll never understand why statists cannot see that redistribution can never lead to prosperity. Only economic growth can be the rising tide that lifts all boats.

Ever since the New Deal, and especially since the Great Society, our economy has suffered because of too much government intervention. There have been times when the burden was lightened, and we prospered in those times. However, this administration is a throwback to LBJs 1960s, and the results are disastrous. Obamacare, class warfare, higher taxes and regulation – all of these are the proper way to slow an economic giant, and we are doing that very well right now.