Krugman Plays a Mulligan

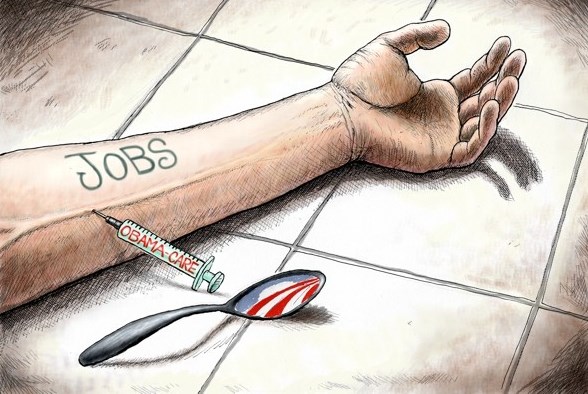

The CBO now estimates that ObamaCare will reduce the labor supply by the equivalent of 2.4 million jobs by 2024. The main reason: the implicit marginal tax rates created by the withdrawal of the ObamaCare tax subsidies in the health insurance exchanges. Like unemployment insurance, food stamps and other welfare benefits, government help gets smaller as incomes rise and this is an implicit tax on labor.

The CBO’s estimate is based on the work of University of Chicago labor economist Casey Mulligan, who estimates that the average marginal tax rate in the economy is 47% — meaning that workers get to keep a little more than half of what they earn. Mulligan says the real loss of labor due to ObamaCare will probably be twice what the CBO is reporting. He also estimates that about half of the excess unemployment we have been experiencing in recent years is due to the combined effect of all entitlement programs.

The CBO’s estimate is based on the work of University of Chicago labor economist Casey Mulligan, who estimates that the average marginal tax rate in the economy is 47% — meaning that workers get to keep a little more than half of what they earn. Mulligan says the real loss of labor due to ObamaCare will probably be twice what the CBO is reporting. He also estimates that about half of the excess unemployment we have been experiencing in recent years is due to the combined effect of all entitlement programs.

Enter Paul Krugman, who week after week, month after month, in his New York Times columns has been telling us that there is no evidence that entitlement spending reduces work effort. He responds to the CBO report by endorsing it. He explains:

[T]he incentive to work will be somewhat reduced by health insurance subsidies that fall as your income rises.

But he also says this is actually a good thing:

If you lose your job, you suffer immense personal and financial hardship. If, on the other hand, you choose to work less and spend more time with your family, “we don’t sympathize. We say congratulations.”

BTW, there is not a chance that Krugman has been unaware of Casey Mulligan, even though pretending not to know about his work. Casey is a regular blogger at the very same newspaper Krugman writes for.

In golf, a “mulligan” is an illegal do over. It asks everyone to forget the last stroke. Krugman seems to be hoping we will all forget his previous columns. The latest is appropriately entitled “Health, Work, Lies.”

As for Krugman’s claim that Republicans are mischaracterizing the CBO report, the CBO Director sides with the Republicans:

The head of the nonpartisan Congressional Budget Office delivered a damning assessment Wednesday of the Affordable Care Act, telling lawmakers that ObamaCare creates a “disincentive for people to work,” adding fuel to Republican arguments that the law will hurt the economy.

The testimony from CBO Director Douglas Elmendorf comes after his office released a highly controversial report that detailed how millions of workers could cut back their hours or opt out of the job market entirely because of benefits under the health law.

The White House and its Democratic allies accused Republicans, and the media, of mischaracterizing the findings. But Elmendorf backed Republicans’ central argument — fewer people will work because of the law’ subsidies.

“The act creates a disincentive for people to work,” Elmendorf said, under questioning from House Budget Committee Chairman Paul Ryan, R-Wis.

I see a couple of problems with your analysis (but your major point — Krugman Can’t Have It Both Ways — is correct)

1. The CBO is no more non-partisan than the Democratic National Committee. They over-complicated a very simple issue with all their weasel wording about workers “offering less supply.” The CBO included a chart showing the effect of PPACA on the labor participation rate, which is really what this is all about. But the CBO never refers to the chart or the term labor participation rate in its words.

2. Strangely the free-fall in the labor participation rate was a big issue in the long-term-unemployment discussion a few weeks ago. But from the left wing’s point of view, that same free fall is no big deal for PPACA.

(However, you play into the lefties’ hands by quoting the CBO director via the far-right-wing Fox News. All you need is the transcript from the hearing from C-Span.)

If only we could just have a mulligan and ignored that Obamacare ever happened. It is clear; the Affordable Care Act is one of the worst pieces of legislation in recent years. Not only is the program not providing the services it promised, it is also costly, inefficient and harmful to American economy. The White House and the Democratic Party are doing everything in their power to blame Obamacare misgivings on the Republicans. But it would be hard, considering that ACA was their battle flag. We are worse off than what we used to be, I hope there could be a mulligan to prevent all of this from happening.

I would be fine with taking a mulligan on ObamaCare. I am sure many politicians would too after seeing the giant mess being made.

Unfortunately there are no mulligans, and we are stuck with ACA for years to come. Hopefully in the future we will see changes being made to the legislation that will stabilize itself. Until then, we all have to hold on through the rough patches.

“If you lose your job, you suffer immense personal and financial hardship. If, on the other hand, you choose to work less and spend more time with your family, “we don’t sympathize. We say congratulations”.

It sounds like Krugman explains this as a matter of choice. Regardless, you are working less.

“In golf, a “mulligan” is an illegal do over. It asks everyone to forget the last stroke.”

It seems everyone from the liberal media and the government are needing to take mulligans from back tracking from their initial claims.

If we are still using golf terms, John scored a birdie on this blog post.

Krugman must be realizing that politics shouldn’t interfere with his economic knowledge. A Nobel Laureate should place his field of work first than his political ideologies. With his blogging in the New York Times he is simply damaging his reputation as a renowned economist and becoming a political voice.

A flawed political voice at that.

More than flawed I would say a naïve political voice. He is blinded by his ideology. It is a blindfold that makes him forget his expertise. If Obama’s promises are capable of fooling an illustrated individual, such as Krugman, into supporting a defective program, what can those promises do to the common American people?

Krugman is a joke at this point. He’ll let nothing get in the way of his political ideology.

“The act creates a disincentive for people to work,” Elmendorf said.”

When the head of the CBO explicitly states this, I don’t see how anyone can argue how working less will be beneficial for the American people and the economy.

I don’t think we should say that Elmendorf sides with Republicans. Elmendorf is citing what his office found as consequences of Obamacare. He is just stating CBO’s outlook. Republicans side with this perspective, and believe that the consequences are dire. I would rather say; the CBO is ratifying something the Republican Party claimed during the discussions of the Affordable Care Act. Stating it like that, individuals from the left wont question the conclusion of the CBO and its non-partisan affiliation.

A statement like this: “If you lose your job, you suffer immense personal and financial hardship. If, on the other hand, you choose to work less and spend more time with your family, ‘we don’t sympathize. We say congratulations.’” is what earned Krugman his Nobel Prize. What he claims here is something that makes economic sense, and that criticizes the issues with the current system. This is the Krugman I want to read, not the naïve politician from the left, which makes no sense at all.

The Social Security program also makes it easier for older people to leave the workforce and retire. For that matter, so does Medicare. Should we get rid of those programs too? I don’t think so. I have no problem with people in their early sixties who want to retire to now be able to do so because they will be able to buy health insurance on reasonable terms without regard for pre-existing conditions. It’s also a good thing for second earners in a household to be able to stop working and take care of their kids when they were previously working mainly for health insurance and bringing home relatively little after taxes, childcare costs, commutation expenses, and lunch among other costs.

Computerization eliminated millions of middle management and clerical jobs over the last 40-50 years. Manufacturing productivity has skyrocketed. For example, the number of labor hours needed to make a ton of steel fell 90% since the 1960’s with the advent of electric arc furnaces, continuous casters and the like. At one time, half the population worked on farms. Now it’s 2%.

In short, we just don’t need nearly as many people to make the things that most of us want or need to buy. More of the work has shifted to business and personal services. Many of those jobs like landscaping most Americans won’t do but immigrants are willing to.

There are problems with Obamacare including the botched rollout and we can argue about how generous the essential benefits package needs to be. However, the fact that more people can retire now who previously wanted to but couldn’t and more second earners can stay home and raise their kids are both good things, in my opinion. This is one of the rare times I agree with Krugman.

Whoa. What you/Jay Carney are saying about SS and early retirement is another Democratic Party propaganda point. Krugman is just parroting it.

Not sure how old you are but SS does not “make it easier for older people to retire.” If you have otherwise saved your money through tax-deferred accounts (that are accessible without tax penalty at 59-1/2) and/or get an employee pension through an early buyout and can live off one or the other plus SS (which you can’t take until 62 and at quite a discount if you take it that early) — AND YOU DON’T WANT TO WORK FOR MONEY (e.g., do some volunteer public service for your local community) OR JUST WANT TO BACK-BACK EUROPE — then early SS can be part of a mix.

But do not drink the Kool-Aid. No one can easily retire just on SS either early or at today’s full retirement age of 66 plus.

And Medicare does not help at all until age 65… and then it does not help very much. On average Medicare covers half a retiree’s healthcare costs. If you buy into the PPACA metal system of Bronze/Silver/Gold/Platinum, Medicare is the Tin Plan.

I didn’t say that Social Security by itself is sufficient to provide a secure retirement though I actually know some people that are making it work. At the margin, though, it’s a significant help if one can also access either a defined benefit pension as early as age 62 or assets from an IRA or 401-K. When it became law in 1935, the country was in the midst of the worst depression in our history. The original idea behind Social Security was to ease people out of the workforce to reduce unemployment at a time when the prevailing wisdom was that there would be a permanent shortage of jobs.

Medicare became law in 1965 primarily as a result of a market failure. The insurance market wouldn’t or couldn’t provide affordable health insurance to older people especially if they already had a pre-existing condition. You’re correct that the actuarial value of standard FFS Medicare today is in the range of 55%-60%. However, the vast majority of people on FFS Medicare also have a supplemental insurance plan to pay what Medicare doesn’t pay, mainly the deductible and coinsurance amounts which have no out-of-pocket maximum limit. About 30% of beneficiaries have Medicare Advantage plans some of which are available for no premium beyond the standard Part B premium of $104.90 per month. It’s also worth noting that 50-75 years ago, there was relatively little that medicine could do for us compared to today. More capability means more cost and more need for health insurance.

For the record, I’m in my late sixties, started collecting Social Security at 66 and have a standard FFS Medicare plan plus a supplemental insurance policy and a separate Part D plan.

You’re writing Krugman’s next column for him. Not only “Congratulations that you don’t have to work anymore but double congrats that you are beating the SS system out of a full retirement payout long before you qualify.”

Have you missed the all of the journalists exposing the SSDI scams?

I know that there are a lot of people getting SSDI benefits who shouldn’t be and there is way too much variance in the approval percentage among the Administrative Law Judges who rule on these cases. A high percentage of claimants who are initially denied benefit ultimately win them on appeal.

One of the contributing factors to the abuse, I think, is pressure from Congress to shrink the backlog of cases awaiting benefit determination. The easiest and fastest way to shrink the backlog is to increase approvals according to people I know who work at the SSA. Following the 2008 financial crisis, too many people came to view the program as the equivalent of unemployment benefits that last indefinitely and come with Medicare coverage after a two year waiting period. Reform is clearly needed here, especially in the adjudication process and the criteria for defining disability.

I apologize. When you said at the beginning of your comment “The Social Security program also makes it easier for older people to leave the workforce and retire. For that matter so does Medicare,” I assumed you were agreeing with Carney, Krugman and the Democratic Party and meant “leave the workforce and retire “early.”” I did not understand that you were not commenting on Krugman’s “ain’t it grand to be old” theory. You just meant it makes it easy when you are 66 plus. I disagree with you even if you mean 66 plus for reasons stated but whatever…

Also, not that it has anything to do with the original post or even much to do with my comment on your comment but you offer a new twist on the history of SS that I’ve never heard before. If that was FDR’s intent, you would have thought he would have made it effective in 1935 instead of making poor Ida wait until 1940 for that check.

One more point on Medicare. People who become eligible for Social Security disability benefits become eligible for Medicare two years later no matter what age they are. There are currently about 10 million people receiving SS disability payments up from roughly 7 million ten years earlier. This is likely another factor contributing to the decline in the labor force participation rate since the financial crisis of 2008.

I realize there are some tricky economic concepts here, and I have no training in economics, but let me offer an observation:

– countries like Canada, Sweden, and Germany have had early retirements and shorter workweeks and generous welfare benefits for decades now.

They certainly appear to be as prosperous as America, and if you count leisure time, many workers are probably more prosperous.

Whereas in America, at least in some occupations, we have more and more workers competing for fewer jobs. A cynic would say that keeping our work force large is just a technique to drive down wages.

I do not buy the whole Marxist line, but I sure do not see a solid connection between the size of our labor force and prosperity.

I have a number of issues with Obamacare but making it easier for older people and second earners to leave the workforce because they can now obtain affordable health insurance away from an employer is not one of them.

My concerns include the following: (1) inadequate income verification tools to determine subsidies, (2) inadequate enforcement mechanisms to collect the penalty from people who choose to remain uninsured, (3) too much emphasis on broadening coverage and not enough on controlling healthcare costs, and (4) failure to tackle tort reform and defensive medicine.

If it were up to me, I would have also offered a higher deductible option up to at least $10K per individual. I would have also offered a plan that didn’t cover mental illness or alcohol and substance abuse. However, anyone who bought a policy without those benefits couldn’t buy a plan later that covered them without first passing medical underwriting.