EpiPen: A Case Study In Health Insurance Failure

I recently wrote a post describing EpiPen as a “Case Study in Government Harm,” describing how the government had made it possible for the manufacturer to increase prices of the life-saving drug multiple times without fear of retaliation. It is also a case study in how health insurance distorts our choices and increases their cost. I learned this by following an Internet advertisement for EpiPen down its rabbit hole.

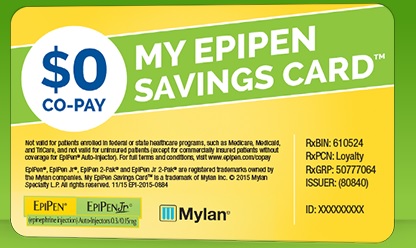

The ad induced me to download my “EpiPen Savings Card” which would ensure I paid nothing for my EpiPens (up to six, according to the ad):

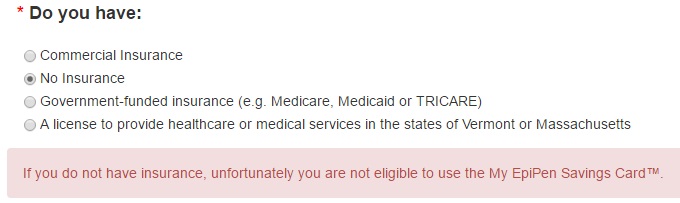

However, I had to answer a skill testing question first: What was my insurance coverage? As you can see from the screenshot below, when I answered I had no insurance, the EpiPen savings card was figuratively ripped from my hand:

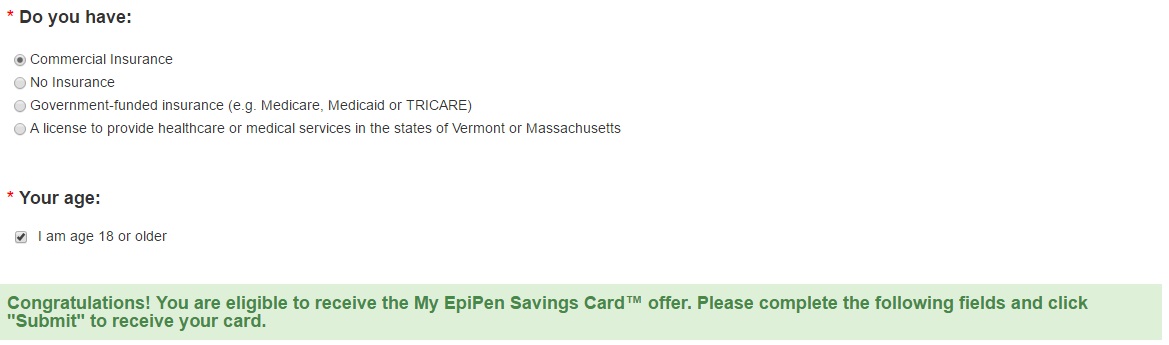

However, when I answered I had private insurance – Hooray! My EpiPen Savings Card was confirmed:

This is an extreme example of a coupon strategy used by some drug makers: Immunize the patient from the direct cost of the medicine so the health insurer has to pay a price much higher than the market can bear. Of course, the insurer might get a discount from the list price, but the uninsured patient will never benefit from that.

Further, the above-market price is paid by patients through high insurance premiums, so nobody is really saving money. In Canada, where EpiPen is sold over-the-counter in drugstores to cash-paying customers, it sells for about $80 (U.S.), instead of over $600 in the U.S. Much of that price differential is due to our overreliance on health insurance to pay for medical goods.

That is because we do not have Health Insurance in this country. Our system is not insurance it is a third party bill paying service.

Very true. But everyone insists on calling it health insurance!

What I find most interesting is that the savings card does nothing for uninsured individuals who are the most price sensitive! Price discrimination theory would suggest Mylan would offer uninsured individuals a savings card to reduce their costs to half price to entice a sale. Mylan would also want to gouge PBMs and health plans for as much as possible while keeping copays low enough to prevent consumers from derailing the sale.

John, If you had selected government insurance (Medicare or Medicaid) it would have also declined to give you a savings card, since copay cards are considered an illegal kickback in public programs.

Exactly! I did that, but did not put in write-up, for the purpose of brevity.

Is that an endorsement of the Canadian system? Or at least, in this case?

OTC drugs in Canada are not part of the single-payer system (if that is the “system to which you refer) in that consumers pay out of pocket, like in U.S.

When government is in bed with the drug company, high costs is the result. Not only is our healthcare system (the government calls it that, the Supreme Court calls it a tax) that increases the costs of almost everything medical simply because government is the purchaser, but the government has also inserted itself into requiring the exact delivery system that EpiPen has a patent on, for schools and other government run agencies have on hand in case of an emergency. They also have been heavy handed to other companies that wish to get into the market by dragging out the FDA approval process for those companies, making it impossible to allow a competitor into the market by crushing them financially.