Churn, Churn, Churn: Measuring the Cost of Fragmented Coverage

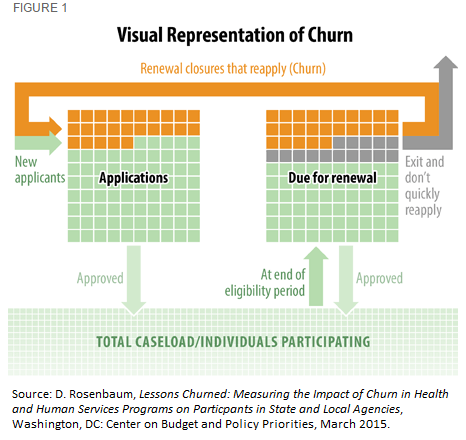

Low-income Americans face bewildering bureaucratic requirements when they try to obtain welfare benefits. One of the challenges is that they have to frequently re-apply for benefits because the state needs to know whether their incomes are still low enough form them to remain eligible. This moving in and out of benefits is called churn, and Dottie Rosenbaum of the left-wing Center for Budget and Policy Priorities has written an interesting paper discussing the challenges in measuring and understanding it:

Low-income Americans face bewildering bureaucratic requirements when they try to obtain welfare benefits. One of the challenges is that they have to frequently re-apply for benefits because the state needs to know whether their incomes are still low enough form them to remain eligible. This moving in and out of benefits is called churn, and Dottie Rosenbaum of the left-wing Center for Budget and Policy Priorities has written an interesting paper discussing the challenges in measuring and understanding it:

States renew Medicaid and CHIP eligibility once a year, as federal rules require, and federal rules have changed to require a minimum eligibility period of 12 months for child care. Many states still review SNAP eligibility every six months……

States are allowed to recertify eligibility of elderly and disabled households for SNAP every 24 months.

There is trade-off here: If people have too much hassle re-applying for fragmented benefits they might not get them and that will cost taxpayers more down the road. On the other hand, welfare that depends on income demands some burden of re-certifying eligibility on the recipient.

NCPA recently published an analysis of the bewildering array of federally funded safety-net programs, and recommended that state, local, and civic agencies be able to apply for block grants that consolidate funding from multiple programs. This would also reduce the challenge of churn, as applicants would be able to re-certify eligibility at one agency.

These are all valid comments about ‘churn’.

However, the way to remove churn is with a universal program like Medicare that totally ignores income. If you are over 65, you get Medicare, rich or poor.

This removes a vast amount of paperwork.

However it is very expensive.

And maybe worth the expense! My only point is removing churn is not cheap.

Thank you. The tax-credit approach proposed by NCPA since many years addresses this problem. Plus it would not be as expensive as Medicare because it does not require massive transfers fro working-age people to retired people, which the current political environment demands.

As an agent, this is very confusing process and I generally do not follow the directions of the state. I receive medical assistance for my child but it has the same process as Medicaid. I have to disclose income and send my return in with the paperwork even know eligibility into the program does not depend on income. I always have questions on my forms since I am self employed and do not like to disclose personal information it is very difficult to ask a question. The turn around time to get the form back to the agency is less then 15 days. It is brutal process and dislike it very much. I can see why someone of a different background would get frustrated. We live in the administrative state.