Why Are There Fewer Uninsured?

The U.S. Census Bureau last week released its latest count of the uninsured (along with a whole bunch of other stuff.) Almost all of the press reports were thrilled over the fact that the numbers of uninsured decreased for the first time since 2007.

The press attributed this mostly to ObamaCare’s new slacker mandate, allowing “children” to stay on their parent’s policies to age 26, even if they are living on their own, married, or even have kids of their own. (The grandchildren are not allowed to be on the grandparents’ policy — yet.)

So the number of people uninsured dropped from 49.9 million to 48.6 million, a decrease of 1.3 million. Kaiser Health News also attributed this improvement to higher enrollment in Medicaid, from 48.5 million to 50.8 million. Curious that the rise in Medicaid enrollment is identical to the 1.3 million decrease in the uninsured.

This suggests that perhaps the slacker mandate wasn’t all that important after all. In fact, the numbers on private insurance coverage, where all the newly enrolled young adults would be recorded, are very curious indeed. Get out your calculators, boys and girls, and look at the following excerpt from the Census Bureau numbers –

Private Health Insurance (in 000s)

| Column A | Column B | Column C | |

| Year | Direct | Employer | Total |

| 2011 | 30,244 | 170,102 | 197,323 |

| 2010 | 30,347 | 169,372 | 196,147 |

Now, I am not a mathematician, but this is straight 7th grade arithmetic, so it should not be too hard to figure out. “Direct purchase” and “Employment based” are the only two categories listed under “Private Health Insurance,” so adding Column A and Column B should add up to the total in Column C, right? But it doesn’t. In fact, the “total” is 3,023,000 less than the two columns added for 2011. How can that be? There is a similar discrepancy in 2010.

Perhaps people are counted twice. Maybe they have both employer coverage and direct purchase (individual) coverage. But I have never experienced that, other than some supplemental dread disease or hospital indemnity coverage like AFLAC. Are these policies included in the Census count? How does Census define individual coverage? The footnotes of the table provide no clarification.

In any case, the gain in employer based coverage from 2010 to 2011 is only 730,000 people and that is offset by a drop in individual coverage of 103,000, for a net gain of 627,000, yet the gain in the “total” column is 1,176,000. How did that happen? How can the “total” gain be larger than the gain of the two categories of coverage? Where did the rest come from?

But there are other oddities here as well.

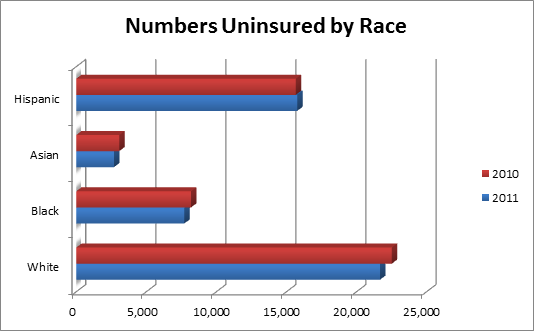

As you probably know, the problem of non-insurance is largely a Hispanic issue. No one ever points this out, maybe for fear of being called racist, but it is true. The rate of non-insurance in 2011 is 11.1% for whites, 19.5% for blacks, 16.8% for Asians, but a whopping 30.1% for Hispanics. That is why on a state-by-state basis the problem of the uninsured is concentrated in a few states like California, Texas, and Florida — all states with very large Hispanic populations. In fact, if you wanted to visualize a “typical” uninsured person it would be 24-year old Hispanic male working in a small grocery store.

Yet, the much-vaunted ObamaCare initiatives, whether we are talking the slacker mandate or the Medicaid growth, failed to help this population at all. Whites, blacks, and Asians all had fewer uninsured in 2011 than in 2010, but not Hispanics. For them the number of uninsured actually grew from 15,667,000 in 2010 to 15,776,000 in 2011.

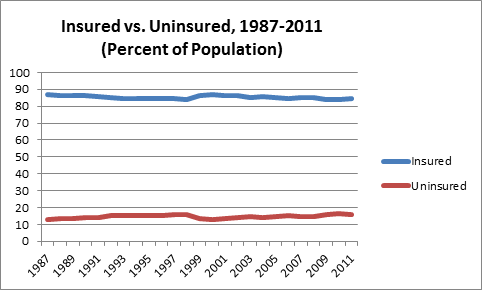

But this whole obsession about the uninsured is misplaced. It is the most static issue one can imagine. For all of the past twenty-five years the percentage of insured Americans has been steady at about 85% and the percentage of uninsured has held at about 15%.

Now, there have been occasional wobbles in the ratio, and in 1999 the Census bureau changed the way it asked about Medicaid enrollment, so there was a technical correction then. But it is hard to imagine a steadier “trend.” It has remained the same during times of prosperity and times of recession, during times of high and low immigration, during times of high and low birth rates, during times of Republican and Democratic administrations, and in spite of dozens of new initiatives aimed at lowering “the problem of the uninsured.”

There is just one other observation worth making here. The Kaiser Health News story on this report interviewed a number of sources for its article. Included was someone from “the nonpartisan Economic Policy Institute,” someone else from “the non-partisan Urban Institute,” and a third person from “the conservative Heritage Foundation.” So the two liberal groups are identified as “nonpartisan” but Heritage is identified as strictly “conservative.” Don’t they ever get dizzy from the endless spinning?

While I disagree with the policy as a mandate, I also disagree with calling it a “slacker mandate”. Things are really bad for young people right now Greg, and it’s about time the system started to help them instead of funneling money to retirees.

I don’t think they ever get dizzy from all the spin. I just wish the govt would remove themselves as much as posible from regulating every part of life. Unfortunetely, I dont think that will happen any time soon.

Why Are There Fewer Uninsured?

The answer to the question is: 1) a better economy; 2) more adults working; and 3) offspring that could stay on their parents health plan and 4) more people on public coverage.

Huh? Medicaid enrollment went from 48.5 to 50.8 which is + 2.3 million; uninsured went down from 49.9 to 48.6 which is – 1.3 million. Something doesnt add up here.

I guess the message is that government programs went up by 2.3 million and commercial insurance went down by 1.0 million. Since Medicaid is free and has generous benefits (albeing poor access) those with access to Medicaid will choose it, I guess. The “slacker” mandate seems irrelevant in this computation. What have I missed?

Ian,

Thanks for the catch. I had put the increase in Medicaid at 1.3 million, but you are right, it is 2.3 million. That is even more puzzling than I had supposed. Kind of makes you wonder, eh?

While steady trend in the uninsured is interesting, I am fascinated to see the implementation of the mandate/tax. Will there be an impact to this trend? Raising the costs should impact this.

Greg: has anyone calculated how many extra got covered as a result of the expansion of the parents’ coverage to age 26? (Slacker Mandate, I guess).

When you’re saddled with tens of thousands of student loan debt and still pursuing graduate school…how are you a slacker exactly?

Alex says “Things are really bad for young people right no….”

That is true Alex, but it is more about finding good jobs than obtaining health insurance coverage. The vast vast majority of “young” people can buy their own health insurance individually (or their parents can buy it for them) for literally peanuts. It is not about access to coverage for these folks. Rather it is about not needing “health insurance” like a an older person needs health insurance.

This brings us back to the utter stupidity of defining the healthcare issue as a health “insurance” issue. Once we are on that side track we are inundated with silly talking points like the “percentage of uninsured Americans”. The subject should be to determine if there is a high percentage of Americans without access to healthcare. That would present an entirely different solution mindset would it not?

Robert, normally when one borrows money one has an idea how one is going to pay it back. If that is a problem it might be a good idea to put off graduate school and find a job.

It’s interesting that I’m getting push-back on the slacker characterization. I find this idea of perpetual adolescence profoundly disturbing. Just when are these “kids” supposed to grow up and take responsibility for themselves? Sure, many are having a hard time finding work. So are many real adults. Sure, many have large debts. So do many real adults. Why stop at age 26? We could allow people to stay on their parents policy until age 45 or higher.

It is interesting to look at the cost of college. College costs have been rising twice as fast as health care costs. Why? I would suggest it is because college loans are so easy to get — people don’t worry about the cost because they can put it on their tab. But the tab has to be paid at some point. What’s wrong with taking a couple of years before going to college and working to accumulate the money needed for college? What’s wrong with work/study? What’s wrong with going to a community college for the first two years?

Yes, these people are slackers in my opinion, and the more they whine, the more slackerish they look.

Meaningful health insurance is not sold for peanuts, even through the institutions where kids accumulate all of that debt.

Most kids are staying in school simply to avoid the job market. Still, education does correlate with quality of life.

Have to agree with Greg, opportunities are out there – unfortunately this is a ‘put your resume on Monster then sit on your couch and lament,’ generation.

Roget, “peanuts” is a relative term here. I will clarify for you. My 23 year old son is in graduate school, and he recently secured an HSA qualified individual health policy from Blue Cross for $77 per month. I assure you that in the world of health insurance that is indeed “peanuts”.

I think you are right regarding the motivation of a lot of kids for staying in school. Of course that direction is highly dependent upon the ability of the parent to continue to fund that extended education. If someone is having to borrow money to continue such educational pursuit it seems that Greg’s suggestions make more sense.

@Frank – I don’t disagree wih anything you said. As I said in my comment, I disagree with the government mandating that insurance companies offer it. However, many insurance companies said they would keep it even if it we’re repealed because so many of their customers like the option. I like the option, I agree with your characterization that access to care is not the issue, and I think we both agree that mandating such a thing is not the role of the government, but I don’t see anything wrong with a company offering it under their own volition.

@Greg – I still disagree with you. It’s not “perpetual adolescence” it’s the reality of exactly how bad the current economic position is.

Unemployment among people age 20-25 is double that of people 25 and older.

This isn’t an inter-generational culture change. It’s the reality that this system favors experience more than anything else, and that is the one criterion where young people just can’t compete.

And I’m sorry but I’m going to have to call out the fallaciousness of your agument. We don’t expand it to 45 for the same reason we don’t allow people to be claimed as a child dependent on taxes after age 24: it would be ridiculous.

We both disagree that it should be mandated, but that doesn’t mean we have to attack the very concept of extended insurance benefits. When we do that we become culture warriors rather than reasoned intellectuals.