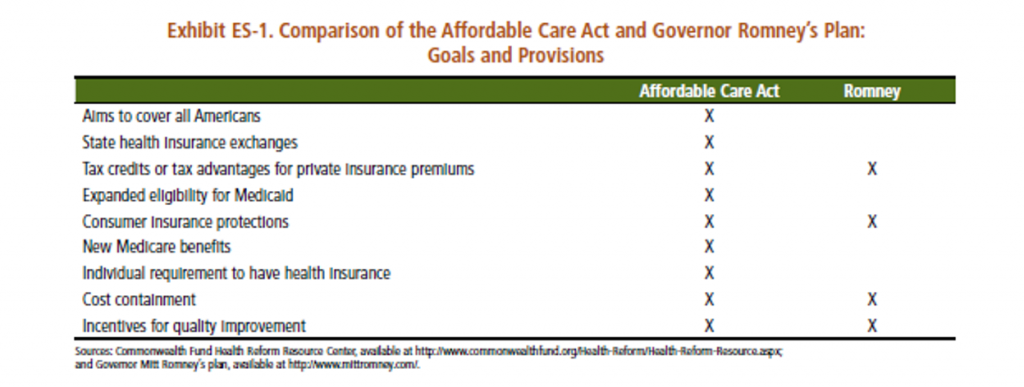

Basically they add up benefits people will receive under ObamaCare and ignore the costs. For Romney, they count the costs and ignore the benefits. This is a study? Here is Avik Roy:

The report details on a state-by-state basis the people who would receive subsidies under ObamaCare, but it does not detail the distribution of the $1.2 trillion in tax increases and $716 billion of Medicare cuts on a state-by-state basis. Perhaps Families USA believes that ObamaCare was paid for by magic unicorns in the sky…

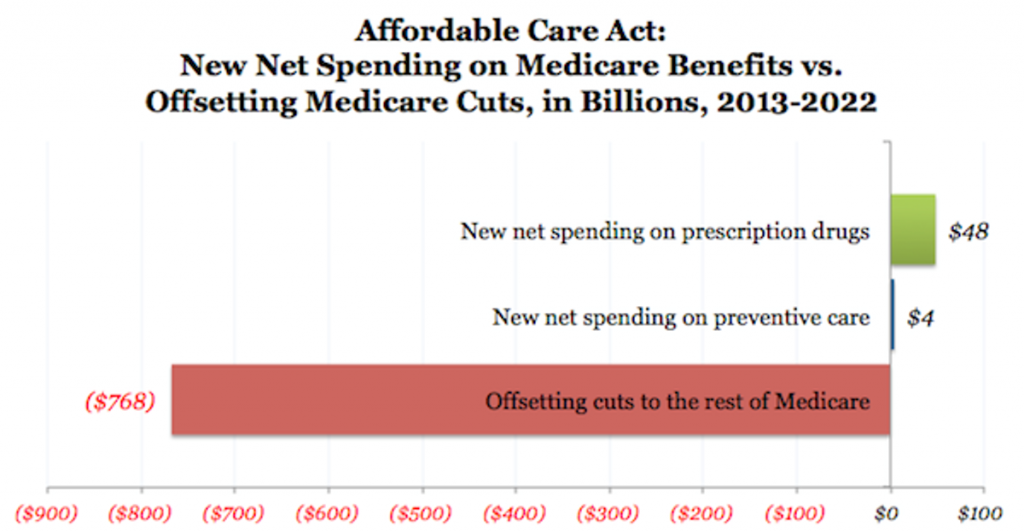

The report makes numerous dishonest claims about ObamaCare’s Medicare cuts, such as that they “extend the life” of the program (which they only do if they aren’t double-counted toward ObamaCare’s deficit-neutrality); and that the law expands Medicare’s benefits, when in fact it cuts benefits to Medicare Advantage and drives hospitals into bankruptcy, reducing access to care.