Variation in Spending Due to Variation in Health Status

The idea that uneven Medicare health care spending around the country is due to wasteful practices and overtreatment — a concept that influenced the federal health law ― takes another hit in a study published Tuesday. The paper concludes that health differences around the country explain between 75 percent and 85 percent of the cost variations…

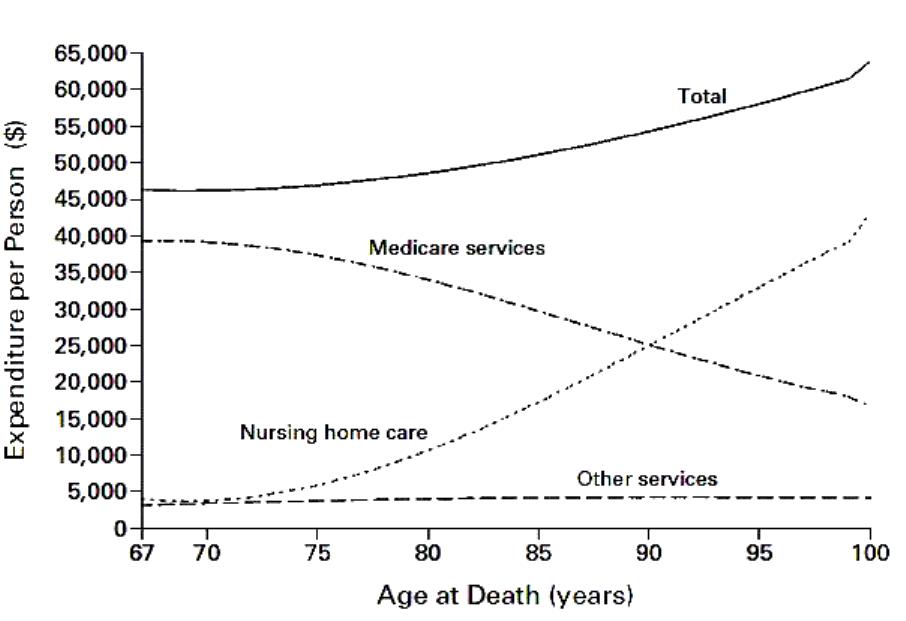

Their conclusions are based on the wide differences in spending, which in 2011 ranged from an average of $14,085 per Medicare beneficiary in Miami, to $5,563 per beneficiary in Honolulu, even after Medicare’s cost of living and other regional adjustments — but not health status — were taken into account….

The new paper is one of the sharpest attacks yet on the work of the Dartmouth Institute for Health Policy & Clinical Practice, whose three decades of research has popularized the theory that the unexplained regional differences in spending are due to the aggressiveness of some physicians to do more, in large part because it enriches them. The theory, popularized by a 2009 New Yorker article on high spending in McAllen, Texas, has divided health policy experts. (KHN)