Health Jobs Dominate Terrible Jobs Report

No good words were used to describe last week’s Employment Situation Summary: “Every aspect of the September jobs report was disappointing,” wrote Michelle Girard, chief U.S. economist at RBS (quoted in Forbes). This is largely a repeat of the August jobs report, although those and previous months’ figures were also revised downwards.

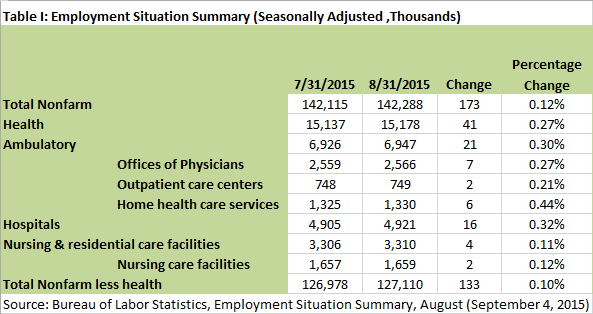

One quarter of September’s new jobs were in health services: 34,000 of 142,000 added to nonfarm payrolls (see Table II). Of those 34,000 health jobs, 37 percent were in ambulatory facilities, and 45 percent in hospitals. This is a change from the last few months. Because of a long-term shift in the location of care, there are now almost seven million people working in ambulatory settings, versus just under five million working in hospitals.