Research Suggests Los Angeles Has No Cardiologists in Obamacare Networks; Chicago No Diagnostic Radiologists

The American Heart Association commissioned Avalere Health to examine the adequacy of provider networks in health plans on Obamacare exchanges. “Narrow networks” have been in the news, as patients have learned that their Obamacare plans do not cover their preferred physicians. This new research covered nine urban areas, and confirms that patients are right to be concerned. It focused on comprehensive stroke centers, and three specialties affiliated with them: Cardiologists, neurologists, and diagnostic radiologists.

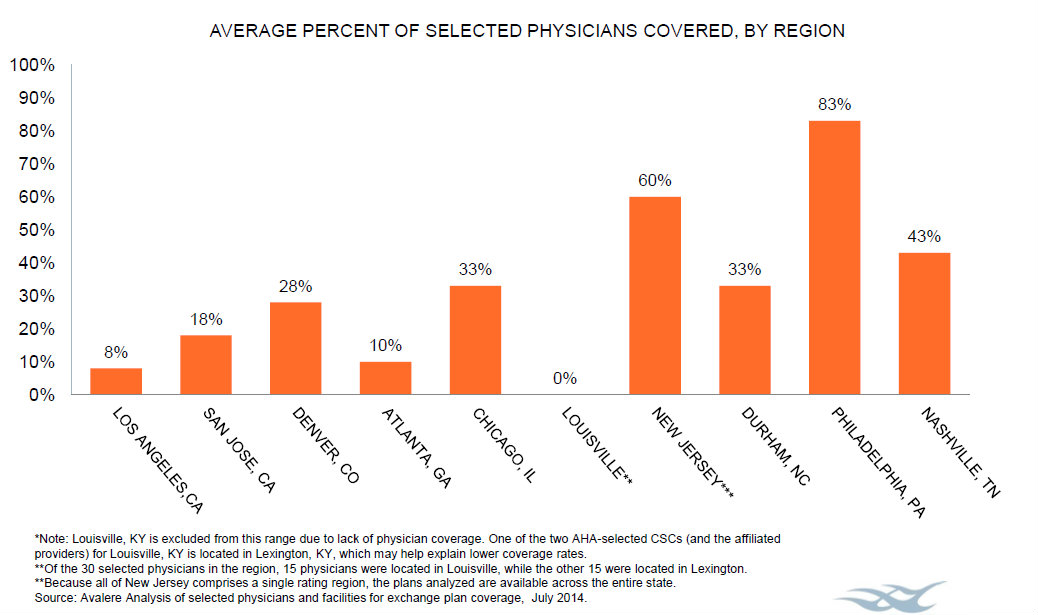

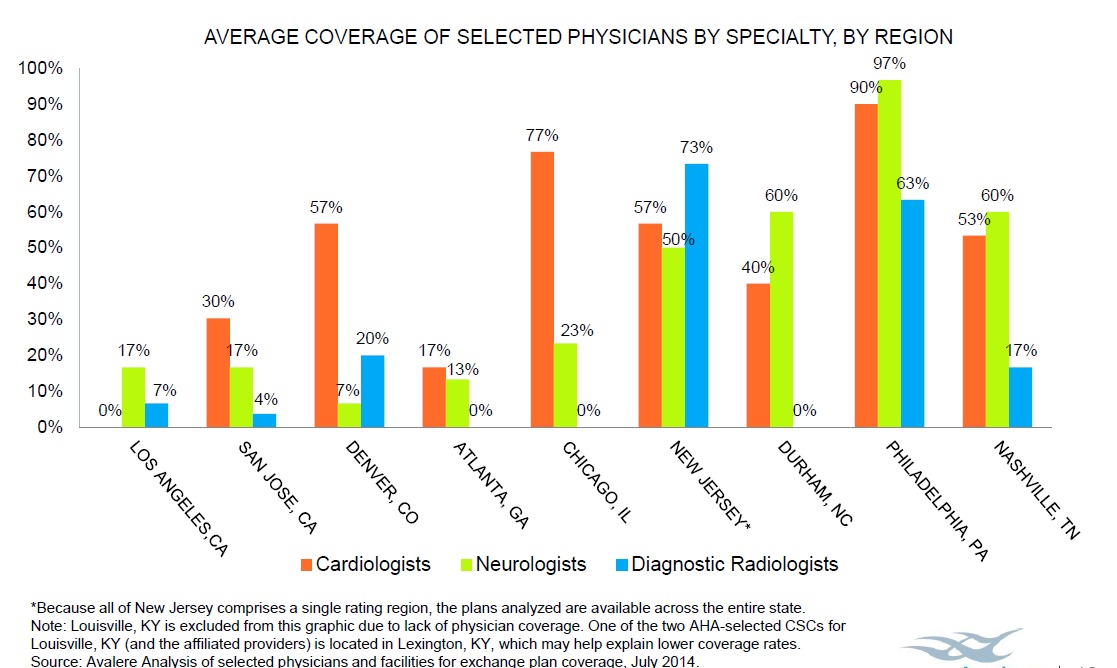

In seven of the nine urban areas, fewer than half of specialists sampled belonged to provider networks in Obamacare exchanges, according to the chart above. The chart below indicates that some of these areas have zero physicians of one specialty in-network.

The take-away? An Obamacare beneficiary who has a stroke is likely to be stuck with very high bills.

This corresponds with previous research indicating that Obamacare incentivizes health plans to design their networks (and prescription-drug formularies) to attract the healthy and shun the sick

Considering the population of Los Angeles is greater than that of the state of Oklahoma, such an absence is inexcusable.

Are there any initiatives in place to further expand the networks anytime soon?

Well, at least they can applaud the low costs that are attributed to these narrow networks… also known as rationing.

Simply put, the post above that purports to be supported by some sort of research which “suggests”, for example, that there are no cardiologists available to persons in the Los Angeles region who obtained their health insurance through the Covered California Health Benefits Exchange is . . . COMPLETELY WRONG and should have been properly researched. Because it is so blatantly false, it should be retracted! And if the data for Los Angeles are wrong, they probably are for the other nine regions as well.

As a California-licensed Life & Disability Insurance Analyst and Life Agent who helped enroll several dozen persons throughout the state into exchange-based health plans and three times as many into Medi-Cal, here’s what I wrote in response to a physician friend of mine who forwarded this blog post to me yesterday (9/26)(my verbatim reply):

Understand first that I have never been a proponent of Obamacare. Although I did not foresee narrower networks as a consequence (I don’t know the precise justification, but it certainly is attributable to the 80% Medical Loss Ratios that the insurance companies must meet), I think the networks are adequate.

When necessary, I have been able to find a person’s existing physician in at least one or more of the six out of seven health plans I promote here in LA County — Anthem, Blue Shield, Health Net, Kaiser, LA Care, and Molina. (The only health plan I don’t represent is Chinese Community Health Plan, and I don’t think they are coming back in 2015.)

I disagree with the “suggestions” in this report as far as LA is concerned. As an example, the Blue Shield PPO network for Covered California shows “224” physicians within a 30 mile radius of downtown Los Angeles. Because some physicians have multiple offices, each of which constitutes a different “provider”, the actual number of physicians is somewhat lower. But this is a far cry from ZERO.

You can try it yourself here: https://www.blueshieldca.com/fap/ Set the plan as “2014 Individual PPO Plans (including Covered California)” then use the “Advanced Search feature to isolate Cardiology as the specialty.

A look at the Anthem, Health Net, and other LA region plans would likely show similar results. I don’t know how this outfit Avalere Health came up with its statistics, but they’re clearly wrong.

Obviously, there are groups out there with certain “agendas”. I don’t think the AHA has one in particular, but they should have done a better job of this. I would hope that Obamacare fails of its own accord, but as long as it is the current game in town, as a licensed agent, I have a responsibility to at least help folks find their way into it.

However, I did fly to Sacramento on my own dime on September 18 to attend the CoveredCA Board of Directors meeting and share with them the frustrations that agents like I have faced in this first year. Executive Director Peter V. Lee goes around patting himself on the back for all the accomplishments, but rarely discloses or discusses the shortcomings. The document I placed in the hands of Director Lee and the other Board members caused at least one to state publicly that what he read was “troubling”. Director Lee replied that he would be “reaching out” to me . . . but I haven’t heard anything yet. And if I don’t before the next Board meeting, which should be in November, I will fly back again and let them know.

* * *

Having said all that, I would like AHA to reveal how Avalere Health came up with its erroneous numbers and publish an apology to cardiologists and consumers in Los Angeles, if not the rest of the metropolitan areas for which it reported statistics and about which it has misrepesented the facts.

* * *

As to “Big Truck Joe” who proclaims (perhaps facetiously) “the low costs” . . . that’s not universally correct in California, either. The majority of insured persons are paying higher premiums but don’t necessarily see it if they are receiving Advance Premium Tax Credits as a subsidy. Despite the promises of Obama that premiums would decrease by 25%, those of us who understand the economics of insurance have laughed at that in disgust for more about five years.

The truth is, in a capitalist economy, the government cannot tell private enterprise how to conduct its business — what it must pay for, such as abortions, and what it must provide for “free” such as contraceptives, wellness appointments, and certain diagnostic procedures such as mammography and colonoscopy — and simply expect the affected businesses to simply absorb those expenses without passing them on to consumers is naive.

Then again, there is a move afoot to destroy American capitalism at large, converting that economic strength into a bowl of gelatin incapable of supporting itself. This is just one of the first steps in that direction.

The insurance industry certainly needed to make some concessions and changes relative to healthcare, and the government itself has a responsibility to make provision for those who, for whatever reason, find themselves uninsured for their healthcare expenses, but the PPACA (“Obamacare” as it has come to be known) was not the correct solution.

The entire industry did not require retooling . . . simply opening up Medicaid (Medi-Cal in California) to all medically indigent persons under age 65, as the PPACA did for those whose incomes are below 133% (138% in CA and several other states) of the Federal Poverty Level, was the only change that was needed. Disguising that as “health care reform” — overturning a system that was generally working for 85% of all Americans — was a lie the American people, by and large, still fail to comprehend.

MAX H HERR, MA

Life and Disability Insurance Analyst

CA Insurance License #0596197

Pomona, CA

max.herr@verizon.net

Thank you very much for taking the time to give such a thorough comment. Please note that the research focused on comprehensive stroke centers (CSCs) only.

And of all the stroke victims on a daily basis in the greater Los Angeles area, how many are fortunate enough to be transported to one of them instead of the closest ER? The LA County Dept of Health Services (as of March 2013) had a list of 32 “Approved Stroke Centers” [see: http://ems.dhs.lacounty.gov/GIS/MAPS/Hospital/Stroke.pdf%5D.

Personally, I don’t know what the difference is between any of these “approved” hospitals and the narrow subset of “comprehensive” stroke centers, if any. But I still believe the “research” resulted in seriously flawed conclusions.

What the article also fails to state is the fact that ALL health plans are REQUIRED under the PPACA to cover EMERGENCY SERVICES at any hospital, in or out of network, to the exact same extent as they would in-network (and where the closest ER is in Canada or Mexico, the [probably lower] costs would be covered there, too). And let’s not forget that for nearly 20 years, EMTALA 1996 prohibits any American hospital from turning away a person because they cannot provide proof of insurance the moment they set foot into the ER.

For this reason, an insured stroke victim — with a health plan obtained through an employer-sponsored group, as an individual through Covered CA, privately off the exchange, or courtesy of Medi-Cal — has no reason to fear not being properly treated and having the cost of care paid for to the fullest extent of his/her coverage.

But let’s not forget that an uninsured person will get EXACTLY the same care, too, and their bill will probably end up being paid for by Medi-Cal or the rest of us through higher insurance premiums in the future.

So please stop this alarmist rhetoric!

Yes, the insurance companies have limited the size of some of their networks. It was inevitable given the ridiculous MLRs of 80% and 85% set forth in the PPACA. Costs have to be contained in one way or another in order to provide the “free” services that Obama promised the masses, not to mention unlimited lifetime coverage of health care expenses.

Sorry, I hit the submit button too soon! I have one final comment concerning the following statement:

“An Obamacare beneficiary who has a stroke is likely to be stuck with very high bills.”

This, too, is essentially untrue. As long as the services provided are medically necessary, a person’s out of pocket expenses are capped according to the plan under which he/she has coverage. A Platinum tier (highest level) plan in California generally has a $2,000 maximum, while a Bronze tier plan (lowest level) has a $6350 maximum.

Every penny of in-network medically necessary health care expense beyond that in a year is covered 100% by the insurance company. If a person is covered under a PPO instead of an HMO, the maximums could be slightly higher, but there would still be coverage in any out-of-network hospital from any out-of-network provider.

As a licensed agent, I make sure my clients understand all of the coverage options available to them and the important distinctions between plans, as well as the relationship between paying slightly higher premiums vs. obtaining lower out-of-pocket expenses and maximums.

If the only thing a person was concerned about when choosing a health plan was, “Will my bills be covered if I have to be admitted to a comprehensive stroke center?” it could make a difference as to which of several health plan options is best, but I doubt that many, if any, are giving consideration to such a minute point as this.

Thank you again, and I agree with you. However, I am not sure all stroke treatment is defined as “emergency”.

Early reports that something like 70% of California doctors refused to sign up with exchange plans was overblown. However, so-called narrow networks is a way health plans negotiate lower fees from doctors wishing to be included in a network. There is certainly nothing wrong with that as long as the health plan includes enough providers to do the job adequately.