Health Construction Boomlet Continues

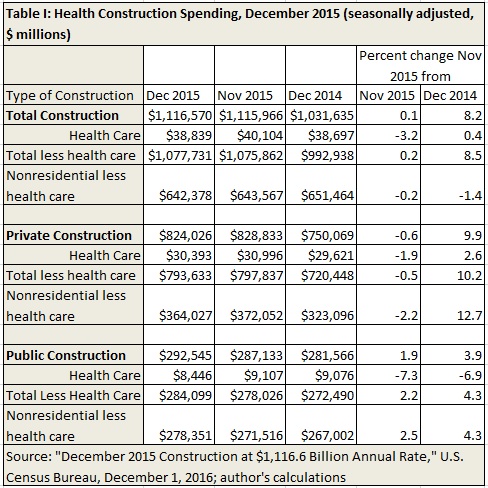

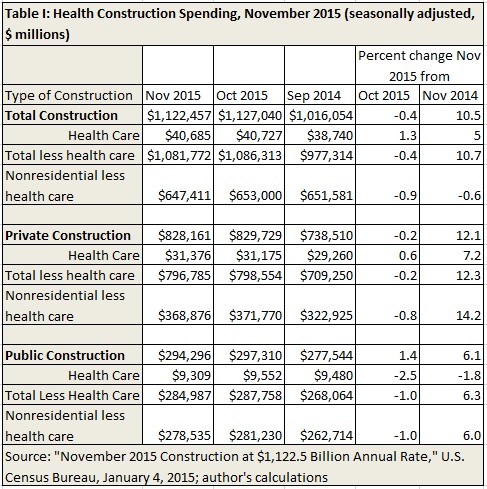

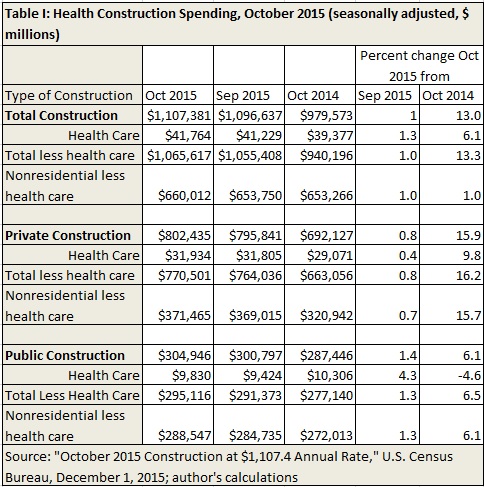

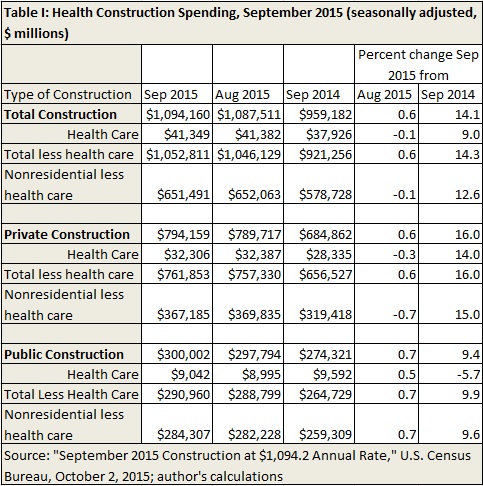

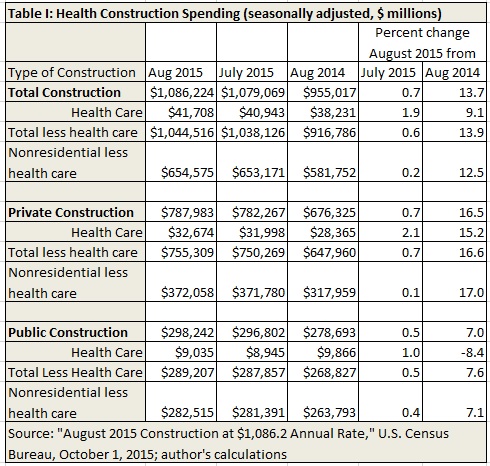

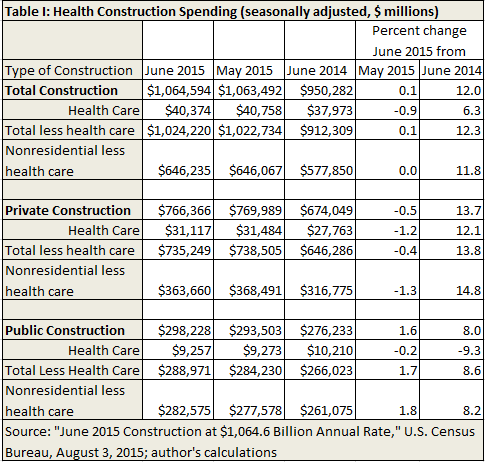

The boomlet in health construction, first noted in last month’s Census Bureau release, continued in March. Health facilities construction starts grew 1.6 percent, while other construction grew only 0.3 percent (Table I).

The boomlet in health construction, first noted in last month’s Census Bureau release, continued in March. Health facilities construction starts grew 1.6 percent, while other construction grew only 0.3 percent (Table I).

The rate of growth was significantly greater for public health facilities (2.3 percent) than private health facilities (1.4 percent). Further, the relative growth was much larger for public health facilities, because non-health public construction declined by 2 percent, while non-health private construction grew 0.7 percent.

This is the second month of uptick in health facilities construction. Over the last twelve months, health facilities construction starts have grown only half as fast as non-health starts (4.1 percent versus 8.2 percent). It is too early to say whether the boomlet in health facilities construction indicates a trending upturn. However, it suggests health systems are beginning to be optimistic about their abilities to continue to extract revenue from the system.