Necessary Spending or a Waste of Money?

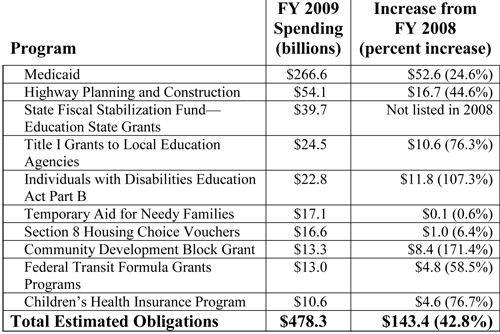

The following tables show the 10 largest Federal Assistance Programs for FY 2009 and FY 2008 according to a December 2009 GAO report.

Note that some programs that might logically be expected to need more funds during a severe recession, notably TANF (welfare) and housing vouchers, received relatively small increases. Programs with costs that are less likely to be affected by a recession, notably education for children with disabilities, federal highway planning and construction, and public education, received substantial increases.

According to the Centers for Medicare & Medicaid Services, the unduplicated annual enrollment in Medicaid from 2008 to 2009 increased by about 4 million people, 6.5 percent from a base of 60.3 million people. The Milliman medical cost index increased by 7.4 percent from 2008 to 2009. Increasing the Medicaid budget by 6.5 percent to reflect the enrollment increase and 7.4 percent to reflect the private medical cost increase yields a budget of $244.8 million, a 14.4 percent increase.

Instead, the parsimonious federal government presided over Medicaid spending that increased by 24.6 percent.

Note: What do these programs do?

The Community Block Grant program is funneled through HUD. It provides funding to communities to “develop decent housing, suitable living environments, and economic opportunities for people of low and moderate income.”

The State Fiscal Stabilization Fund is supposed to help stabilize state and local government budgets and avoid reductions in education.

The Federal Transit Formula Grants Programs supports public transit systems whether people need them or not.

The Individuals with Disabilities Education Act controls how states and public agencies provide special education.

But how well do any of them work?–especially in comparison to private relief or assistance programs?

Notice the double-digit increases in every program except for those that might actually provide some assistance.

The federal and state cost of Medicaid will continue to grow unless something is done. Unfortunately, what was done was an expansion of Medicaid by 16 million to 18 million additional people over the next few years. Moreover, there are around 10 million people currently eligible for Medicaid but unenrolled. The CBO assumes most won’t bother to enroll in the future but with a mandate, many surely will. The expected 16 million to 18 million additional enrollees could easily become 25 million additional Medicaid enrollees before this decade is out.

States often use the CDBG and other assistance funds to supplement (or replace) funding for their own state and local programs. Governors have become so dependent on this money, that the office of governer has devoled into a shadow of what it used to be, with all 50 governors routinely traveling to Washington to beg for more.

Watch those formula grants: they could become the new earmarks!

There are big increases in spending designed to encourage the states to spend more (e.g., education, Medicaid expansion) and keep people on the payroll — hence increasing state pension obligations & likelihood of default. How about, instead, since the feds will do it anyway, offering to bail the states out of their definable, accrued pension costs (not any going forward)–as the federal govt bailed them out after the Revolution. Simultaneously, eliminate any federal program that gives funds to states, or provides funds that are administered or disbursed by the states.