More Price Transparency Problems

Writing in Health Affairs, Ge Bai and Gerard F. Anderson have highlighted the fifty U.S. hospitals with the most “extreme markups” from what Medicare pays to their list prices (from the hospital chargemaster). The paper, available by subscription, is written up by Olga Khazan in The Atlantic (which you can read online for free):

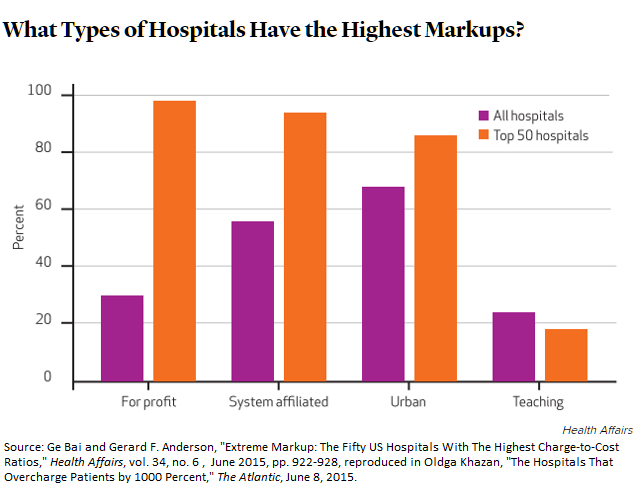

The study found that, on average, the 50 hospitals with the highest markups charged people 10 times more than what it cost them to provide the treatments in 2012.

Bai and Anderson call for more government interference in hospital pricing:

Uninsured patients, who lack bargaining power, are commonly subject to the full hospital charges, and their medical bills may be sent to bill collectors if they do not pay the high markups.

Federal and state governments may want to consider limitations on the charge-to-cost ratio, some form of all-payer rate setting, or mandated price disclosure to regulate hospital markups.

Argh! It’s probably time for me to do a more weighty paper on this problem, because my recommendation of a common law solution needs more momentum behind it.

Let me put it this way: WalMart, Home Depot, and Safeway have consolidated the department store, hardware, and grocery business. When you and I go to these places we “lack bargaining power,” and yet we enjoy low prices. There is no government-regulated “all-payer rate setting” or any of the other “solutions” posed for the hospitals.

Harris Meyer, writing in Modern Healthcare, shares a 360 degree view of the problem, and promotes New York’s law on price transparency. IT was only passed in April, so it is too soon to pronounce judgment on it.

“charged people 10 times more than what it cost them”

Givernment dictates the amounts it will pay.

No problem, hospitals can increase its charges to private payers.

Private payer

When providers, including hospitals, send bills to the uninsured or patients who find themselves out of network, they should have to include the Medicare payment rate on the bill so the patient can have a benchmark amount that the provider accepts as full payment even though it’s an administered (dictated) price. They are not required to participate in Medicare. Then let the hospital try to justify charging the uninsured person 10 times what Medicare pays and let the patient take the matter to the state’s insurance ombudsman if the hospital doesn’t agree to accept an amount that more closely reflects both the cost of providing the service and its value.

I still prefer legislated limits on how much can be charged to uninsured patients and patients who find themselves out of network and for any care that must be delivered under emergency conditions.

More regulation! The Medicare rate is publicly available and claims by providers are released by the Administration. So the jury would have that information, if the law adopted the common-law approach I’ve suggested.

“charged people 10 times more than what it cost them”

And thereby hangs a tale. (A tale, btw, that should never, ever, be attempted from one’s smartphone).

Once upon a time, hospitals determined the cost of delivering their services, and set prices for their patients accordingly. But it came to pass that medical care costs got more expensive, therefore so did hospital prices, and many people were no longer able to pay for their hospital care.

No problem. Private insurance plans like Blue Cross were invented.

The years went by and the cost of medical care continued to rise. So the cost of Blue Cross insurance also rose. People had a hard time paying their premiums.

No problem. Private insurance companies invented group medical insurance for large and small companies.

In group insurance, each employer contributes a goodly part of their employees’ premium and that helped keep group medical insurance affordable for the employees. But the group medical insurance plans mostly avoided high cost populations of non-working people – elderly and poor.

No problem. The government invented Medicare and Medicaid.

Unfortunately, medical costs stubbornly continued to rise. Medicare and Medicaid costs were higher than anyone had predicted, and grew much faster than anyone had predicted. This required large tax increases to pay for them.

No problem. To finance the programs, government began to raise Medicare premiums. Government also started trimming Medicare and Medicaid benefits. More importantly, government started to negotiate lesser Medicare and Medicaid reimbursements to hospitals. This tactic quickly began to squeeze hospital revenues.

No problem. Hospitals could, and did, make up for lesser reimbursements from government programs, by charging private programs a little more.

Unfortunately, while medical costs continued to grow, government reimbursements continued to shrink. This increased the squeeze and forced hospitals’ additional charges to private insurance plans to became larger and still larger.

No problem. Private insurance plans began negotiating their own hospital reimbursements.

But these reimbursements could not be as low as Medicare and Medicaid because the government insisted on being the lowest payer. And, of course, without sufficient overall revenue hospitals would fail. So private insurance premiums continued to rise faster than medical costs. Meanwhile employers that paid the majority of group insurance premiums used the same tactics as Medicare and Medicaid – that is, by increasing employee contributions and by passing costs along via trimming benefits. Of course, individuals were having to pay the highest premiums of all, because they received no employer or government subsidies at all. Public outcry grew and grew.

No problem. Again the government stepped in to create the “Affordable Care Act”.

This Act promised to subsidize almost everyone’s insurance premium, depending on family income, so insurance would again be affordable. Unfortunately, the Act did not bend the medical care cost curve. Hospital charges continued to rise, and so did insurance premiums. Now researchers are finding that hospitals charge people and insurance plans much more than what it costs to provide the medical care. These researchers say the government – yeah, the same government that has been progressively reimbursing hospitals less and less; the same government that has been causing private sector medical care costs to grow higher and faster; that same government that has a vested interest in shifting costs into the private sector – should now intrude even more into hospital pricing.

At long last – this is a problem.

John,

Thanks for that post.

My fundamental question, though, is why did hospital costs grow so rapidly in the first place? According to Milton Friedman, the number of hospital employees per occupied bed increased nine fold since 1946 while many consistently operate at occupancy rates too low to ensure long term economic viability. I’ve also seen estimates by M.I.T.’s Clayton Christensen that suggest for each dollar that hospitals spend on direct patient care, there could be as much as nine dollars of indirect overhead. Why is that?

I’ve asked numerous times if anyone knows of any studies that compare U.S. hospitals with Canadian and Western European counterparts based on number of employees per occupied bed or per licensed bed. I’ve never seen such a study though Princeton’s Uwe Reinhardt suggests that it would be very expensive to conduct a study like that. I have no idea why that is either.

Medicare overpays for some procedures and underpays for others. In NJ a couple of years back, it was determined that Medicare reimburses NJ hospitals at about 91% of costs on average. Medicaid reimbursement rates are significantly lower and then there is uncompensated care though that should decline as more people get health insurance. Even Medicaid rates are still well above zero.

Don’t hospitals submit cost reports to CMS? The information exists. It would be helpful if the underlying reasons for ever increasing hospital costs beyond general inflation were made available to the public. Specifically, why do hospitals need so many employees?

Most hospitals in all countries are non-profit, so suffer the same perverse incentives: Because investors do not demand dividends, management consumes the economic rent by stuffing capital and increasing salaries, thereby raising both fixed and variable costs.

“why did hospital costs grow so rapidly in the first place?”

Barry, I agree that the first question that should be asked is about the cost of medical care delivery. I don’t know the answers; like you, I don’t know of any definitive study that has the answers; but it seems to me there has never been a shortage of “swamis” who advocate their own answers about what this elephant really looks like.

So, fwiw, I dug up my file of articles I’ve saved over the years about rising hospital costs – here are three of them. The first two are more or less academic, one from 1973 and the other from 1992. Isn’t it interesting how similar the suspected causes remain, after so many years?

1. http://www.ssa.gov/policy/docs/ssb/v36n8/v36n8p18.pdf

2. http://content.healthaffairs.org/content/11/2/134.full.pdf

The third article is the oldest, from Atlantic Magazine, March 1970. I include this because of its perspective, its readability, and because you will recognize its author, who was a 27-year-old physician (in 1970).

3. http://www.theatlantic.com/magazine/archive/1970/03/the-high-cost-of-cure/307121/

btw, it was in this last article that I first encountered the concept of cost-shifting from public insurance schemes into private insurance.

John,

The Chichton article could be the best one I’ve ever read about the rising cost of medical care generally and hospital costs in particular.

I haven’t had a chance to read the other two articles yet.

Thanks for the links.

in 1970, Medicare had barely gotten on its legs. Nevertheless, if you added a zero or two to the dollar figures and changed not one word of text, you could change the date to 2015 and nobody would think it was a 45-year old article.

Note to John G —

Good post, but your comparison of hospitals vs. Welmart or Home Depot might be a little flat.

A customer at Walmart or Home Depot has complete exit power (I may be butchering that phrase). All I mean is that the customer can walk away at any time if they feel the prices are unfair. They can even walk all the way to the checkout counter, and drop an items on a shelf before they pay for it.

Hospitals are wildly different. About 20% of patient come in on stretchers more or less, and have no say on prices.

Even patients who have scheduled care cannot tell a doctor who visits them for 10 minutes and sends a bill for $300 to bug off. (If the doctor is out of network, the undebatable bill could be even worse.)

We do need countervailing power vs hospitals. The patiemt

is not a countervailing power.

Of course, the emergency department scenario is different. (Although, as we have discussed her, a large proportion of those who show up in EDs give up waiting and walk out!)

The out-of-network problem is due to insurers’ inability to get providers to bundle and re-bundle services efficiently, as they would if patients controlled dollars directly. There are also medieval-guild type aspects to the relationships between doctors and hospitals.

Note to Barry:

I just sent a post to The Health Care Blog on this very issue of hospital job count.

So many parts of hospital care are more productive than in the past. A dramatic example is lithotripsy, where a one hour procedure for kidney stones has replaced 5 days of nursing care. I could go on and on with examples.

Yet the number of employees per bed goes up and up.

The single payer devotees blame this on our multiple insurance carriers and claims handling snafus. This is part of the problem but not the whole thing!