Is Medicare A Good Deal?

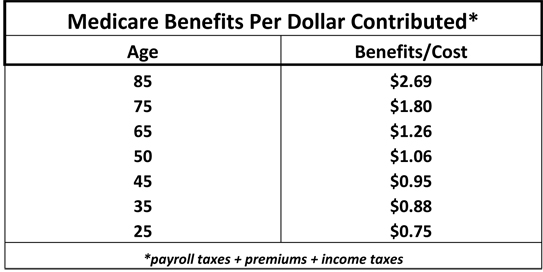

Think about everything you will pay to support Medicare: the payroll taxes while you are working, the premiums during retirement, and your share of the income taxes that subsidize the system. Then compare that to the benefits of Medicare insurance, say, from age 65 until the day you die.

Are you likely to come out ahead? That depends in part on how old you are. If you are a typical 85-year-old, for example, you can expect about $55,000 of insurance benefits over and above everything you have been paying into the system. If you’re a typical 25-year-old, however, you will pay an extra $111,000 into the system, over and above any benefits you can expect to receive.

By the way, this is not the sort of calculations you want to try at home on a pocket calculator. It’s too complicated. Fortunately the heavy lifting has already been done by Andrew Rettenmaier and Courtney Collins in a report for the National Center for Policy Analysis. See the table.

In terms of dollars in and dollars out, Medicare breaks down this way:

- A typical 85-year-old is going to get back $2.69 in benefits for every dollar paid into the system in the form of premiums and taxes—a good deal by any measure.

- People turning 65 today don’t do nearly as well — they get back $1.25 for every dollar they pay in.

- The average worker under age 50 loses under the system — with a 45-year-old getting back only 95 cents on the dollar.

- That’s better than the deal 25-year-olds get, however; they can expect to get back 75 cents for every dollar they contribute.

Why does Medicare favor the old and discriminate against the young? Because like Social Security, Medicare finances work like a chain letter. Although workers have been repeatedly told that their payroll taxes are being securely held in trust funds, they are actually being spent—the very minute, the very hour, the very day they arrive in the Treasury’s bank account.

No money has been saved. No investments have been made. No cash has been stashed away in bank vaults. Today’s payroll tax payments are being spent to pay medical bills for today’s retirees. And if any surplus materializes, it’s spent on other government programs. As a result, when today’s workers reach the eligibility age of 65, they will be able to get benefits only if future taxpayers pay (higher) taxes to support them.

Just as Bernie Madoff was able to offer early investors above-market returns, early retirees got a bonanza from Social Security and Medicare. That’s the way chain-letter finance works. But in the long run, there’s no free lunch. That’s why things look so dismal for young people entering the labor market today.

The return from Medicare has been very much in the news lately because of an Urban Institute finding that seniors are getting a lot more out of Medicare than they put in. This conclusion is being used to justify cuts in Medicare spending favored by both Democrats and Republicans.

There is no question that Medicare needs reforming. But the Urban Institute paints a picture that is too rosy. That report failed to account for income taxes seniors pay to support Medicare, failed to adjust for the full measure of Medicare cuts under health reform (ObamaCare) and treated Medicare promises as though they are as secure as government bonds, even though they clearly are not.

Regardless of who cranks the numbers, the reality remains the same. The generations who will be hit the hardest by Medicare reform are the same people who weren’t going to get a good deal from the system even without reform.

John,

Are you sure you’re citing the right study? I looked at it and couldn’t find anything age-related. Their disaggregation seemed to be by state, not age.

not to mention the QUALITY of the benefits…

This is similar to Social Security. The first enrollees into the system will receive higher returns than later ones. This is partly the result of political pressure on politicians to boost benefits without raising taxes. When Baby Boomers were contributing payroll taxes into the system it was easy to pay benefits greater than were funded. Once Baby Boomers become recipients of Social Security and Medicare benefits, the system will be hard to maintain.

This is the study that this health alert should be linked to http://www.ncpathinktank.org/pub/st333

Not to mention the fact that with accelerating technolgy, we have no idea what “normal” healthcare coverage will look like when I am 80 years old (60 years from now…) People are rarely right when predicting future inventions.

David, I was traveling to Washington this morning (God knows they need help) and we put up the post with the wrong link.

It’s been corrected.

Obama Care wiped out the positive net benefits for an entire generation: Age 30 to age 50.

“Chain Letter” is one description (I think a bit too benign). I have always called it the Pyramid Ponzi Scheme, and it has been taking in suckers in various forms for decades. In fact, it wouldn’t surprise me if old LBJ didn’t have this methodology in mind when he started using “Trust” funds to finance all his generous “Great Society” agenda. By the time it ever hit the fan he knew he would be pushing up pansies by the Pedernales River.

The dems take in the suckers the same way the snake oil salesmen (like Madoff and countless others) take in their suckers. The notion of getting “sumpin fer nuttin” always draws a crowd. In the case of the democrats the crowd is at the polling booth.

There seems to be a high positive correlation between John Goodman’s frequent presence in Washington and Washington srew-ups. Can someone enlighten me on which way does the causation flows?

But John is right: Because someone in the past (I believe it was President Johnson) “unified” the budget by adding the trust funds to the general operating budget, government has been able to finance on all kinds of things, including waste and wars, with what essentially is pension-fund assets.

Ideally, we should have invested the Social Security and Medicare Trust Fund surpluses in US or foreign private markets. The Canadian public pension fund does exactly that. It joint-ventures with US equity funds in investments here and abroad. Had we adopted that strategy, it would have reduced the brewing tax burden on our children and theirs.

There were, of course, plenty of Presidents and Congresses from either party since the 1960s that could have rectified that tragedy. They did not.

Indeed, look at the sweetheart deal George W. Bush gave the elderly: the MMA ’03, a huge new entitlement wholly debt financed, then, now, and in the future.

Usually I focus on what is known as the “on-budget” federal budget in my writings. It excludes the trust funds.

Ken:

Can you explain a bit better how Obama wiped out these benefits?

Uwe

Figures don’t lie, but liars figure…

-Dr Bob Kramer

“Indeed, look at the sweetheart deal George W. Bush gave the elderly: the MMA ’03, a huge new entitlement wholly debt financed, then, now, and in the future.”

Hmmm…Citing GWB’s unfortunate dalliance into the democrat’s fantasy Island financing fest is like defending a drunk who killed 6 people in an auto accident by reminding everyone that Mother Teresa once drank a glass of wine.

Deficit financing was birthed, nurtured and matured into a big hungry ogre under the care and direction of democrats. They own it, and all the spin from the national media and D.C. pundits can’t change the political reality. That relativism dog will not hunt.

@ Uwe

Before the passage of the PPACA, the average person over 30 could expect to get more back than he paid in. Afeter the passage of the act, the cut off point has risen to about 50. So average wage workers from age 30 to age 50 went from a net gain from the system to a net loss.

Check out my blog post showing the problem with this study:

http://econlog.econlib.org/archives/2011/06/medicare_almost.html

I wouldn’t trust any jerry-rigged figures from John Goodman or the right-wing billionaire-funded think tanks who are there only to support the profits of the insurance companies.

Rather than kill Medicare we need to expand it to an improved Medicare-for-All – a single-payer, not-for-profit national health insurance, which would expand the tried and true Medicare system to cover all medical procedures and extend it to cover all persons from birth to death. Publicly funded, privately provided, health care for all. Free choice of doctor and hospital. Its superiority lies in excluding profit-seeking insurance companies and Big Pharma from controlling and undermining our health system. We waste 400 billion a year on private insurance administrative costs and profits – 1/3rd of every dollar spent on health care. Expanding Medicare to cover everyone would cost each of us less out of pocket than ever-increasing insurance premiums.

The private for-profit insurance system is like a malignant cancerous tumor. In an effort to cure cancer, do we open up the patient, do some artful carving on the tumor to rearrange its shape, and then sew the patient back up, leaving the tumor intact? No. We do everything in our power to remove the tumor completely.

This study also does not take into account that contributions to Medicare and Social Security, if contributed to a personal retirement account, would have earned interest over the years. Therefore a person who made contributions to Medicare in the past SHOULD expect to get back more than they actually contributed. In addition to the interest that they might have earned, dollars contributed in the past were worth much more than 2011 dollars. The effects of inflation make the value of current benefits worth less for all age groups.

All these greedy old farts are are going to drive the boomers into euthanasia in the future

Ken:

Interestingly, the haircut the PPACA imposes on Medicare ($500 billion over the decade) was kept dollar for dollar in the Ryan budget.

Surely you knew that, as John has blogged on that irony.

Uwe

Frank Timmins:

Look at Figure 1 of the CBO Budget Outloook February 15, 2011 at http://www.cbo.gov/ftpdocs/120xx/doc12039/SummaryforWeb.pdf

and then try to sell me that bullshine about who creates budget deficits again.

Uwe

Rick is right.

The problem with Medicare is that it is a separate program for expensive individuals – end of life care, long term disabilities, and end-stage renal disease. We’ve left out of Medicare the very large, inexpensive population – the healthy workforce and their young healthy families. Combine everyone into one risk pool and it becomes more logical.

No private insurer is expected to maintain reserves that would pay for all care for the entire lives of their insured clients. Incoming revenues (premiums) pay much of the outgoing expenses (health care), with the balance paid by investment income. If you judge winners and losers by amounts paid out, then high-cost individuals win and the healthy lose. But that is what insurance is all about – one of the rare times in life that it is great to be a loser.

It is not logical to have the healthy sector – wage earners – pay into a pool for high-cost individuals when they are not allowed themselves to draw from that pool for their own health care needs (except by the arbitrary decision to move individuals into that pool only after developing ESRD, a long-term disability, or reaching the age of 65).

Establish a single risk pool for everyone, fund it equitably based on ability to pay, and the “Ponzi argument” goes away. You are left with transfers from the healthy to the sick (and from the wealthy which is what makes it possible to buy health care for low and moderate income individuals that would otherwise be unaffordable for them).

Sadly, it is that last parenthetical point that seems to divide us as a nation.

Medicare-for-all: Adding more suckers to a ponzi scheme does not improve the underlying investment, it just creates more victims.

True market discipline (the Ryan Plan) is the only way to improve quality and reduce costs. Doubters should look into the quality and cost improvements in the area Lasik Surgery, which has been subjected to market discipline.

Ryan’s plan left the $500 billion cut intact because it is currently the law of the land. You have to work within the framework of laws currently on the books. If and when Obamacare can be repealed, the budget will reflect that.

Mr. Reinhardt, the only telling statistic from your CBO figures (table 1) is the fact that revenues seemed to rise “after” democrats “lose control” of congress and vice versa. And of course, it is the congress that controls the legislation that deals with revenue and expenditures (which have a similar relationship to the party in power).

Note the graph in the years following a democrat takeover of both houses of congress (1986 – 1992) and (2006), and then compare to the years of GOP takeover (1994 – 2000) and (2002 – 2005). That is not bullshine.

“I wouldn’t trust any jerry-rigged figures from John Goodman or the right-wing billionaire-funded think tanks who are there only to support the profits of the insurance companies.”

Nah Rick. I wouldn’t trust any legitimate sources of data either – not when we can always find some obscure irrelevant data (if we look long enough) that will support our ideology.

And why waste 400 billion a year on private company administrative costs and profits when we can waste 800 billion on government inefficiency and graft? Hey, who could argue with that logic?

To Frank Timmins:

I recall that toward the end of President reagan’s term, conservative commentator George Will wrote an op-ed piece “A Deficit fit for a King” (I think it was called) in which he noted that Reagan not once vetoed a budget bill passed by Congress although he could have. And the Wal Street Journal had an artcle showing that Congress pretty much gave reagan every budget he submitted. The variance was only 1% of the budget, and I don’t even recall in which direction that was.

You should also read some of the writings of Bruce Bartlett, formerly of the NCPA I believe.

So, with all due respect, i still don;t buy the bullshine.

Does this take into account the net present value of money?

If you invest a dollar to day and then get a dollar back 50 years later, you did not break even. To calculate what it takes to break even, one has to multiply the time invested by the rate of return on a secure investment (actually, divide 100 by that rate of return and then multiply it by the number of years invested). So if something like AAA collateralized bonds return 2% a year, they would double in value in 50 years (assuming my math is correct). Therefore, a dollar invested at that rate for 50 years would have to return two dollars to break even.

@Lynn Miller,

Actually, Lynn, the study does not make the mistake you say it does. They use various rates of return and show the results for each.

Ok, besides national defense and saving many countries from various forms of dictatorship (Nazism, Communism, Fascism, etc.), which government programs have worked as they promised and came in on or under budget?

The typical liberal argument was to provide a relative argument that “they also did it!” or “It’s no worse than such and such” or “they failed because it was not funded enough or they weren’t as smart as we are now.”

It’s a new world, the awakened are shouting ENOUGH! Your “change” from both sides is destroying my children’s future.

Medicare funding problem is not going to change until we privatize it, modernize it, and move to a Personalized Medicare program that focuses on the individual behaviors and rewards and incentives better health and healthcare decisions (i.e. compliance with treatment plans, better lifestyle choices, Medicare HSAs)

Taking $1T in fraud out of the system and defeating the growing theft from organized crime would be a good start before we reduce benefits or eliminate coverages.

How about getting the country to produse goods and services that the world wants that would increase government revenues to fund the “over promises” and improve our standard or living once again. We should be the world’s producer of energy and food. We should be the center for the world’s job creating entrepeneurs. Then we won’t be fighting over a shrinking pie, but enjoying a growing bakery of sweets.

To John and Frank Timmins:

Medicare is neither a chain letter nor a Ponzi scheme. Those are closed-loop circular arrangements in which the scheme eventually comes around to the same people who already have paid into it and asks for more money than those people got. Medicare and Social Security are open-loop intergenerational transfers in which the person receiving benefits now is never asked to pay in the future because he is dead by then.

Both Medicare and Social Security in principle could remain solvent, in contrast to chain letters and Ponzi schemes, which necessarily cannot. In practice, Medicare and Social Security were undone by two unrelated things. First, the politicians saw they had vote-buying goldmines in both programs and kept ramping up the benefits associated with each, necessarily ramping up the cots, too (but of course politicians never talk about the costs of anything). Second and more important, there was a major demographic shift in the form of a huge drop in the number of children born to fertile couples, leaving far fewer young people to pay for the benefits being received by old people. That was bad luck as far as financing Medicare and Social Security was concerned, but it was in no way a necessary outcome of either program.

Characterizing either Medicare or Social Security as a chain letter or a Ponzi scheme is simply a mistake, and it misleads people about the true nature of the problems with both the financing of both programs.

Jam:

You assert that Ryan had to keep Obama’s $500 billion Medicare cut in his budget bill because it now is the law of the land. Are you telling us that Congress cannot change the currennt law of the land?

If so, your assertion is not just bullshine it is the real thing.

U we

I presume the statistics in your article published in Townhall don’t take into consideration the income that could have been earned on the dollars put into medicare. Thank you for the article.

-HARRELL PAILET

John,

I just reached 65, when I started by Social Security application process I found out that I was too early. The eligibility age has since been changed to 66. I’ll see what they have to say next year.

-Don Van Dorn

To John Seater

John, I get what you are saying about the subtle nuances between a carefully constructed Ponzi scheme and the Medicare/SS conundrum, but I contend that the similarities are more striking than the differences.

A pyramid scheme is not necessarily “closed loop” because in theory the base keeps expanding indefinitely (as long as the suckers keep coming). Of course the reality is that one does run out of suckers and that’s when the whole pyramid collapses. The “suckers” in this example are the young and the yet unborn who will be paying into a scheme originally sold as a “trust” but ultimately diverted and purloined by LBJ and his ilk for their own purposes, leaving serious doubt that current money “invested” in this scheme can ever be returned to the sucker. As far as I am concerned this qualifies for the tag “Ponzi Scheme”. I wouldn’t be surprised to learn that Madoff actually drew inspiration from it.

Cost, Mr. Goodman. We need you to go talk about managing the costs. Cost reduce the processes in the healthcare system. Demonstrate in a way that we can research, find the same conclusion as you. then we talk about defining value in healthcare. Your description of entitlement programs as ponzi schemes or chain letter financing is inaccurate. For one, there are literally more Gen Y paying in now then there are Gen X. The demographic reality does not match your theory. Go do some more research and focus on cost. For example, how can yo reduce fraud? Second, identify waste separate from fraud by analyzing processes that should be streamlined. Thirdly, identify cost separate from fraud and processes in the delivery systems. Do not include technology. We can look at that later. In fact, your work in the other areas will put technology on notice.

John,

Compound this problem by the change in the profile of the working population, from primarily Caucasian, to a majority of Chinese, Latino, and points East. They are likely to resist paying through the nose for our Boomer retirees. And, they will be the ones in elected offices, as well. Doesn’t look promising for either Social Security or Medicare. Whereas, every newby wants to get on Medicaid.

Cheers,

Wanda J. Jones

Bravo!

You are finally seeing the results of “sick insurance”, not health insurance. The greed factor has overtaken the business of medicine, where the doctors are doing unnecessary procedures to provide income that offsets the loss due to the insurance industries need to increase their revenue by lowered reimbursement, and denial of services. I do not think that health care should be a bottom line, Wall Street sensitive and publically owned industry (or Business) where the only mandate is to show a return in increased revenue, without caring about the most important mandate of healthcare; to do what is necessary, not overdo, not overcharge, but to provide the best possible care with only concern is the care of the patient.

-Dr Bob Kramer

Of course Medicare and social security are sound. Many Washington insiders have been telling us for years that all is well because there are all those trust funds just overflowing with wealth.

As one who is not statistically savvy, I have to wonder about the effect of running the calculations by age bracket when so much of Medicare, Part A payroll taxes, Part B “Premiums” and Part D “Premiums” vary based on income/compensation. Similarly, benefits are significantly weighted in favor of individuals with inconsistent earnings histories or consistently low wages and no significant retirement benefit accumulations – dual eligibles under Medicare, the Social Security bend points, etc. Finally, social security benefits are taxable based on other income; again benefiting those with no other retirement income.

I used to joke all the time when people called for a payroll tax cut versus an income tax cut (because the payroll taxes are regressive and because so many Americans pay no income taxes and would not benefit from a reduction there), that the only thing more regressive than the payroll taxes are the benefits that they fund. So, has anyone run a comparable study where there are cohorts by age and income – perhaps quintiles, or by cohorts at the Social Security wage base, the Part B/D premium levels, etc.?

Seems to me, as someone who has played by the rules and deliberately reduced consumption to fund future income needs in retirement, that my higher income level in retirement will leave me much worse off (in terms of my return on investment) than the numbers cited in either the NCPA or Urban Institute study.