Entitlement Madness, Part II

At nearly $86 trillion, Medicare's unfunded liability is almost six times the size of Social Security's. Unfortunately, there's no easy way out. If we were to end Medicare tomorrow, collecting no more payroll taxes and allowing no more benefit accruals, we would still need $32 trillion in the bank right now to pay for the benefits people have already earned!

In the meantime, the cash flow deficits in Medicare and Social Security are on a course to crowd out every other federal program. As I explained at the National Journal Health blog, we cannot pay benefits with Trust fund IOUs that the government has written to itself. So to cover these deficits, we will need one in ten income tax dollars in 2012, one in four by 2020 and one in two by 2030.

Ah, but here's even more depressing news. Awful as all these numbers are, the reality is even worse. The reason? To estimate future Medicare spending the Social Security/Medicare Trustees and the Congressional Budget Office (CBO) must forecast health care spending as a whole. And neither agency is forecasting the actual path we are on.

httpv://www.youtube.com/watch?v=FkZLgJKQ46w

Let Me Help

To the casual reader (including almost all members of Congress and the financial news media), the Trustees and CBO estimates of future spending appear to be straightforward extrapolations of the past into the future. And this is what they should be. After all, how can policy makers know if the current policies need changing without first considering where those policies are taking us?

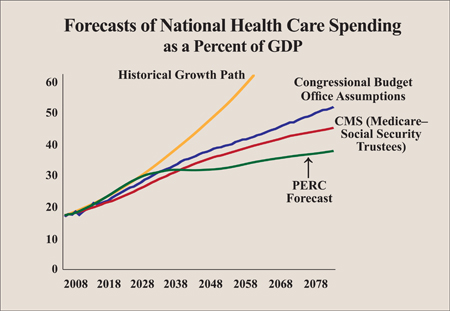

In fact, these two agencies assume that health care spending will slow. The Trustees assume it will eventually grow no faster than the economy as a whole. As the graph below shows, if we stay on the path we are on the country will be spending half the national income on health care by mid-century. Yet we will be spending only 37.4%, according to the CBO and 34.8%, according to the Trustees.

What policy changes will cause this slowing? How will they come about? Why will they come about? These questions are left completely unanswered. In fact, they are not even discussed.

In their defense, the estimators note that it is impossible for health care to grow forever at twice the rate of growth of income. True enough. But this response confuses the problem with the solution. The job of the estimators is not to predict what changes Congress will make and when it will make them. It is to show Congress what path we are on so that it will appreciate why changes in policy are necessary.

An alternative approach to estimating health care spending begins by noting that health care spending doesn't occur in a vacuum. Andrew Rettenmaier and his colleagues use a model in which health care has to compete against every other good, both in the private and public spheres.

Also shown on the graph (PERC forecast), this approach produces a more favorable estimate. But there is a terrible price. Along the way, not only does health care crowd out other government programs, it also crowds out investment — which is essential to economic growth.

Eventually health care spending may stop growing because it causes the economy to grind to a complete halt.

Great song paring, John. As usual.

Problem is: These guys don’t want your help.

The graph says it all. Let’s see, Bernie Madoff is going to prison because he did what?

John:

I share your concerns of these unfunded liabilities.

But you probably know these liabilities are not really liabilities.

The GASAB, who is the accounting advisor for the federal government, came out with a paper a few years ago entitled Accounting for Social Insurance, Revised.

From page 8 “Expenses and liabilities are incurred for social insurance when the amount of benefit is due and payable.”

Page 9 “Characterizing future benefits as liabilities may undermine efforts to reform these programs.”

Page 80 “The liability for all social benefits should be recognized only when all eligibility criteria have been satisfied, which means the liability generally equals the next payment.”

So, the unfunded liabilities are really only the payments due for the next year.

This is where legality and politicality collide.

Unfortunately, economics still ultimately prevails.

And, the government does not take its economic responsibility seriously enough.

Don Levit

What’s PERC? It’s not the outfit in Montana, is it?

John…this is a great analysis. We believe that if we could enroll the entire US population into The Prevention Plan we could make a significant dent in the coming crisis.

We bundled primary, secondary and tertiary prevention (prevention, early detection, chronic disease management and care coordination/advocacy) into the first health benefit for prevention.

This approach was identified in the Milken Institute’s 2007 Study, An Unhealthy America.

For more info go to http://www.USPreventiveMedicine.com.

Headquartered in McKinney, TX.

PERC is the Private Enterprise Research Center at Texa A & M University. It is headed by Thomas Saving, who was for many years a Trustee of Social Security and Medicare.

John has stated the problem quite clearly. However, what few people realize is that many physicians have a poor perception of the Medicare program. You can check out the follwing link for a sample of physician responses.

http://www.aapsonline.org/medicare/medrep.htm

In essence we are spending and have promised to spend trillions of dollars on a program which is becoming more and more of a hindrance to quality medical care.

Mark Kellen, MD

John, thanks for all your work and for publicizing the facts…but…referring to the last line of the first page, how can I have a good day after reading this?

Have you seen any modeling of the effect means testing may have in terms of changes to the Medicare growth curve? What does a solution look like?

[…] by underpaying doctors, how doctors often refuse to see patients, and how these financially unsustainable programs will suffocate the U.S […]