Bernie Sanders’ Single-Payer Utopia

Back in October I wrote “Is Obamacare’s Failure Intentional, to Promote Medicaid-for-All?” In it I discussed how Bernie Sanders famously advocated for single-payer socialized medicine during his campaign. In 2011, the Vermont legislature passed a bill to create a single-payer initiative known as Green Mountain Care. In 2014 it was abandoned by Vermont’s governor — a Democrat — as being too costly. Green Mountain Care was going to require an 11.5 percent payroll tax and an additional sliding-scale income tax that topped out at 9.5 percent. Despite the heavy tax burden, a single-payer system in Vermont was projected to run deficits by 2020.

A similar single payer initiative also failed in Colorado this past November when voters rejected it:

Colorado Health Institute (CHI) found the program would operate in the red from day 1 and the deficits would grow each year. The CHI analysis also found the “savings” from lower overhead, less administrative costs, lower hospital fees would about equal the “new expenses” from covering the uninsured and higher utilization by people whose taxpayer-funded care is now nearly free. In other words, the savings from a Single-Payer program in Colorado is a big, fat goose egg.

The analysis found the program would almost breakeven in its first year (2019). In 2019, ColoradoCare would cost about $36 billion, losing only $253 million. By 2028, ColoradoCare would run an $8 billion deficit — more than $100 per member per month.

Now, Bernie Sander is back at it again. More than 50 House Democrats have introduced The Expanded and Improved Medicare for All Act, (more accurately known as Medicaid for All). Although being presented as new & improved, it’s the same bill that failed last year.

This brings me to a point I’ve made in the past. Medicare is a public program that covers about 54 million beneficiaries and costs nearly $600 billion per year. It is bloated and is in dire need of reform. It’s prone to waste, fraud and abuse. Medicare is a mixture of fee-for-service piecemeal providers and private managed care plans. If it were expanded to six times its current size, the opportunities for fraud would increase. More importantly, Medicare’s plan design is nothing like single payer systems used in other countries.

A single payer system such as the one used in Canada, would have to include monopsony pricing. Everyone knows what a monopoly is: it’s a when one firm is the only seller of a good or service. Monopoly has bad connotations because everyone knows monopolies can price gouge and charge more than what would be charged in a competitive market. Think about some of the specialty oncology drugs on the market. They sometimes cost $100,000 per course of treatment because there are no competitors and death is not a popular alternative.

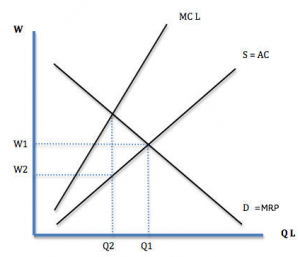

A monopsony is similar to a monopoly except it’s the only buyer of a given good or service. Just as a monopoly can charge higher prices than in a competitive market, a monopsony can pay less for the good or service than in a competitive market. If doctors don’t want to work for a mere $100,000 per year, tough. Find something else to do for a living. The point is that a monopsony like the Canadian government looks at the supply and demand curves for medicine and figures out where to set wages such that the cost is lower than in a competitive market creating a slight shortage of labor.

In a competitive market, the quantity of labor supplied (think doctors, nurses, and so on) is Q1 while the wage rate is W1 (see graphic below). If the government is the only buyer of doctors’ services, it could set doctors’ wages at W2 and accept that fewer doctors are willing to work for that rate. The quantity of labor supplied would be lower – at Q2. In a monopsony health care system that is fine, since every doctor working is costing money to treat patients (whose demand for care that’s free at the point of service is insatiable).

Paying lower wages to service providers is one way a single payer system saves money. They have the power to tell providers “it’s my way or the highway!” This is true not just of doctors, but every specialized employee of the health care system. Some employees would seek work in other industries. But a doctor and a nurse doesn’t have much choice, although some would retire or retrain for other careers.

Paying lower wages to service providers is one way a single payer system saves money. They have the power to tell providers “it’s my way or the highway!” This is true not just of doctors, but every specialized employee of the health care system. Some employees would seek work in other industries. But a doctor and a nurse doesn’t have much choice, although some would retire or retrain for other careers.

Another way single payer systems hold down costs is by paying less for medical supplies and hospitals stays. Hospitals in Canada are generally paid a global budget, whereas in the United States hospitals expect to be paid for every service they provide. What his means is that rather than paying a hospital for everything they do piecemeal like insurers must do, the government has a formula based on prior years’ capacity and provides the hospital with the money to operate but no more. In return for that global fee, hospitals are expected to accept all patients who present for care. Of course, a formula could be created that slightly rewards hospitals for seeing as many patients as possible.

Finally, single-payer systems have the power to ration the range of medical goods and services available to patients. When the $100,000 per year oncology drug price tags are capped at a mere $10,000, you can expect fewer advanced oncology drugs to be developed. Also expect fewer pieces of high-tech equipment and longer waits to use the equipment that is available. When the health care system is controlled by the government there are no competitors, it too has the ability to tell patients it’s the government’s way or the highway. Naïve proponents assume this would not occur. But it’s a necessary cost-saving measure when tax revenue runs short of patient needs, which inevitably occurs when medicine is funded by taxes.

There are a lot of liberal Democrats and Bernie Sanders’ supporters who think single payer is some panacea that will magically cure what ails our health care system. They know nothing about how it actually works. A single payer system that actually saves money would have to exercise monopsony power the way it is done in Canada, Britain, New Zealand and Australia. It would also have to ration care using waiting lists, equipment shortages and monopsony power. Most experts do not believe Americans are ready for that kind of overt rationing. Without overt rationing, there would be little savings as ColoradoCare proponents hated to admit.

aingle-payer advocates such as Bernie Sanders and others never seem to get around to providing good information or explanations to the general public.

These advocates don’t like to acknowledge that single-payer schemes have their own flaws and perverse incentives. They cite patient satisfaction with single-payer access to primary care but avoid talking about hospital or specialty care. And they choose to ignore the constant flow of stories about problems patients have in such systems – particularly with access to specialists and specialty care – because those stories damage their narrative.

As it stands, far too much of the advocates’ rhetoric takes the form of “aw, ma, all the guys have one, why can’t I”? Or, worse, “you hear a lot of horror stories about such systems, most of them false.” – the latter of course coming from Paul Krugman

Americans are being asked by these advocates to support single-payer here; why should we not know much more about how such schemes actually do work in other countries?

PS: “a doctor and a nurse doesn’t have much choice, although some would retire or retrain for other careers.”

I would also expect fewer able students would choose medicine as a career, in favor of careers that offer better compensation in return for the knowledge, responsibility, and stress involved. That would lock in an environment of fewer physicians, which may be a deliberate goal of planners in a single-payer system.

Very good John. Much of what I’ve read about the healthcare systems in countries with socialized medicine suggest that they are quite good at primary care and reasonably good at emergency care. It’s the non-life threatening conditions where overt rationing is most prevalent. In the end, the percentage of GDP that these countries are willing to spend on healthcare is more of a political decision than a reflection of how much healthcare the population actually needs or wants.

“the percentage of GDP that these countries are willing to spend on healthcare is more of a political decision ”

Yes, that’s true. History shows when governments control medical delivery, decisions about its supply, and spending for it, are political – including the same sorts of political favoritism found in all government programs.

Your comment and the president’s recent remarks about NATO remind me of a European problem I haven’t seen reported. Yet.

For the past 75 years, the U.S. thru NATO has provided the principal military defense shield for Europe. U.S. taxpayers have paid for that. Not having to fully shoulder the cost of defending themselves, European nations enjoyed the political luxury of funding social programs instead.

But now? Pressure to increase Medical spending is rising in the European single-payer utopias, even as US is making scary noises about reducing its financial commitment to NATO.

Guns and butter. Just like the graphs my Econ 101 prof drew back in the day.

We used to call this The politics of medicine. Under public choice economics, it makes sense for politicians to use public resources to benefit the most voters. The millions of people who want to see a doctor when they get sick are voters. The few thousand who are desperately-ill probably are not strong enough to go vote.

Devon, I agree it’s understandable why single-payer systems are designed that way.

its also understandable – but for entirely different reasons – why advocates of single-payer in the US don’t want Americans educated about how those programs are designed – and how they actually function. It’s not because most of the hair-raising stories about them are “false”. Wouldn’t you agree? 😎

Yes, it makes for some pretty bad press when someone dies waiting for radiation or because Avistan is not available in your health region. At the same time, another real problem is also single-payer Medicare for All would be come a single payer without any mechanism for rationing. Every scarce resource must be rationed somehow.

Yes. And aren’t all resources “scarce”? 😎

this doesn’t even make sense, inasmuch as a political decision IS an expression of what a “population actually needs or wants”, however much you want to insist that transactional “marketplace” decisions are the only “true” expression of what anyone “needs or wants”. But you be you, Barry, you crazy ideologue you. & take Fembup with you…..

“a political decision IS an expression of what a “population actually needs or wants”,

I think there is an enormous difference between a small number of bureaucrats deciding how to allocate government spending for medical or health care vs. individuals making their own decisions about medical care. I think those are very different things.

Apparently you believe since both types of decisions are “political” there is no sense in making distinctions between them. Seems to me that’s an opinion without sufficient nuance to distinguish very different things.

Or perhaps you’d be willing to explain.

We can only hope that the States will continue to maintain the political capital necessary to assure their governance of the health insurance industry. Speaking of institutional governance in healthcare, another influence among the payers comes from the institutions primarily connected with Complex Healthcare Needs, the University based medical schools. For hundreds of years, the Universities stayed out of the essential operational affairs of society, e.g., Law, engineering, architecture, psychology, philosophy etc.

But, in the last 50 years, the economics of complex healthcare have increasingly dominated the day to day affairs of most medical schools within Complex Healthcare. The long-standing traditions for basic research and a commitment to maintain our systems of thought and knowledge no longer represent the dominant influences within a medical school environment. There is no reason to believe that this evolution of the “power elite” within our nation’s healthcare will promote an appropriate use of our nation’s economy for population HEALTH . OR . reverse the 20 year worsening of our nation’s maternal mortality ratio. We are the only developed nation in the world with a persistent worsening in our nation’s maternal mortality ratio.

.

The Design Principles for managing a common pool resource, as in our national economy, are known and validated. We simply lack the ‘social will’ to apply them, community by community.

I would argue that The ACA intentionally expanded the common pool resources rather than define them and manage them. Regulations like Guaranteed issue / community rating, no annual or lifetime caps on benefits. These were all attempts to take individuals’ resources and pour them into the community pool.

Agreed, absolutely

.

Parkinson’s Law governs the use of unfettered resources. Since Basic Healthcare is really a pre-paid expense and Complex Healthcare is more actuarially efficient and in higher demand, the distribution of resources for Complex Healthcare has preferentially occurred to the detriment of Basic Healthcare. Paradigm Paralysis perpetuates it. The demand goes up conincidentally from the worsening in Stable HEALTH caused by the poor traditions of availability and accessibility for Basic Healthcare. The example of our nation’s maternal mortality is the most egregious example of this, worsening for twenty year is a row.

50 people a day die because of RX over-dose. Your dead infants is a itty-bitty number. Why don’t you figure out a way to stop these crack addicts from having sex, community by community, all for Stable HEALTH.

We need to go the complete opposite way of single payer

An entity that apparently has access to infinite dollars should have very little influence over an economy

That is a blueprint for fiscal disaster

We need to start extending private policies one year for 35 years until Medicare is no longer available up to age 100

Of course we need to drastically change how we pool risk and finance health expenses before the fact and accumulating real reserves for the policyholders

I agree. Why do we need an inefficient “payer” when the medical establishment would cater to consumers much more if there were no third-party payers. Rare events would be package deals that worked on the casualty model.

jesus christ, Herrick what you know about how insurance of any kind works – never mind how health insurance works – would fit in a thimble with room left over for all 27 volumes of the World Book Encyclopedia.

I am NOT a fan of single payer solutions, but the ignorant gibberish coming out of the foaming mouths of you ideological zombies is completely embarrassing.

Foaming mouth? I assure you, your rhetoric has more foam than mind. I’m merely talking about a system where the small bills are paid out of pocket (or an HSA) so insurance is not billing for office visits. And yes, when doctor have to look to patients for more of their payment, they will have to provide more customer service and work with you when you ask questions about prices. Just because the US has moved away from a market where doctors had to bill patients reasonable fees does not mean there is no merit to it. When I was a kid, we didn’t have insurance. We also did not have a problem paying our medical bills. There was no fear when we went to the doctor that the doctor would present us with a bill (list price) that was five times what he billed for the county employees on BlueCross.

Third party payment is very inefficient. Something like half of all workers in our health care system are administrative according to the BLS.

Is rabies covered under Obamacare?

I don’t know the answer to that, but rabies seems to be running rampant in the Democratic Party.

Bernie sucks at selling socialized medicine. The benefits of socialized medicine and Republican Healthcare Reform are very similar. Both do away with employer-based health insurance so our economy would prosper again.

The result of Republican age-based tax credits:

Americans won’t pay $1,000 a month to add their families onto their employer’s health insurance if age-based tax credits enable them to get coverage for free or very low cost. When Republicans lift the heavy burden of health insurance off the backs of American employers the economy will soar. America’s high health insurance costs are embedded into all products and services making them more expensive. Republican Reform will diminish the cost of products for Americans and make them more competitive on global markets so we will create more jobs. Reform will also drop the cost of Medicaid. City, county and state governments will save because they are employers too, enabling lower local taxes.

Republican Healthcare Reform will make America great again!

Ron, you describe a person using tax credits to get inexpensive insurance for their family, instead of paying $1,000 a month to add them to the employer plan.

I like that scenario a lot also.

However, for it to happen, tax credits must be made available to any worker, and NOT just to those without employer coverage. This means perhaps 120 million more people being eligible for tax credits, versus a smaller number who are eligible for subsidies today.

I have no problem with that either, but how will it be paid for? IF 120 million is the right number, and the tax credits average $2500 each, that is $300 billion in new spending. There have got to be some new taxes in here somewhere.

Bob, Republican Healthcare Reform saves the Feds money on the employer exclusion ($400 billion), Medicaid ($400 billion), S-CHIP, and Federal employees health insurance.

PLUS, the states save billions and maybe they could cough up a buck or 2 for these High Risk Pools.

PLUS PLUS, Chicago saves on their employees’ health insurance.

We are Americans, we went to the moon before the computer was invented. High Risk Pools is not as big a deal.

Bob,

1. employees will not choose a $12,000 plan. more like a $4,000 plan and have the $2,800 extra fund a HSA .

2. Employer stops paying for insurance. then employer no longer takes a tax deduction on the $8,000 per month. (current tax payer subsidy)Governmentthen get more income.

3. Employer wants some form of tax deduction so contributes a fixed cost to employee HSA.

Counter points:

1. Where will a family of 4 find a health plan for $4000 a year? (other than short term insurance)?

2. Many employers do not pay corporate income taxes.

(either by statute as non profits, or by how they arrange their books)

Bob,

The republican health care reform has been the same since 1993.

Tom prices proposal says that you can choose not to have your employer plan and then get the tax credit.

The 300 billion you are looking for is the same 400 billion tax payers are subsidizing employer plans. It’s the same money in a different column. The individuals get to decide where the money is spent and not the employer. Then the employers are free to contribute to hsa plans. the problem is that employer based insurance dies all on its own.

Lee, remember when W was running against Gore in 2000 and wanted a $4,000 tax credit per family? We were enrolling 30-year-old couples with 2 children for $80 a month on MSA qualifying insurance then.

Gore said $4,000 wasn’t enough and Dr. John Goodman was on FOX News agreeing with Gore and said that it costs $6,000 a year to insure families. I thought, with friends like the NCPA’s John Goodman, who needs enemies.

I have always had a little trouble on the mechanics of the Republican tax credit reform.

Picture a couple age 35 each with two kids in MN.

The employer plan just pays $8,000 a year for one of them, and it would cost up to $12,000 a year to put the spouse and kids on that plan.

So, they refuse the employer plan, and get $6800 in total tax credits to shop the market (%2500 for each adult, $900 for each child.)

They find a family plan for $12,000 a year total, so they only need to pay $5400 after the credits.

They are happy.

But where does the federal government get the $6800 to pay for the credits? The employer has stopped paying for the employee, he has rejected their plan.

Are you assuming that the employer will raise his salary by the $8,000 they were paying toward his health insurance before?

I powerfully disagree that this will happen in most cases. Certainly not right away!

Bob, a 35-year-old couple with 2 children in Des Moines can get a Short Term Medical PPO with a $2,500 per person deductible that pays 100% for $432 a month or $5,184 a year. The tax credits are only $4,200 a year. If they want the tax credit to pay 100% of their premium they would have to raise this itty-bitty deductible.

The Feds lose $6,000 on this family if they take employer-based insurance if their income tax is only 15%.

Bob, the tax credit is cheaper than the employer exclusion now plus the Feds save $1,800 a year on this low wage worker. If the worker is higher paid, like Dr John Graham, the Feds save a whole lot more.

Plus, the state saves too if they have income tax. Minnesota people pay income tax – right?

It’s so simple it’s like the jitterbug, it will plum evade you – jimmy buffett

https://www.youtube.com/watch?v=XLYomt_cSZs

They can only get the short term plans if they have no major health history and are not pregnant, and every six to twelve months they must be underwritten again.

Some persons will be lucky and get one short term plan after the other, just like in the old days of World Insurance and the old Golden Rule.

But it is like having a life insurance industry where everyone buys one year term every year…….kind of constant gambling on your health.

On the other hand, the ACA policies change year to year also so they are not the answer either.

I never sold a Short Term Medical in my life before Obamacare because the client had a term date staring them in the face just like your employer plans if the worker gets sick or fired. The savings on STM is too small but now its the only product and takes the client to the next Obamacare Open Enrollment.

But Bob, STM gives us the opportunity to know how cheap people can get health insurance before they get sick.

I am different than you Bob because I have never enrolled anybody into employer-based insurance because its too dangerous.

Someone mentioned that the GOP replacement proposal has been around since 1993. It’s true– it even proposes an individual deduction and not a tax credit!

My concern is that a high risk pool that takes over for the function currently performed by ESI will be expensive, on the order of $250 billion. Including the high-risk currently on the exchanges or uninsured, it’s more like $300 billion.

And then these proposals give away the same $250-300 billion in individual tax credits (or deductions). So now we’re looking at $600 billion. Subtract the $350-400 billion saved by eliminating the employer exclusion, and we only have a $200 billion shortfall. Ron thinks there will be cost savings elsewhere. I hope he’s right.

One note of encouragement is that with the elimination of employer-based insurance, the risk pools will need to be ten times larger than they were in the past. So they should have more political clout, and will hopefully be able to draw the required funding.

Bart, when you say the risk pools will have to be 10 times larger are you talking about the number of people in the risk pools or the total amount of money needed? I’m not disputing your number, but I wish to know if it is a guess or a number you saw based upon a valid study.

Risk pool analysis is a tough actuarial feat. There are knowns and unknowns (risk). The unknowns can end up with the same costs as the knowns so that fee is partly incorporated into their present premiums. Therefore the high risk premiums have to subtract that amount. Things get even more difficult to calculate if one wants to consider how much the individual’s can contribute to their own care. One last point. When calculating a premium the insurer recognzies that a certain number of newly created knowns will not be covered by them. That reduces the insurer’s risk.

It’s a guesstimate. I figure it’s within a factor of 2, same as most such numbers being tossed around here.

Partly it’s based on the size of the employer market versus the size of the non-elderly, non-employment, non-Medicaid, non-income-subsidized individual market.

This all depends on who is included in the risk pools. Pre-ACA individual insurance basically excluded anyone who would have been up-rated at 2x or more the normal premium. ESI-as-a-risk-pool is basically anyone above the 1x rating, since these are the people being subsidized by the tax exclusion.

For people concerned about whether risk pools will have the political clout needed to assure adequate funding, a more inclusive approach would be advantageous.

Thanks. I thought so, but wanted to be sure. I sometimes believe that though the high risk patients are a difficult problem some make that group appear to be more difficult than actually exists. As you indicated the numbers are small enough that the clout is not that large.

Solving funding for the general population of healthcare issues appropriately can reduce costs tremendously for all people including those that are considered high risk.

Bart, President George Bush Sr. 1992

Choice and coverage: health insurance tax credit. (Jan 1992)

http://www.ontheissues.org/George_Bush_Sr_.htm

Ron:

http://healthaffairs.org/blog/2017/01/05/the-republican-study-committees-aca-replacement-proposal/

Thanks for drawing this out. I wonder if any private insurer would be willing to take on such a large high risk pool. Certainly not much opportunity for profits! We might be back to an expansion of Medicaid and Medicare, which would not trouble me that much but is certainly not what Republican reformers really want.

As I understood the McCain proposal in 2008, and others that you cite, all employer paid premiums would be taxable, but all employees would get a tax credit.

So if your employer paid $20,000 a year for family coverage, you would take that into income. At 40% tax bracket this would cost you $8,000, but with a family of four your tax credit might be $6,800.

Where this might go off the rails politically is that families with high incomes, higher employer premiums, and in high tax states would be in the hole more than

$1200 in my above example.

This would include schoolteachers, firefighters, professors, senior government employees, and I suspect most members of Congress.

I am not sure it would ever pass.

Here’s the problem I see. Everyone seems to assume that each employee’s benefit can be calculated by dividing the employer’s total cost by the number of covered employees. And by extension, they think each employee’s share of the total benefit can be calculated from this per-head share.

I’ve been arguing that this is a total fallacy. We can’t tell what the employer paid for a particular family’s coverage by using simple division. The group benefit is more valuable to some employees than others. The real value of the benefit to a particular employee is what that employee would have paid on an open market.

If an employee could have purchased an equivalent package on the individual market for $8000 a year after tax, and his marginal tax rate is 40 percent, then the true pretax value of this benefit is $8000 / (1-.4) or about $13.3K, not $20K. And the employee’s real share of the tax benefit is $5.3K, not $8000.

A different employee who was uninsurable in the individual market could be receiving an actual insurance benefit much higher than the 20K pro-rata figure, and correspondingly higher real tax benefit.

So when we talk about taxing benefits and giving everyone an equal tax credit, we are really just moving arbitrary amounts of money from person to person with no good accounting of the amounts being taken or handed out.

In my first paragraph I meant to say “And by extension, they think each employee’s share of the tax benefit can be calculated from this per-head share.”

Actually I missed another problem in both Bob’s and my example.

If the employer’s per-head cost of insurance is $20K and the marginal tax rate is 40%, then the per-employee pretax value should be $20K / (1-0.4) = $33.3K, and the value tax benefit would have been $13.3K not $8K. But again these are only bookkeeping figures that have no validity for any particular employee.

Data for 2015 recently published in Health Affairs magazine shows that per capita healthcare spending for privately insured people not eligible for Medicare or Medicaid was approximately $5,433.

The numbers for Medicare and Medicaid were $11,904 and $7,869, respectively. The Medicaid numbers are held down by the large number of inexpensive to cover children but offset by the relatively small number (as a percentage of total enrollees) of elderly needing very expensive long term custodial care.

I was trying to stick with family coverage prices above, for consistency with the previous comment.

If everyone were risk rated, including those who already have a very expensive to treat disease or condition, some of those people will be quoted a risk rated premium of $300K or more. Think of people with Cystic Fibrosis or Gaucher’s Disease that need to take an ultra-expensive specialty drug for life and may need periodic hospital based care as well. These are the cases that break the bank. They need to be paid for somehow.

There are those cases that break the bank for either the individual or the insurance pool. They should be treated as entities outside the market pools.

30,000 people with cystic fibrosis should not determine the care of over 320,000,000 people.

I guess that would put them in the 39+15% tax bracket for purposes of calculating the pretax value of their employer benefit packages.

The constant theme that I see in American health insurance is the efforts of the healthy to escape from paying for the sick.

Republicans in general support medical underwriting, and high deductible policies that appeal to the healthy. Democrats in general support guaranteed issue, and low deductible policies that appeal to the sick.

The Democrats won with the ACA, and virtually anyone who had a cheap underwritten policy saw their costs go way up. The Republicans sort of won in the Trump victory, but their current proposals seem incoherent at this time and their victory may be very short-lived.

Bob – This issue is addressed by Uwe Reinhardt of Princeton over at The Healthcare Blog.

http://thehealthcareblog.com/blog/2017/01/31/purging-healthcare-of-unnatural-acts/#comments

Barry, Reinhardt should teach Princeton University about choice and freedom to save. Princeton is paying OVER $28,000 a year for family health insurance.

Uwe is a goofball. Princeton needs to be hit with the Cadillac tax pronto.

http://www.princeton.edu/hr/benefits/hlth/cobra/rates/

Romn, if the Ivy League professors were placed under Obamacare, and not permitted to have their own universities subsidize them, Obamacare would have died before it was born.

The reality of insurer underwriting was quite different than what Reinhardt seems to wish us to believe. It was not as onerous or costly. It was not as exacting and dealt with actuarial fudge factors to make things relatively equal and unknown for all.

Reinhardt talks about leakage but leaves out the obvious remedies. He questions Pauly who is not there and then proposes responses that are his not Pauly’s. (He creates a whole list of problems making things seem impossible, but they are answered in any well drawn contract and are manageable.)

Reinhardt apparently finds complexity daunting. Does he consider the ACA a simple, non complex one page document? He berates us because he is probably a Europhile that has some disdain for American individualism. Apparently he forgets America is the place Europe depends upon for its ultimate security and that America is the strongest economy.

“The efforts of the healthy to escape from paying for the sick”

Is that true in general? Most people buying insurance realize that they are not sick and will pay in more today than they will take out tomorrow. Americans are very generous, but most Americans don’t like socialism and don’t believe in redistributing their wealth through forceful means.

“Republicans in general support medical underwriting, and high deductible policies that appeal to the healthy.”

You left out that appeal to the healthy and the large number of soon to be sick and needy. In essence the Republicans are looking out for more of our countrymen both healthy and sick. Since eventually almost everyone becomes ill they are even looking after a greater number of those unknonws (high risk) soon to be high risk knowns.

“Democrats in general support guaranteed issue, and low deductible policies that appeal to the sick.”

Democrats in general like to feel good about themselves and force others to give money to make that happen. They could use their own money to support those in need, but they are not really generous and therefore want to force others to do the good deed.

“The Democrats won with the ACA”

The Democrats committed suicide with the ACA.

“The Republicans sort of won in the Trump victory, but their current proposals seem incoherent at this time.”

Trump has been in power only 22 days and the obstructionist Democrats haven’t even permitted him his cabinet. Take note that the Democrats had a full 8 years and failed miserably. The original bill from the House wasn’t passed, but the Senate passed its version which was intentionally passed incomplete.

(Note I am using the terms Republicans and Democrats in the way presented, not necessarily the way I fell about the two parties.)

Maybe from the insurers. But I think the people understand that if you want an insurance market people have to buy it before they become sick.

Alan, I was just referring to plain old self interest for healthy persons.

Before the ACA, a young man in the 45 states that allowed underwriting could buy health insurance for $75 a month.

Why? because he could keep sick people (and pregnant women and premature babies) out of his risk pool.

Now with the ACA, his premium is $300. But sick people have the best health insurance they have ever had.

Democrats tend to believe in some version of the John Rawls philosophy…………..namely, that the progress of a community is measured by how much it helps those who are worst off.

By this standard, Democrats feel that they won the ACA.

“I was just referring to plain old self interest for healthy persons.”

Bob, healthy people don’t want health insurance. They want to protect their assets or have the ability to get expensive care they wouldn’t be able to have if they didn’t have insurance. Is this self interest? Yes. That is what makes the world go around.

They aren’t keeping anyone out of their risk pool. They want to buy insurance and insurance classically is risk based. Those that are already sick can join their pool as long as they pay the appropriate risk rated price.

“Democrats feel that they won the ACA.”

Really? I have a healthcare plan for a dollar a year that has first dollar coverage and covers everything. It can’t possible survive. Does that make my plan a winner as well or does that just make me look stupid?

I don’t think you are correct that sick people have the best health insurance they ever had. I treated a lot of people with risk rated insurance and they seemed to have more options, more choices of doctors and doctors that looked them in the eye instead of down at their computer.

Part of the Rawls philosophy also includes the notion that any given person doesn’t know in advance whether he / she will be lucky or unlucky in terms of how well or poorly his / her own life works out.

Alan, thanks for your notes, always valuable.

I would offer these counters:

a. Some people do lobby vigorously to keep the sick out of their risk pool. The resistance to making maternity an essential benefit is exactly this kind of lobbying.

b. For some of the sick, the ACA policies are the first decent insurance they ever had. I still run into people who had “telephone pole insurance”, i.e. they had a skinny indemnity plan that was advertised on late nite TV and never paid claims.

This does not justify the battering ram of the ACA, just says that the pre-ACA landscape was very uneven.

Bob, don’t say we needed Obamacare because there were plans that only paid $100 a day in the hospital, geez.

You socialists are so bad at propaganda.

Bob, (a) the insurer’s are supposed to be the one’s that determine risk and its cost. The consumers are the one’s that are supposed to choose which policy is best for them. Willing buyer/ willing seller. What I assume you are advocating is a redistributionist policy which leads to a higher rate of people refusing to buy insurance.

(b) Yes, the ACA made things better for a few, but caused havoc and harm for many multiples of that few and in that group injured the unknown high risk patients. The sum result is bad, not good.

I do not question for a moment that willing buyer/willing seller is a foundation for general prosperity.

But in this blog we debate health care situations that slip outside the model….

namely, how to handle “desperate exchanges”, where the buyer is desperate for ER care or a specialty drug, and the seller (i.e. hospital or drug company) can extort outrageous and cruel prices from the situation.

Or, cases where there is no seller of insurance for a buyer who is ill and desperately wants it.

You were correct to say that the dilemmas of 30,000 cystic fibrosis patients should not damage the health care of 300,000,000 others. After studying this issue for several years, I believe that the least bad solution is to let the cystic fibrosis patients go onto Medicare. We did this with terminally ill dialysis patients, and it is not cheap but I think it was worked.

“But in this blog we debate health care situations that slip outside the model….”

Bob, first you have to clearly and carefully define the situations that slip out of the model and then you have to prove your case. Most of the times we find an emotional bias not situations that slip outside the model. Let’s see if you can’t avoid the emotional bias.

After defining the situations you have to prove them. If you can’t prove them then more likely than not there is an emotional bias. Try testing your theories with trade offs before drawing any conclusions.

ER care. We have laws in place that provide such care regardless of the ability to pay.

Specialty drugs: Our or should I say your method of providing these needed things has caused more of the problem than exists without such intervention.

I understand why you wish CF patients to go onto Medicare. But, what you are actually doing is passing the buck and not creating a defined method of managing expensive care, nor are you reducing the cost of care, but you are negatively impacting the Medicare program. You run the risk of saying that we can only spend so much per life year on a Medicare patient while paying more for some of the diseases that would end up on the program.

Yes, the program worked for dialysis, but there were significant trade offs in both money and lives.

“passing the buck and not creating a defined method of managing expensive care, nor are you reducing the cost of care ”

Allan, I think this is exactly correct. What is the objective if not optimal delivery and cost of medical care? Focusing on insurance is passing the buck, because even the optimal insurance scheme cannot improve the delivery of necessary medical care, or reduce its cost by one nickel.

So why do many people get sidetracked on insurance? I think because many people think about “cost” solely from their own perspective – which helps explain the common misunderstanding that the cost of an office visit or prescription is simply the copay. That misunderstanding leaves the public vulnerable to all kinds of demagoguery – as Jonathan Gruber helpfully admitted.

To see why that’s a misunderstanding, it’s only necessary to consider a different perspective – a hospital’s or physician’s. Insurance is a source of their revenue; the actual delivery of care is a source of their expense . . . and isn’t revenue different from expense?

This insight reveals that, in order to address the “cost” problem, it is necessary to analyze the organization and expense of delivering medical care. In other words, failure to distinguish insurance cost from medical delivery cost inhibits analysis. Cheese, is this so difficult?

My opinion – it’s essential that physicians and hospital administrators take the central role in figuring out what America needs to do now. Yes, they are busy. That does not change the need for their leadership. Yes resources are limited. I think we cannot afford yet another round of government bureaucrats, academics, and business types designing a national health care system. That would just be more passing the buck.

There are two types of funding available for care. One is paid by the individual and the other is paid for by something else. The two must substantially be kept apart. In other words charity or government aid must be given in a fashion that has the least possible affect on the free marketplace.