A New Front in Obama’s War on Seniors

The Affordable Care Act (ACA) will undoubtedly reduce seniors’ access to care. A huge chunk of the funding for ObamaCare is derived from cutting $716 billion from the Medicare program over the next decade. For instance, one provision cuts the fees paid to physicians who treat Medicare enrollees by 25 percent. Another provision — the Independent Payment Advisory Board — will have the power to slow Medicare spending by curtailing increases in Medicare provider payments. A third strike reduces funding for Medicare Advantage (MA) plans, which cover one-quarter of Medicare beneficiaries. Compared to traditional Medicare, MA plans provide approximately $825 annually in added benefits to (mostly) moderate-income enrollees.

In early January the Obama administration announced yet another attack on seniors’ pocketbooks. The Centers for Medicare and Medicaid Services (CMS) wants to block seniors from choosing Medicare Part D drug plans that offer lower premiums (and lower co-pays) in return for patronizing a preferred pharmacy network.

Reducing Seniors’ Choices. Since its inception, the Medicare Modernization Act of 2003 (MMA) mandated a statutory, non-interference clause. The MMA specifically blocked Medicare from taking sides in the negotiation process (i.e. interfering) between the plans and plan vendors. Contract negotiations between drug makers, pharmacy networks and drug plan sponsors were strictly left to the respective parties. However, some Medicare administrators remain skeptical of provisions in the MMA prohibiting it from interfering in the negotiation process — something the MMA explicitly prohibits.

The MMA was passed by the Bush administration with the help of congressional Democrats. The Bush administration wanted the Medicare drug program to be composed of private drug plans, whose primary mission is to vigorously compete for seniors’ patronage. Part D drug plans are free to use a variety of techniques to control drug costs: including preferred-drug lists, tiered formularies, use of mail-order drug suppliers, negotiated prices with drug companies and drug distributors, and contracting with exclusive preferred pharmacy network providers.

Medicare Part D drug plans have increasingly adopted preferred pharmacy networks as leverage to negotiate lower drug prices for seniors. An estimated 75 percent of seniors in Part D “stand-alone” plans are in a plan that features a preferred pharmacy network — nearly 14 million people.

As part of the negotiation process, pharmacy networks compete to become one of the exclusive network drug providers. When drug plans create preferred pharmacy networks they negotiate for the lowest possible prices. Negotiated prices are the result of bargaining power — the ability of the drug plan to deny business to a firm if their bid isn’t favorable. However, the Obama administration wants to prevent drug plans from excluding the losing bidders from participating in a drug plan if the losing bidders are willing to abide by the contract terms of the winning (pharmacy network) bidder. Thus, the incentive will be to bid high knowing a losing bid will boost the prices seniors (and their drug plans) pay, without reducing the number of customers walking through the door. Medicare’s reasoning is that preferred pharmacy networks must cost taxpayers more — despite CMS’s own research that found preferred networks lower taxpayer costs three-fourths of the time. Go figure!

How Medicare Part D Works. Seniors participating in Medicare Part D pay about one-quarter of the cost for their drug plan, while the government subsidizes about three-quarters of the cost. Seniors have a wide range of plans to choose from. Nationwide, 1,169 Part D plans compete in 34 regions for seniors’ business. The actual number of plans any given senior has access to varies from a low of 28 in Alaska to a high of 39 Pennsylvania and West Virginia. Seniors can choose from plans that feature low premiums but more cost-sharing, or they can choose a more expensive plan that has little out-of-pocket costs. The least expensive plan is $15 per month, although most seniors choose plans costing more than double that amount. The average monthly premium for the plans chosen by seniors is about $38.

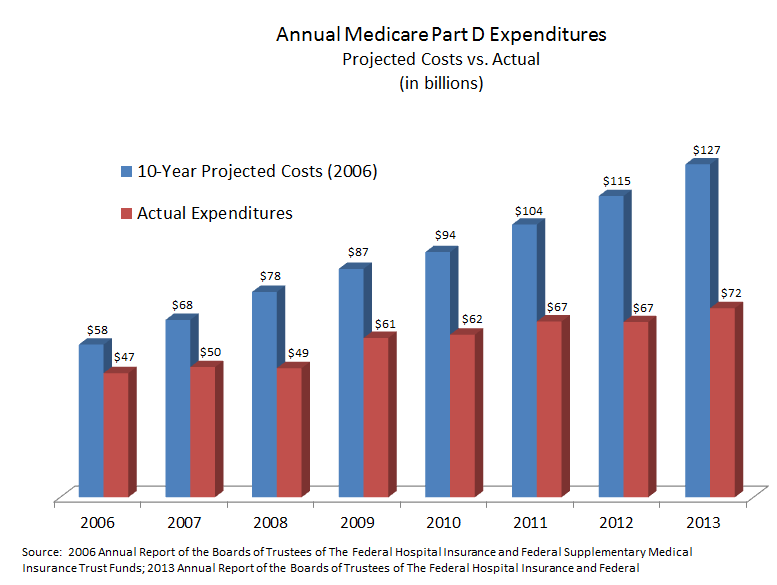

By virtually all measures, the program has been a great success. Seniors’ satisfaction rates average about 90 percent to 95 percent. Though subsidized by Medicare, the premiums seniors pay are a function of the plan they choose — and ultimately of total program expenditures. Premiums have remained affordable because drug spending per member has been far lower than projected:

- Nearly a decade ago the Medicare Trustees projected a per capita benefits cost of $1,971 in 2006, rising to $3,047 by 2013.

- But the actual per capita cost in 2013 was only $1,846 — a savings per enrollee of nearly 40 percent.

Indeed, back in 2006, the Social Security and Medicare Trustees projected the program to cost about $127 billion by 2013 — eight years later. Yet the cost in 2013 was far less — only about $72 billion. [See the figure.]

Conclusion. Vigorous competition among numerous competing plans is the primary reason given why Medicare Part D has come in under budget and held seniors’ drug plan premiums in check. Seniors select a plan that best meets their needs, so plan sponsors are constantly looking for ways to earn seniors’ patronage. Seniors seem to appreciate lower priced preferred pharmacy networks. These plans are among the most popular among seniors. An estimated 75 percent of seniors in Part D “stand alone” plans are enrolled in a drug plan that features a preferred pharmacy network. That’s a huge jump from 2013 when only about 43 percent were in such a plan. All told, nearly 14 million seniors with Medicare Part D will lose the plan they currently have if preferred networks are banned for 2015. Nearly 14 million seniors will be forced to find another drug plan if preferred network plans are banned from the Medicare Part D marketplace. As a result, the losers will be seniors — and taxpayers.

“Nearly 14 million seniors will be forced to find another drug plan if preferred network plans are banned from the Medicare Part D marketplace. As a result, the losers will be seniors — and taxpayers.”

. . . and voters!

Good post.

Good post.

They do not care the middle class, nor the seniors. Is this what they mean by “Justice”?

Government is not calling for justice, they are calling for equality. These reforms are intended to force equality in America. The problem is that these reforms are not making the poor live like the rich, or give them a better standard of living; the changes in the system are lowering the middle class’ quality of life.

Everyone will have it equally as bad.

It’s obviously very good news that Part D program costs are 40% lower than the CBO projected in 2006. It’s likely, though, that the CBO forecast was based on a projection of the most recent trend at the time and didn’t make much effort to estimate the impact of a wave of patent expirations for high volume drugs that would occur during the forecast period.

On the other hand, specialty drug consumption is rising rapidly but many of the Part D plans either don’t cover those at all or cover them as Tier 5 drugs which require 33% coinsurance at a minimum until the beneficiary reaches the catastrophic coverage zone.

People like me who take a number of drugs for a chronic condition get them filled through one of the large PBM’s because the plan structure makes that the cheapest option even if we would prefer to go to a local retailer if the copays were the same.

The bottom line is that it’s far from clear that preferred drug networks make much difference in controlling costs. Even with any willing provider laws in place, drug plans still have a powerful incentive to do everything possible to minimize their costs including the use of tiered copayment structures to steer patients toward the most cost-effective generic drugs where they exist which now account for close to 80% of all prescriptions filled but only about 20% of the dollars spent for drugs through retailers and PBM’s.

CMS’ analysis found that preferred drug networks were cheaper about three-fourths of the time. CMS sampled a couple dozen different drugs (as I recall). In the one-quarter of cases where a preferred network was more expensive, costs were from 2% to 11% higher. From this, CMS decided that preferred networks must be bad. By contrast, the actuarial firm, Milliman, and the Federal Trade Commission believe otherwise. The FTC has reported on several occasions that any willing pharmacy regulations raise costs for consumers.

You’re correct that many people credit drug patent expiry for lower costs in the Medicare Part D program. My reply is that, of course, the availability of newly-generic (blockbuster) drugs could lower expenditures. But the drug plan sponsors had to create the incentives to entice seniors to ask for generic drugs. At the same time, innovator drug companies were undoubtedly looking for ways to entice seniors to demand the name brand drug (e.g. through co-pay debit cards, drug samples distributed through physicians, DTC marketing in magazines and on televisions, etc.).

Yesterday I was in Walgreens picking up a prescription. There was a senior lady in front of the line picking her medicine. She was complaining of how much the price for her prescriptions had increased. She was telling the pharmacist that her insurance plan premium had doubled and that the amount she had to pay out-of-pocket had increased dramatically as well. This scenario is happening all throughout America, and all thanks to Obamacare.

Obamacare is a disaster, but knee jerk blaming of Obamacare of everything including sunspots, is very counterproductive and diminishes the credibility of well documented arguments.

The seniors that are having trouble with their costs are those that are drinking the Kool-Aid dished out by the likes of AARP, and not taking the opportunity to shop for a better plan during open enrollments. Medicare makes the info available. it is up to beneficiaries to use medicare.gov to shop, or use agents who will help them do that.

In general the costs of part D have been held down not by the competition (that has of course helped) , but rather by the fact that since 2010 most of the top 20 medications that Americans take have gone generic.

One of the keys to keeping things going in that direction is to make sure that seniors continue taking generics whenever available. Whenever a one-for-one direct generic is available, people who insist on brands should be only reimbursed at the level of the generic cost, including during the catastrophic phase. That will stop the abuse by Dr’s prohibiting the clients from using generics so they can favor the brands that provide the free “seminars” in the Bahamas.

There are apparently quite a few seniors who think brand name drugs are better than their generic version even though they are chemically identical. Mercifully, if a doctor recommends a branded drug when a generic equivalent is available, the pharmacy or PBM will usually substitute the generic version automatically unless the doctor has checked the DAW box on the prescription form. DAW stands for dispense as written.

The branded version of one of my maintenance drugs is Plavix, a blood thinner. Before it went off patent, it cost $546 for a 90 day supply. After it lost patent protection, the price for the generic version, Clopidogrel, dropped to $24.01, a decline of 95.6%! Many Part D plan formularies don’t even include the branded version of drugs that have lost patent protection on their formularies anymore which is a good thing, in my opinion.

Seniors don’t wake up one day thinking that the brands are better just out of the blue…they have a lot of help from their physicians.

Some four years ago a senate committee put pressure on a pharmaceutical to publish the results of a clinical trial where their med, Vytorin (Zetia plus Simvastatin and $260 for a 30 days supply at the time) was compared to just plain , dirt cheap, Simvastatin. The trial results (published under extreme pressure) showed that both drugs worked equally well at their stated job (controlling cholesterol), however, the $260 drug, produced significantly higher mortality than the cheap $4 generic. Based on this info I fully expected the $260 drug to disappear into the sunset.

Lo and behold, today I continue to run into seniors (frequently) who tell me that their physician has told them they must use the brand.I give them a few links to research the topic, and ask them to get their physicians to give them the reasons for taking the expensive, higher mortality drug. I never get feedback, but they continue to take the expensive drug, and continue to moan about the high cost of drugs. Go figure !

Medicare Part D is the only effective and self-sustainable part of the health care system. It is ridiculous to even touch or tweak it because of its effectiveness.

Seniors are satisfied and everyone else is satisfied. So why change it at all?

They are going against the voters with this reform. No wonder people are predicting that the Democrats will lose some seats in Congress in the upcoming elections.

I also agree that is a good thing that the expenditures for Medicaid part D are lower than estimated by the CBO. This means that there is something in the program that is actually working and reduces costs. It also signals that the program will have sufficient funds going forward. Let’s hope that the reforms that are taking place don’t destroy what is working and end up making this program fail.

Medicare part D is actually functional. That doesn’t fall into line with the rest of Obamacare so they are trying to screw it up just like everything else.

Either the program is working and reducing costs, or the CBO is incapable of accurately predicting the costs and are basing their forecasts on faulty models. Knowing our government, probably it is the latter.

I had no idea the Medicare Part D drug program was running under budget. I considered it another government give-away, even if promoted by a Republican president. Glad it’s less of a give-away than forecast.

What arguments is the administration giving to reform this program? It sounds that it is working just right. (I am not an expert on the topic, so I am guided from what I read here). If they want to change something, shouldn’t they convince us in what are the mistakes they want to correct with the reform? If not, it sounds as if the administration has some hidden interests that are inciting them to make this reform.

The administration is apparently reacting to the independent pharmacy lobby — called PUTTS believe it or not — on the Part D preferred pharmacy issue. No one else in the mix has ever argued against preferred pharmacies. One would wonder why the Obama administration wants to help small town pharmacists since I would assume they are bunch of Main Street Republicans. (I would guess they just want to make a change to the program — any change — in order to open the door to other changes.)

Cutting the Part C kickers has long been a Democratic Party goal. Here again, the reason is not clear because the situation is just the opposite of that with the putzs in PUTTS. The Part C kickers disproportionately help the poor and minorities. (That being said it is unfair to give me, a middle class suburbanite on Original Medicare plus a good public option Medicare Supplement, more benefit from the trust funds than my middle class suburban neighbor on Original Medicare plus a private Medicare Supplement. So they should achieve parity and find another way to help the poor.)

“The Centers for Medicare and Medicaid Services (CMS) wants to block seniors from choosing Medicare Part D drug plans that offer lower premiums (and lower co-pays) in return for patronizing a preferred pharmacy network.”

I do not see any reason to do that…

And yet it’s the Republicans who apparently want to push granny off a cliff…

All:

This is one more example of the screwed thinking of Washington Bureaucrats. They want to achieve some social goal via a re-do of a working program where there is no upside at all, and where even those whose feelings are supposedly being hurt by a pharmacy network will not know or appreciate the gesture.

Referring back to the Independent Payment Advisory Board, that they are forbidden to do certain things just signals that, with enough elapsed time, they will do just that. There is no integrity in this law or the agencies that will administer it, nor, indeed,in the Chief Executive Officer.

As a beneficiary of Part D, I have been unusually pleased with how it works and with the competitiveness of he plans. I am a high cost member, as I take some 8 prescriptions, only 2 of which are generic.

The biggest fear I have is the 25% cut in payments to physicians. They are poised to go out the door in droves. I keep thinking “What is the pivot point in this whole circus where there is something so awful that the public as a whole rebels?” I think it will be this. Already, getting a doctor if you are a Medicaid patient is extremely difficult unless you are in a county with a public teaching hospital. Someone should track and report on physician practice changes as they are the canary in the coal mine, or in this case, the sacrificial lambs of the healthcare system.

Are you all as disappointed in the Republican strategizing as I am?

Wanda Jones

NCHI

SF

Wanda, did you watched the Energy & Commerce hearing on Medicare Part D? Deputy Administrator, Blum, seemingly implied that seniors have too many choices. He stopped just short of saying drug plan sponsors intentionally confuse seniors with so many choices. I thought it amusing when Doug Holtz-Eakin explained 30,000 complaints was less than 1/10th of one percent of plan enrollees.

Come on….we all know that seniors cannot make wise decisions with all those choices. I understand that CMS is proposing to limit the number of aisles that seniors can shop at Walmart. Too many aisles and hundreds of thousands of products are just too confusing for the seniors….or maybe the WDC bureaucrats. lol.

That’s sort of the mentality of Medicare bureaucrats — choice is confusing to seniors, not empowering!

Similar to what ObamaCare did with health plans, Medicare wants to limit seniors’ choices to only those plans that Medicare thinks seniors should have.