Premiums Hiked 10 Percent for Most Popular Obamacare Plans

Consultants at Avalere have confirmed that which I previously suggested: Obamacare plans that won market share in 2014 are hiking their premiums significantly. Here’s a vignette:

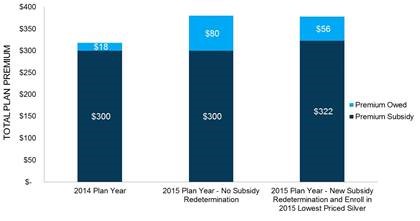

In 2014, Jane enrolled in the lowest cost silver plan in her region with a $318 monthly premium. Jane earns approximately $17,500 a year (150 percent of the federal poverty level) and qualifies for a subsidy that caps her monthly premium at 4 percent of income. Because the plan she purchased was priced below the benchmark used to calculate subsidies, Jane pays only $18 a month for insurance in 2014.

In 2015, Jane does not go back to the exchange to re-enroll in coverage and instead is renewed automatically in her existing plan, which has a new premium of $380. While her premium has increased, Jane’s monthly subsidy will be the same as in 2014, $300. This means Jane will pay $80 a month for insurance, a nearly 400 percent increase over 2014. While Jane’s eligibility for premium tax credits will be reconciled when she files her tax returns in April 2016, Jane will experience higher monthly costs until she receives her refund.

Although Avalere’s analysis does not diagnose why these plans are increasing premiums almost twice as much as premiums for group benefits, it is almost certainly because they experienced medical claims higher than they had anticipated.

The manifestation of adverse selection?

Looks like there is a relationship between rising premiums and lower approval ratings

What John Graham knows about how health insurance works you could fit in a thimble, with plenty of room left over for the entire 906-page (sorry, spittle-flecked ideologes, NOT “thousands of pages”) text of ACA.

Good post, but one could also ask the following question:

what is a person making $17,500 a year buying private health insurance in the first place?

I have been a health insurance broker by the way.

People like Jane should have Medicaid or something similar.

It is just brutal to ask them to choose deductibles et al.

Thank you but I am not so sure about that. In fact, I would even suggest that some of the subsidy be cash (into an HSA-type vehicle) instead of premiums for health insurance.