Zeke Emanuel Praises the Coburn/Burr/Hatch Bill – Sort Of

First there is this:

Senators Tom Coburn, Richard Burr and Orrin Hatch deserve credit for developing this plan. Putting together a proposal to reform the American health care system is hard and politically courageous. And while it is lacking in important details, this plan contains some interesting ideas that might have enabled bipartisan compromises had they been offered in 2009, when I was a health care adviser to the Obama administration and the Affordable Care Act was being debated.

Senators Tom Coburn, Richard Burr and Orrin Hatch deserve credit for developing this plan. Putting together a proposal to reform the American health care system is hard and politically courageous. And while it is lacking in important details, this plan contains some interesting ideas that might have enabled bipartisan compromises had they been offered in 2009, when I was a health care adviser to the Obama administration and the Affordable Care Act was being debated.

But then there is this:

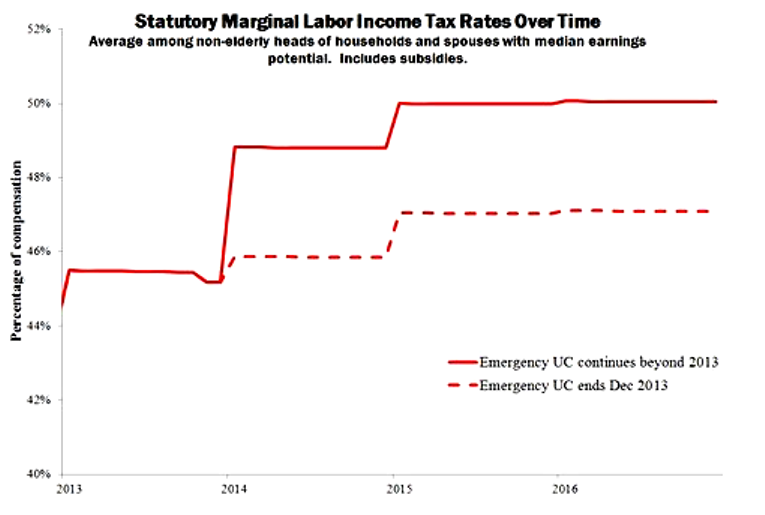

On a more individual level, this is what the Republican plan means: If you are one of the 150 million Americans who get their health insurance through an employer-sponsored plan, get ready for a big tax increase. For a family in the 28 percent tax bracket (earning around $150,000 per year), according to my calculations, it would add up to about $1,470 per year.

Ouch! More here.