One Quarter of Obamacare Enrollees Dropped Out in 2015

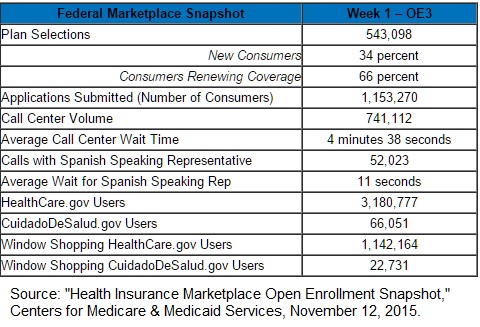

The administration recently announced 12.7 million people selected or were automatically enrolled in an Obamacare exchange plan at the end of the third open season – February 1. Except for special cases, anyone who missed that deadline cannot enroll in an Obamacare plan for 2016.

The administration recently announced 12.7 million people selected or were automatically enrolled in an Obamacare exchange plan at the end of the third open season – February 1. Except for special cases, anyone who missed that deadline cannot enroll in an Obamacare plan for 2016.

That is a few more people than the 11.7 million than at the end of 2015’s open enrollment. However, the administration also announced that only 8.8 million people remained enrolled in Obamacare on December 31, 2015. That is a drop of almost one quarter from the end of 2015 open enrollment.