Buying Off Seniors to Win an Election

In the 19th Century, it wasn’t unheard of for politicians to pay constituents for votes with cash payments, livestock and even whiskey. Although election-day gifts of pigs, chickens and whiskey have long since gone by the wayside, modern day political parties have other ways of buying votes — at least that’s what Republican Rep. Darrell Issa, is alleging. Issa, the chairman of the House Oversight and Government Reform Committee, is accusing the Department of Health and Human Services of using an $8 billion program that pays bonuses to Medicare Advantage plans to “buy” the election.

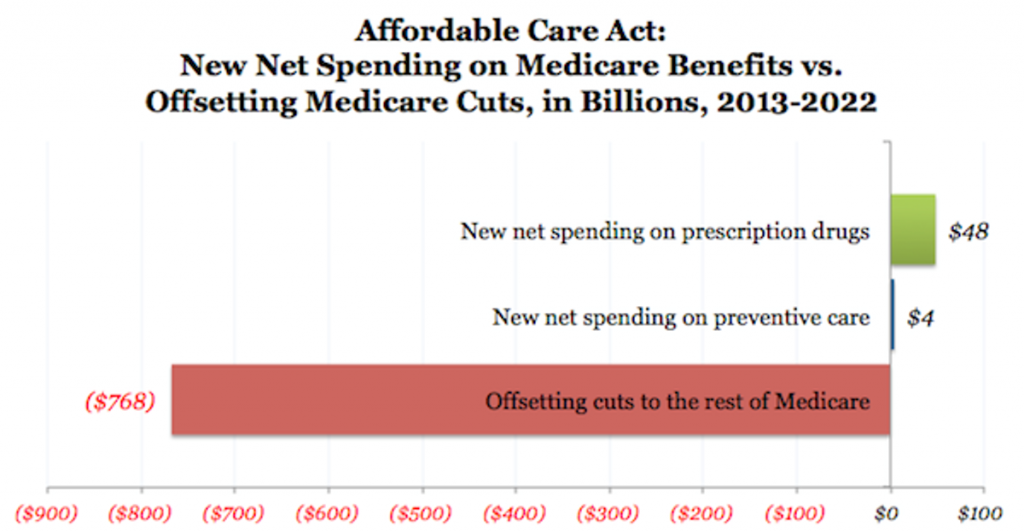

His office wants to investigate whether they bonus payments are designed to temporarily hide the detrimental effects of the Affordable Care Act from seniors until after the election. The ACA, the federal health care law signed into law by President Obama, is slated to cut about $716 billion from the Medicare program over the next decade. Of this, $156 billion is due to be cut from Medicare Advantage plans. Issa has threatened to subpoena the documents on the Medicare Advantage bonus program if the Department of Health and Human Services does not willingly turn them over.

More about this issue from Fox News.