Will ObamaCare Prove More Costly Than Medicare and Medicaid?

One consistent argument in favor of expanding government-run health care in the U.S. goes like this: “We’re the richest country in the developed world, so we should be able to provide universal health care like all the other developed countries.”

Well, we are a heck of a lot richer than we were in the 1930s or 1960s, when Social Security, Medicare, and Medicaid rolled out. Despite our significant increase in income, those three programs are bankrupting the nation. And ObamaCare wreaks more fiscal havoc at a significantly faster rate than any of those programs.

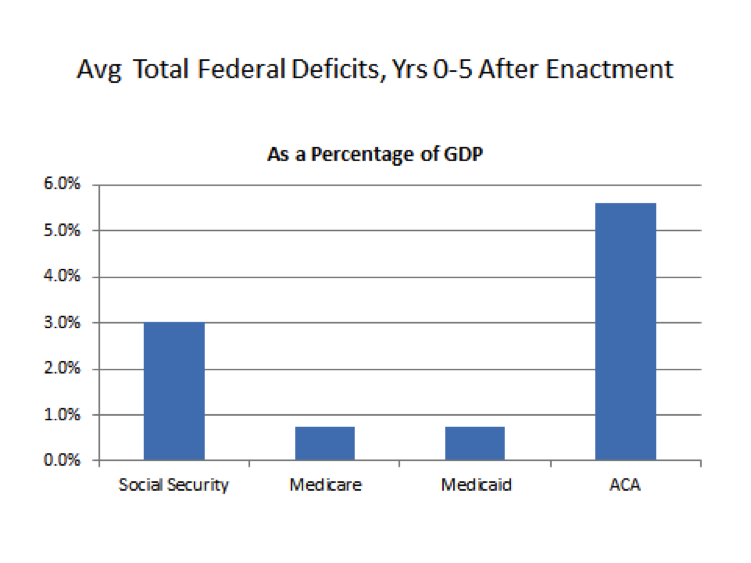

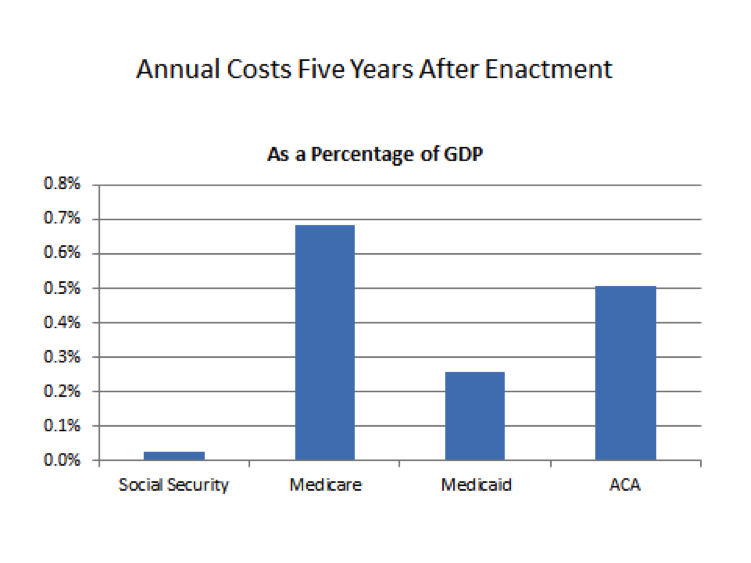

With two simple charts, Charles Blahous of the Mercatus Center shows how much more expensive ObamaCare will be than Social Security, Medicare, or Medicaid — just five years after Congress enacted them.

In one chart, Blahous illustrates that the federal deficit will be about 5.5 percent of GDP five years after ObamaCare’s enactment — versus only 3 percent five years after Social Security’s enactment and less than one percent five years after Medicare’s and Medicaid’s enactment.

Source: Mercatus Center.

In another chart, Blahous illustrates that ObamaCare spending will account for 0.5 percent of GDP five years after enactment. Five years after Social Security’s enactment, it still accounted for a trivial share of GDP; while Medicare and Medicaid together accounted for about 9.25 percent of GDP. Lest this latter figure instill a false sense of security, Blahous reminds us that ObamaCare does not replace Medicare or Medicaid (which now account for a far greater share of GDP than they did in 1970), but adds to their burden.

Source: Mercatus Center

Well, I think what we are discussing is how to provide a universal healthcare, right?

Yes. I think the opponents have a different perceptive that the government should encourage people to buy their own health insurance not just enforce them to buy.

But it needs a long process of persuasion.

It eventually benefits people. The process of persuasion is shorter than expected.

The government recently cuts the military expenditures.

Are you saying they have extra coins to pay for the healthcare bill?

Of course people shouldn’t be forced to purchase anything, especially health care. But this is where we are at in America.

Well it is down right un-American to force cost upon us.

un-American?

Agreed. That is the right way.

If thought Medicare and Medicaid were costly, ObamaCare is going to dig us deeper in the hole

This reform looks closer to a Ponzi scheme than to an entitlement program. The government is making people pay today, making them believes they will be covered tomorrow at a cheap rate, yet they won’t be able to provide the care. This is an irresponsible maneuver by the administration.

I’ve said it before, and I say it again. This reform was intended to benefit some undisclosed individuals, a sign of corruption at its greatest. It is an unfortunate reality.

They provide mediocre plans..

What concerns me is what will happen next. What will happen when the system collapses? Are we going to experience another catastrophic series of events like those in 2008?

Quite likely, then that administration will look back and blame this one, rightly so.

At least there are corresponding taxes and consumer revenues paid in for the AcA.

This is opposed to Medcare Paret D which has no associated revenues, only costs.

There are actually (rational) people out there who actually believe Medicare Part D is full paid for.

There are enough believers to qualify as a name: the trust fund perspective.

These “humans” believe since theTtreasury CAN PROVIDE UNLIMITED FUNDS, WITH NO REPERCUSSIONS, PART D IS FULLY PAID FOR, SIMPLY BECAUSE congress AUTHORIZED THE TREASURIES TO BE PROVIDED EACH YEAR, WHILE ALSO INCREASING THE DEBT HELD BY THE PUBLIC.

DON LEVIT

This is opposed to Medcare Paret D which has no associated revenues, only costs.

Medicare Part D participants pay a premium. I think that is considered “revenue”.

If you want to compare the proposals between Republicans and Democrats, read the following.

The alternative to the Republican’s Part D was the Democrat’s CBO’s preliminary estimate of the impact of the Democratic amendment to H.R. 1, the Medicare and Prescription Drug Modernization Act of 2003:

The net effect of the bill, we estimate, would be an increase in the deficit of $0.4 billion in 2003, $5.1 billion in 2003, $255.0 billion over the 2004-2008 period, and $968.7 billion over the 2004-2013 period.

In other words, if the Democratic substitute, offered as an amendment to H.R. 1, the Medicare and Prescription Drug Modernization Act of 2003, had passed, we would have added almost ** $600 billion more to the debt by 2013. That is an additional $600 billion “unpaid” for.

** Note: The CBO estimate for H.R.1, showed a projected deficit of $372.5 billion over the 2004-2013 period. So, $968.7 billion, the Democrat substitute, minus $372.5 billion = $596.2 billion.

As it happens, the free market provisions included in Medicare Part D, have been a surprising success. Part D: Bending the Medicare Cost Curve