Why Work?

Gene Steuerle warns that public policies increasingly promote consumption and penalize investment. Of particular concern are the high disincentives to work and save imposed upon low income households by social welfare policies.

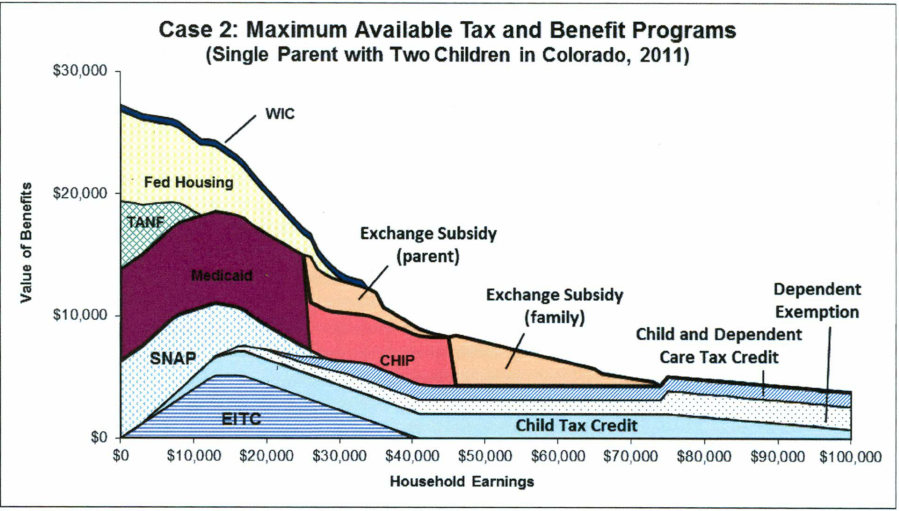

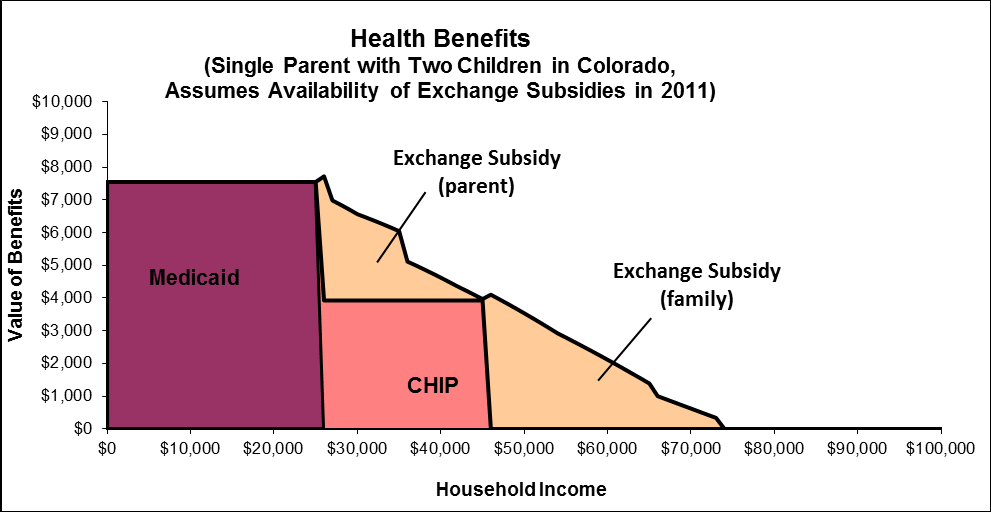

The diagrams, below the fold are from his statement before a House Ways and Means subcommittee hearing. They show that CHIP and ObamaCare subsidies have roughly doubled the subsidies available to median income households, with the result that marginal tax rates faced by households receiving all available government benefits plus child care grants can exceed 100 percent.

The tax rates faced by citizens include both statutory tax rates and the cost of various phase-outs of benefits. If one looks at only the effects of the explicit tax system, federal income taxes, payroll taxes, and state income taxes, the marginal tax rate for a family with children earning between $10,000 and $40,000 is about 29.4 percent. If one includes universally available programs, SNAP (food stamps) plus Medicaid, state children’s health insurance program, and the ObamaCare subsidies, the marginal tax rate rises to 54.5 percent. If benefits like TANF, federal housing subsidies, and WIC are added to the universal benefits, as incomes rise the marginal tax rate is as high as 81.9 percent because families lose even more benefits due to higher earnings.

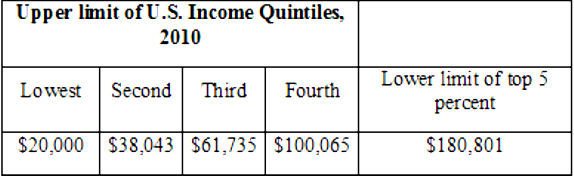

For reference, here are some numbers from the Census Bureau on the household incomes that defined the upper limits of US income quintiles in 2010. Twenty percent of US households had money income below $20,000. Sixty percent of household have incomes below $61,735. Only 5 percent of households have money incomes above $180,801. Given the extent of the ObamaCare subsidies, the net tax burden of the legislation will fall on a relatively small fraction of households.

I like Gene Steuerle’s work.

That’s not as bad as most of Europe, probably, but still pretty bad.

Those Medicaid costs are about to go up considerably as the ACA gets implemented.

Answer to your question: There is no reason to work.

Marriage Penalties are not a good sign.

Having a higher incentive not to work than to work, cant be good for our economy.

The phase out of benefits can put the marginal tax rate at over 100%; when this happens there is no incentive to increase your income.

However figure 2 in the paper shows that this happens only between $25000 and $30000. After that the marginal rate dips below 100% again.

Thank you a lot for sharing this with all of us you really recognise what you are talking approximately! Bookmarked. Please additionally talk over with my site =). We will have a hyperlink change contract among us

That’s funny John. I didn’t realize you could eat your Medicaid card.