Why Did Health Spending Slow Down Before It Sped Up?

Last quarter, spending on health care grew an astounding 9.9%. That’s the biggest percent change in healthcare spending since 1980.

What’s the reason? Many people blame it on the Affordable Care Act (ACA), more popularly known as ObamaCare.

But this assessment contrasts markedly with the picture the president painted for us only a few months back when he said that “health care costs are growing at the slowest rate in 50 years.” He and members of his administration attributed that to the ACA.

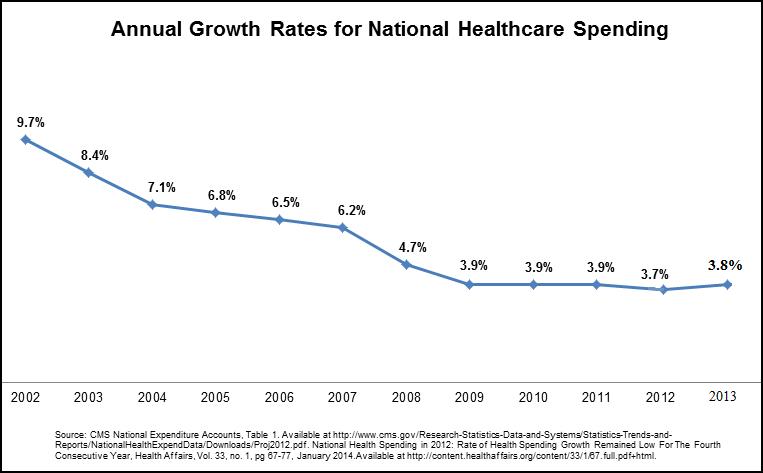

So which view is correct? Probably neither. It’s too soon for ObamaCare to have resulted in a big boost in spending. And the previous slowdown was underway over a decade. (See the chart).

Over the longer period, what does track the slowdown very closely are three other developments: the growth of Health Savings Accounts (HSAs), the growth of Health Reimbursement Accounts (HRAs) and the general trend toward higher deductibles. All three changes mean that patients are paying more medical bills out of their own pockets. And that has produced profound changes — both on the demand and the supply side of the market.

HSA plans have a high deductible, in the range of $2,000 to $6,000 a year or more. High deductible plans have lower premiums and the premium savings help fund the HSA, which pays for health care costs below the deductible. These amounts roll over tax free from year to year and are available for future health care or other expenses in retirement.

The opportunity to have an HSA plan was created by legislation in 2003. Participation in HSAs has been growing by double digits every year since then. They grew by 22% in 2012, with total HSA assets soaring to nearly $15.5 billion. There has been parallel growth in HRA plans, a similar arrangement commonly offered by large employers. Today, close to 30 million Americans are covered by consumer-directed health plans.

In fact, enrollment in consumer-driven health plans probably now exceeds enrollment in HMOs. The 2013 annual Kaiser Family Foundation survey reported that one-fifth of all workers are now enrolled in these plans, up from 8% in 2008. And as individual accounts have grown, national health spending growth slowed.

What about ObamaCare? Over the past three years almost all the significant features of the new legislation have increased, rather than reduced, health costs — providing risk pool insurance to the uninsurable, forcing private plans to cover more benefits, and adding such extras to Medicare as free “wellness exams” and closing the prescription drug “donut hole.” Serious people expect ObamaCare to increase costs even more in future years. Medicare’s actuaries project that ObamaCare will add $625 billion to total health care spending over the next decade. The RAND Corporation predicts that ObamaCare will increase health insurance costs by almost $2,000 by 2016.

HSA accounts give people the opportunity to manage some of their own health care dollars. And when people are spending their own money in the medical marketplace, they are usually more careful shoppers than when they are spending money that comes from a third-party payer — an employer, an insurance company or government. That is why a 2012 Rand Corporation study found that people in HSA plans spend 21% less on average on health care in the first year.

The emergence of so many people paying for care with their own money is also changing the supply side of the market. Nationally, 1,300 walk in clinics post their prices and provide timely care. Free-standing emergency care clinics and Doc-in-the-Box outlets have now arisen to complement them. The first mail-order prescription drug organization, RX.com, was also driven by cash patients saving time and money. Walmart now offers $4 generic drugs financed by cash, not costly insurance. Phone and email consultation services are another development.

HSAs are advantageous for vulnerable populations, particularly the sick and the poor. Because they have complete control over their HSA funds, the sick become empowered consumers in the medical marketplace. Because they can pay for care themselves out of their HSA account, the poor have ready access to a wide range of providers.

HSAs and their incentives have proven very effective in controlling costs in the real world. Total HSA costs have run about 25% less than costs for traditional health insurance. Annual cost increases for HSA/high-deductible plans have run more than 50% less than conventional health care coverage, sometimes with zero premium increases.

As HSAs and similar plans have soared in the private market, health-spending growth has plummeted. That reflects the success of market competition and incentives.

Thank you for the post. My belief is that the per cent increase in health care costs will go up until something breaks. The aging population, the sicker population (too many fat people), new technologies and , so far, the inability to stop pharmaceutical firms from charging outrageous prices for some new drugs will overwhelm the “penny ante” savings from fewer visits to ERs and doctors’ offices.

At some point it’s all unsustainable,even with money printing. I suspect that the first real sign will be cut backs in Medicare or increased cost sharing by wealthier Medicare recipients.

It is not the health savings account but rather the high deductible that causes people to forgo appropriate health care.

I would argue that high-deductible plans coupled with HSAs aligns consumers’ incentives more closely with their preferences and priorities. Care that is deemed “appropriate” will vary from one physician to another; and from one patient to another. What one considers appropriate will also vary with out-of-pocket costs.

I’ve had my doctor look at my file and ask about my insurance before recommending a care plan. In the process he helped me decide whether I wanted “aggressive care” or a “step therapy” approach. I’ve had similar conversations with my dentist. On the other hand, I’ve had physicians recommend costly procedures to treat conditions that could wait or ceased to be a problem.

Given the statistics posted are correct, the private sector seems to be solving the dilemma with much higher efficiency than the federal government. Sound familiar? Using an economic landscape, the equilibrium seems be found using the free market, not using government intervention. Hopefully, these HSAs gain more prominence in the public sphere over the next few years in order to demonstrate that the private sector truly has the better method of solving the health care problem in the US. However, with that being said, I would have liked to see a graph/chart showing the public costs vs. private savings to reveal the stark contrasts between the two spheres.

Good morning John,

The shell game of health care financing continues. The health plan industry is shielded from legal accountability by ERISA and McCarren-Ferguson, but neither the industry nor government can address the real source of medflation. The problem is that prices are arbitrary and irrational, and that there are no incentives to lower them or make health care delivery more efficient.

While I fervently believe in free markets, the oligopoly power of the health care-industrial complex has become too great and too intertwined for the market power of single individuals to have meaningful impact. It is for this reason that I have been working on the Patient-Physician Alliance to develop alternative incentives that would empower health consumers–i.e. patients–i.e. all of us. Anyone interested in helping should feel free to contact me directly.

Cheers,

Charlie Bond

Good post.

HSA’s are a great vehicle, most specially for people in fairly high tax brackets who can purchase pre-deductible care with tax exempt dollars(potentially up to a 38% discount on care). Low income earners with little or no tax exposure, realize no benefits from an HSA, and it is this fact about the HSA that makes many people feel they are yet another loophole for the well-to-do.

Rather than looking at the HSA as the enemy to be destroyed (the Obama Administration approach), perhaps we should combine the goodness of the HSA (make people better shoppers) with a subsidy or tax credit, to help lower income people participate in what is a great cost reduction incentive.

Doesn’t take a rocket scientist to come up with such a twist, yet I have never seen any of the health care writers tackle the subject…Wonder why ?

I agree with your point about HSA’s being a great vehicle for people in fairly high tax brackets; however, don’t you think that those with lower incomes need a little bit more help from the government since the premiums would be relatively lower for them? Or, would allowing the free market to find an equilibrium for those with lower income brackets be the most beneficial? Just a thought.

To answer some qualms related to your question Samford, I believe that the last part of post best explains the question about HSA’s and those with lower income brackets: “HSAs are advantageous for vulnerable populations, particularly the sick and the poor. Because they have complete control over their HSA funds, the sick become empowered consumers in the medical marketplace. Because they can pay for care themselves out of their HSA account, the poor have ready access to a wide range of providers.”

So, in short, HSAs are really better all around for everyone, no matter their income bracket.

Rebekka, not picking on you, but the minute the point is made about the up to 38% discount the more well-off enjoy due to HSA’s, the heads start diving into the sand, and the arguments come out on how poor folks are empowered by HSA’s even though they get no other benefit. Well-off people get just as empowered, but they also get a 38% discount!. In all my years working with health insurance I have never once placed a low income earner into an HSA plan.

I believe HSA’s are a great idea that can have a major contribution in creating a more rational health insurance market, but it will not happen as long as HSA’s remain a dog whistle for “Welfare for the well-off”

Interesting thoughts! I think this would also be a very informative article from Forbes for those who are interested in learning more about HSAs: http://www.forbes.com/sites/ashleaebeling/2014/05/05/5-health-savings-account-mistakes/.

I think people are spending now on items that they think ACA will not cover or may give them difficulty in getting later.

Dear John and Friends:

While I am impressed by the impact on demand of medical savings accounts with high deductibles, I see a cultural gap that makes them not a solution for everyone. Really poor people tend not to have checking accounts, nor a reasonable ability to open insurance bills and write checks for their payment. In the absence of a delivery solution, many of those people simply will remain outside of the formal delivery system.

I long for alignment like this: The POPULATIONS TO BE SERVED., not just who we (policy people) think they are, THEIR NEEDS AND PREFERENCES, not just what others think they should have and relative DEMAND for care, not just a demand pattern like the currently insured, then a DELIVERY SOLUTION that matches all that, not just uttering a false promise that everyone will get the same delivery solution as those who are already insured.

A recent blog on the fact that Obamacare is creating a two tier system was naive; we have always had a two tier system; private and government. Now we will have a three tier system; a government/private sector partnership under the ACO model. This strategy puts a serious premium on the competency of managers, as one does not go into an MPH program with an expectation that on graduation the healthcare executive should be competent to negotiate risk contracts with representatives of HHS. In all the talk about payment, and what hospitals and doctors will do, we’ve neglected the topic of “Who is going to run this vast and complicated set of economic and delivery relationships?”

It will be good to step back and ask “What works now, for the poor?” “How do we get more of it.?” And only then ask “How do we insure for it?”

Cheers…

Wanda J. Jones

San Francisco

John, you are right that the demand controls of account based plans and higher deductible plans are driving innovation and changes on the demand side. For example, telehealth services will mean that the “doctor’s office” of the future will be your living room!

Also, don’t ignore the impact on consumer health and healthcare decisions due to the increasing use of outcome and health status biometric rewards. The additions to HSAs from “shared savings” means that the plan called “high deductible” may in fact have zero out-of-pocket exposure.

Wow, this is among the most specious of specious assertions ever made by the frequently specious “Dr” Goodman.

HDHPs & their filial companion HSAs are wondrous & all, but they have had about as much causal impact on health care spending as El Nino or sunspots.

So, civisius, you group HDHPs and HSAs together with Obamacare as not responsible for the temporary slowdown in medical care spending.

That suggest a Q for you – what do you think is responsible?