The Federal Government’s Dismal Record on Corporate Income Taxes Drives Firms Offshore

Many companies in the healthcare sector are undertaking so-called tax inversions to move their headquarters overseas. Here’s an explanation of why the trend has picked up.

Because the U.S. federal government is refusing to respond to international competition for the headquarters of successful multinational companies, U.S. multinationals are moving their headquarters out of the U.S. in order to protect their shareholders from high U.S. corporate tax rates. The shareholders needing protection include large numbers of retired and working U.S. citizens who have investments in company stock, either directly or through various collective investment vehicles.

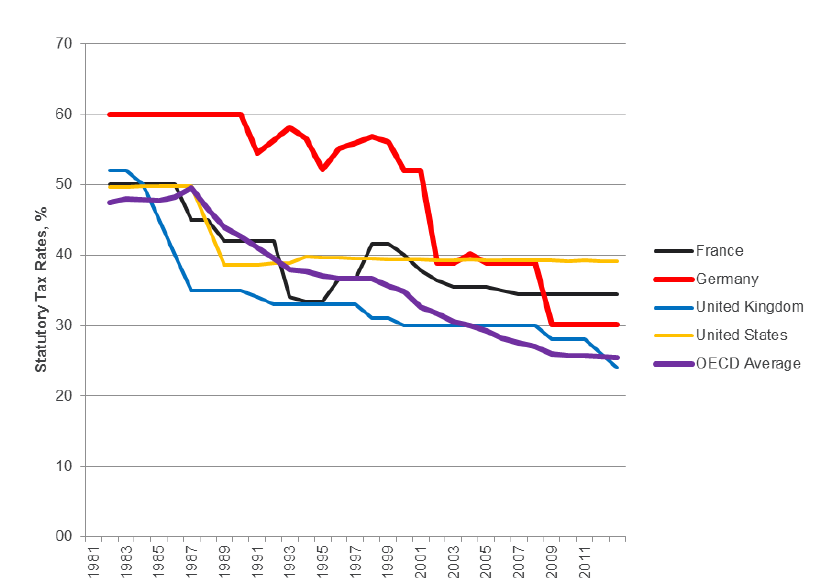

As the following graph from a Baker & McKenzie presentation at a 2013 meeting for tax experts shows, the U.S. federal government was a lot smarter about the realities of global competition back in the 1980s. In the 1980s, it responded to international competition by reducing the U.S. corporate tax rate. Since then, it has increased the U.S. rate even as other countries have been lowering theirs, driving corporate headquarters out of the country.

I thought we did not want socialized medicine like the EU but we compare corporate taxes with the EU?

Isn’t that having your cake and eating it too?

Pay your taxes and we all thrive…

The bigger problem with the US corporate (and individual) taxes isn’t the rate, it’s the frankly practically unique way the USA tries to tax citizens (or corporations headquartered in the US) for things that they do overseas. (In the case of individuals, even if they’re living overseas but keep US citizenship.) Nowhere else does that.

Consider two corporations, one headquartered in the US, one headquartered in Canada, France, the UK, or anywhere else. Both will pay full US taxes on US revenue, but only the one headquartered in the US will pay US taxes on non-US income.

U.S. domestic tax policy encourages firms of off-shore manufacturing and other business functions. Surprisingly, many opponents of corporate tax reform are also advocates for domestic manufacturing. Yet they don’t understand the two issues are related.

Everyone is right here, it seems. It’s not like tax dodgers are doing anything wrong per se. They have a strong motivation to move their headquarters to reduce tax. I still have not heard a good argument for why we should not adopt a territorial system of taxation. Even if we did, would we not get the same amount of revenue from these large corporations?