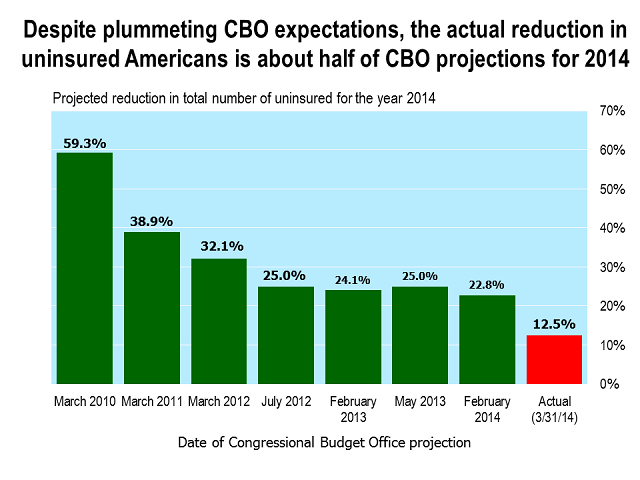

4 to 7 Million Will Be Fined under ObamaCare’s Individual Mandate

From the Congressional Budget Office and the Joint Committee on Taxation:

CBO and JCT estimate that 23 million uninsured people in 2016 will qualify for one or more of those exemptions. Of the remaining 7 million uninsured people, CBO and JCT estimate that some will be granted exemptions from the penalty because of hardship or for other reasons.

All told, CBO and JCT estimate that about 4 million people will pay a penalty because they are uninsured in 2016 (a figure that includes uninsured dependents who have the penalty paid on their behalf). An estimated $4 billion will be collected from those who are uninsured in 2016, and, on average, an estimated $5 billion will be collected per year over the 2017–2024 period.

(CBO, Payments of Penalties for Being Uninsured Under the Affordable Care Act: 2014 Update)

So, even when we combine the most optimistic estimates of gains in mortality and morbidity, the average uninsured person would gain about 16 healthy days a year…As a comparison, 75-year-olds with foot problems prior to chiropody treatment rate their quality of life at .956. For the average uninsured person, having health insurance coverage provides health benefits that are roughly equivalent to averting the foot problems experienced by typical 75-year-olds.

So, even when we combine the most optimistic estimates of gains in mortality and morbidity, the average uninsured person would gain about 16 healthy days a year…As a comparison, 75-year-olds with foot problems prior to chiropody treatment rate their quality of life at .956. For the average uninsured person, having health insurance coverage provides health benefits that are roughly equivalent to averting the foot problems experienced by typical 75-year-olds.