Social Security Finances: Getting Worse and Worse

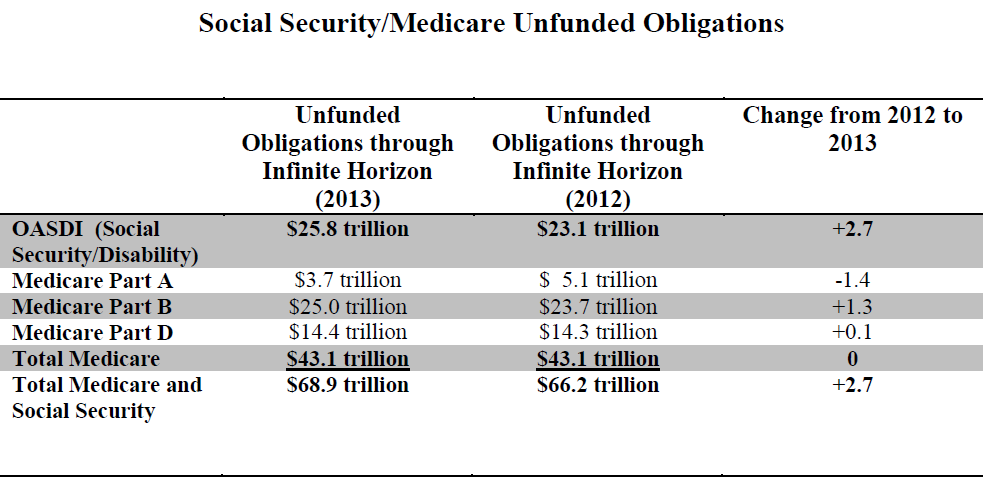

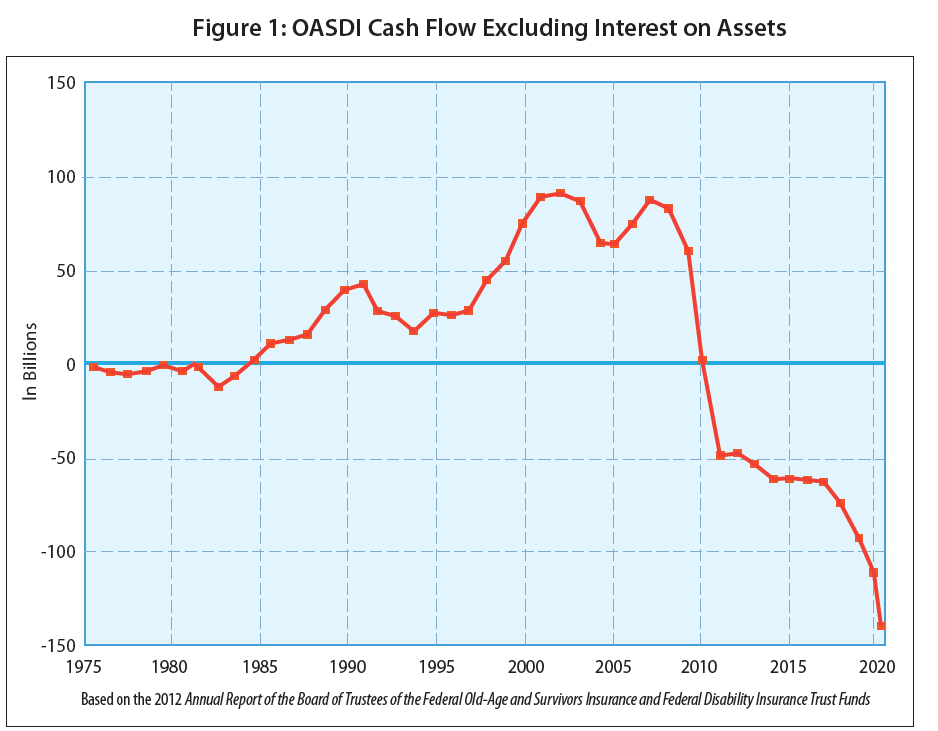

The just-released 2013 Trustees Report on Social Security’s long-run finances shows an infinite horizon unfunded liability of $23.1 trillion. This massive shortfall is 50 percent larger than U.S. gross domestic product and almost twice the federal debt held by the public. Social Security began reporting its infinite horizon fiscal gap in 2003. Back then it was $10.5 trillion. On an inflation-adjusted basis, the gap’s risen 74 percent leaving the system in far worse shape than when the 1983 Greenspan Commission “fixed” it.

Larry Kotlikoff, Daily Policy Digest/Yahoo Finance.