RAND: Premium Support Best Way to Reform Medicare

In 25 years Medicare spending is projected to reach one-quarter of all federal expenditures, about 6 percent of gross domestic product (GDP). Several proposals to reduce the growth of Medicare expenditures have been debated in recent years. These include:

1) Mean-tested premiums for Medicare Part A Hospitalization.

2) Premium support, providing seniors a credit to purchase private plans.

3) Raising the Medicare eligibility age to 67.

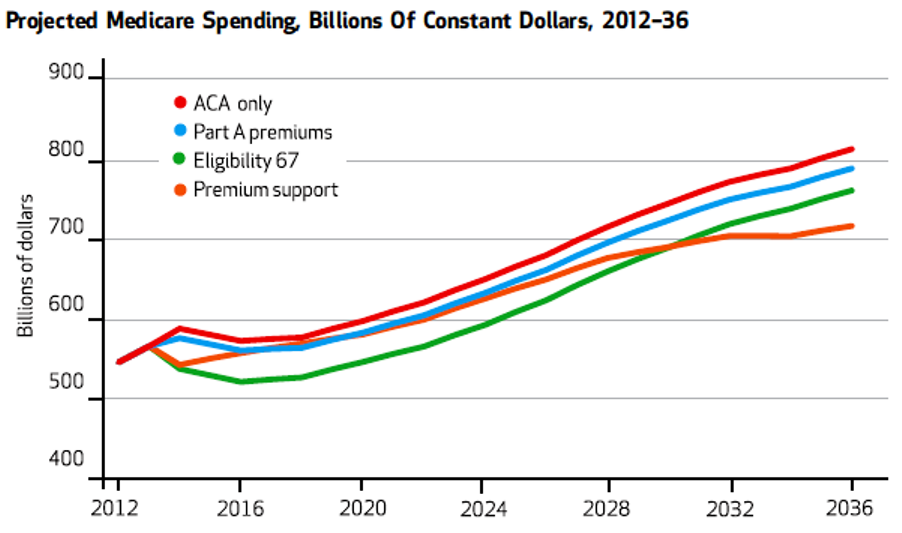

Means testing Medicare Part A premiums only reduces Medicare expenditures by 2.4 percent through 2037. Increasing the age of Medicare eligibility to age 67 reduces the cost by three times that amount — 7.2 percent. The proposal with the most potential was premium support. If a tax credit was tied to the growth in the economy, the savings is equal to 5.4 percent. However, if the premiums credit was tied to the consumer price index (i.e. merely adjusting for inflation), the program would save 24 percent.

Source: Health Affairs.

Raising eligibility to age 67 is a great idea. I think it’ll solve a lot of the problems we face with Medicare.

Devon

You should point out that the type of premium support analyzed by Rand in its Health Affairs article and described here by you is not what is typically meant by premium support in proposals by Wyden/Ryan, Rivlin/Ryan, etc. I’m sure there are such tax-credit-based premium support proposals somewhere but I believe the most publicized premium support proposals going back to Moffet/et al (two Republican guys that ironically first called it a voucher best I can tell) and Aaron/Reischauer in 1995 simply meant premium support in the same sense most of us get or got healthcare insurance from an employer: the employer “supports” most of cost of the premium.

Yep especially by time I get to draw.. I’ll be on my third midlife crisis.

Just don’t use the words insolvent. It draws angst from the saltwater folks.

Dennis Byron raises a good point. Here’s what the RAND study says about premium support…

What stops us from doing all three? It stands to reason that there would be some additional benefit from enacting multiple cost-saving procedures.

As I learned from eating tacos:

http://www.youtube.com/watch?v=NuEIsqeRR1o

I’m ashamed of all of you who are taking this Rand study seriously 🙂

The actual intention of the Rand report is to “prove” that these are three bad ideas and that they would — according to Rand’s PR — kick millions of seniors off Medicare and over the cliff in their wheelchair.

That’s what the Rand PR release says. The actual Rand report is only a little less intellectually dishonest. The Rand report itself absurdly claims that these three proposals — together or separately — would cause millions of seniors NOT to sign up for Medicare (and therefore roll themselves over the cliff).

You have to read the report to get the absurdity of the thinking but it’s worth it for a laugh.

Dennis, I thought the comparison of cost-savings was interesting. But I confess that I paid less attention to the part of study about Medicare participation among seniors because I found it rather implausible that seniors would refuse to sign up for Medicare.

Isn’t discouraging (or at least providing less incentive for some seniors to gorge on Medicare) a worthy reform goal for its own sake?

I’ve been eligible for Medicare for several years, but have opted out because its coverage is so lousy.

Instead I enrolled in a Medicare Advantage plan offered thru my former employer. Much better coverage, same cost to me as Medicare.

I don’t know for a fact, but I suspect the 25% of all Medicare-eligible seniors who have enrolled in Medicare Advantage have the same reason I have. “Original Medicare” (Part A and Part B) sucks; Medicare Advantage is a much better deal.

I think it’s instructive that the administration considers Medicare Advantage something to disassemble rather than trying to make Medicare better. But that’s how governments “compete” – they use their powers to wreck their competition. They don’t have to get better. They’re the government.

John Fembup — Absolutely correct. Traditional Medicare is the worst insurance program in the country. It is fragmented, confusing, and so expensive that most people have to buy supplemental coverage. As far as I can see, the only reason it has political support is because it is a government program. If a private insurance plan had the same characteristics it would be universally slammed. We have to stop being cowardly about this and start calling it for what it is.

Greg and John Fembump

The reasons that seniors have not yet revolted against Original Medicare Parts A and B are threefold:

— Until recently. the majority of retirees have had retiree insurance from a former employer so they did not see the problems John describes. As far as most pre-2005 retirees could see they had the same insurance they always had (albeit probably more expensive). As baby boomers come onto Medicare, the problems with Original Medicare are becoming more obvious because fewer and fewer of us have retiree insurance. Today the number of Medicare beneficiaries on retiree insurance plans is down to 40%.

— Most (but not all) Part C Medicare plans are as good as what we had when we worked. This is especially relevant because most (but not all) are HMOs or regional PPOs and us baby boomers (more so than our parents and older brothers and sisters) have been making the HMO vs. fee for service decision almost all our working lives (and we don’t have the same hang ups with HMOs that our predecessors had). That’s why Part C plans have gone from covering a few percent to over 30 percent of those on Medicare in the less than 20 years since they were formalized (a few percent of seniors had Part C-like plans before 1997 when the law was passed because there were demo programs)

— Part D worked better than advertised

@Dennis Byron – I agree with all you’ve said. Thanks for extending the scope of my comments so logically.

I would note only that one need not participate in original Medicare to obtain Part D-equivalent benefits.

My Medicare Advantage plan offers a Part-D equivalent (along with other, far more comprehensive plan designs. I enrolled in the Part D-equivalent. I assume most Medicare Advantage programs offer a Part D-equivalent as their “base” Rx plan.

John and Dennis — I agree too. My wife and I have a Medicare MSA with Geisinger, and we also have a Part D program with Humana. We are very happy with this design and only wish it were more available in other states. But I would never buy a MediGap policy.

For those who love Medicare Advantage, the Advantage is a huge financial subsidy that a while back cost on average about 112% of what the Traditional client cost. So enjoy the subsidy that you and the managed care folks love. What is interesting is that ObamaCare and RyanCare look about the same to me, so go figure; why does Obama want to kill Medicare Advantage?

The best Medicare plan was proposed by Greg Scandlen!

Scandlen, Greg. Bringing Health Savings Accounts to Medicare. September 28, 2005. Google “HSAs in Medicare–Scanlen”.

Bob

@Bob Geist “cost on average about 112% of what the Traditional client cost.”

Medicare Advantage coverage is a lot better, that might have something to do with cost. Still, the cost to me is the same. Better coverage – same cost. Of course I and more than 11 million other seniors find it a better deal.

And don’t forget that Medicare itself specifies the formula for reimbursement of Medicare Advantage plans. Insurers must bid to obtain Medicare Advantage contracts based on Medicare’s own rules. Medicare then awards the contracts on a competitive basis. Let’s not rush to blame Medicare Advantage insurers for all that.

Of course, the administration can’t accept the success of Medicare Advantage and what will happen as a result simply illustrates what I already said above:

The administration considers Medicare Advantage something to disassemble rather than trying to make Medicare better. But that’s how governments “compete” – they use their powers to wreck their competition. They don’t have to get better. They’re the government.

From 2000 to 2010, Medicare Advantage plans grew substantially.

During the same period, total Medicare spending went from about $260 billion to $545 billion, even though the number of persons covered by Medicare went from 40 to 48 million.

I bring this up only to comment that whatever the virtues of Medicare Advantage, (and they are real virtues), holding down total costs does not seem to be one of them.

I have no argument with the proposition that Medicare Advantage is better for the senior citizen than traditional medicare.

My fear is that without some major changes in the benefit package or in what we pay doctors and hospitals, America may not be able to afford either version of Medicare.

It is kind of debating the merits of classic coke vs new coke, but not discussing whether you should buy coke at all.

Bob Hertz

What’s your data source? According to the 2011 MedPAC Databook spending went from $227B to $514B over those years but “managed care” (it wasn’t called Medicare Advantage until 2005) only went up a few percent as a share of the total — from 18% to 22%.

However, 12% of the $514 was Part D, which did not exist in 2000 so the real comp is $227B to $463B.

So basically the cost doubled while the number of people on Medicare went up about 50%. But that didn’t seem to have anything to do with Medicare Advantage. The conventional wisdom is that the reason is the escalating cost of all health care as compared to inflation in general. (Of course then you get into the circular discussion: Did healthcare costs drive up Medicare costs or did Medicare drive up healthcare costs?)