Ponzi Schemes

Jack Lew is lucky he isn’t in prison. Were he representing a private pension fund and if he made the sort of statements he made in USA Today the other day, he might well be sharing a cell with Bernie Madoff.

So who is Jack Lew? And what did he say?

Lew is the Director of the federal Office of Management and Budget. About Social Security, he wrote: “Taxes are placed in a trust fund dedicated to paying benefits owed to current and future beneficiaries. When more taxes are collected than are needed to pay benefits, funds are converted to Treasury bonds — backed with the full faith and credit of the U.S. government.” As a result of these investments, the Social Security trust fund will be able “to pay full benefits for the next 26 years.” Not only is this preposterous, Charles Krauthammer called it a “breathtaking fraud.”

Before dissecting Lew’s transgressions, let’s consider why Bernie Madoff is in the hoosegow. Madoff told investors he was investing their funds in real assets, when in fact he was not. He secretly used their funds for personal consumption and to pay off other investors. Either figuratively or imaginatively, Madoff wrote IOUs to himself, all backed by the full faith and credit of Bernie Madoff. Maybe in the beginning he fully intended to pay off. But that’s beside the point. Inducing people to give you money with this sort of lie is criminal fraud. It’s against the law.

What I have to say about the Social Security trust fund also applies to the disability fund, the Medicare trust funds, the highway fund, the unemployment insurance fund and almost every other federal government trust fund. None of them are real trust funds. And that, by the way, is not fraud. The fraud part is telling people you have a real trust fund, when you don’t.

Like most government-sponsored retirement programs in the world today, our Social Security system is pay-as-you-go. All payroll tax revenues are spent — the very minute, the very hour, the very day they are received by the U.S. Treasury. Most of these revenues are spent on benefits for current retirees. Any additional amount is spent in other ways. But there is no funding of future benefits. No money is being stashed away in bank vaults. No investments are made in real assets.

Most pay-as-you-go systems do not have trust funds, since there are no investments for the trust funds to make. In the U.S., we have trust funds — but they serve an accounting function, not a financial function. For example, the trust funds do not collect taxes. Nor do they disburse benefits. Every payroll tax check sent to Washington is written to the U.S. Treasury. Every Social Security benefit check is written on the U.S. Treasury.

The trust funds do not buy bonds. That’s because they do not buy anything. But they do create special pieces of paper which are misnamed “government bonds.” They are misnamed because — unlike other bonds — these bonds were never bought or sold. They are literally IOUs the government writes to itself. For Social Security, they are created on a typewriter. For Medicare, they are created electronically.

Technically, the trust fund bonds represent the cumulative surplus (payroll tax collections minus benefit payments). But these bonds are only important for accounting purposes. They are like bookkeeping entries, without any market value. The annual reports of the Social Security trustees list the yields and maturity dates of these bonds. But the special-issue bonds are not the same as the bonds held by the public. They are not part of the official outstanding debt of the U.S. government. They cannot be sold on Wall Street or to any foreign investors. And they cannot be used to pay benefits.

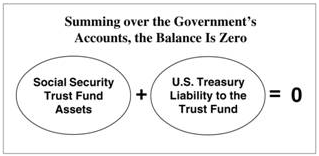

The technical issuer of the bonds (the U.S. Treasury) and the holder of the bonds (the Social Security trust fund) are both agencies of the U.S. government. Moreover every asset of the trust fund is a liability of the Treasury. Summing over both government agencies, the balance is zero. [See the diagram.]

For Social Security, the trust fund’s special issue bonds are paper certificates held in government filing cabinets in Parkersburg, W.Va. If a fire were to burn down the building tomorrow, or if thieves were to take the filing cabinets away, there would be no harmful consequences for retirees. Similarly, if the trust funds themselves were simply abolished, real economic activity would be unaffected. The government would not be relieved of any of its existing obligations or commitments. Alternatively — as the late economist Robert Eisner suggested — with the stroke of a pen, we could double or even triple the number of IOUs the trust fund holds. Either event would allow us to dispense with artificial crises (the “trust fund is running out of money!!”) and address the real problem: How is the Treasury going to pay the government’s bills?

Since Social Security’s inception, the program’s managers have tried to convince the public that it is a funded system. Statements like Jack Lew’s are routinely made by the Social Security Administration itself. If these statements were made by a private company, they would constitute fraud and violate all manner of federal financial regulations.

When Social Security runs a cash flow deficit, as it is doing today, it is paying out more in benefits than it is in collecting taxes. In the face of this deficit, the government only has three options: Raise taxes, cut benefits or borrow. These are the same choices the government would face if there were no trust fund at all.

Great post. Where’s our video?

Interesing idea. Why don’t we put all the Trustees in jail. Plus all the people they report to.

Let’s just get the guy at the very top. Everyone else can turn state’s evidence.

Everyone in America should be required to read this article! Thanks for doing it.

John,

I agree with what you say. Why doesn’t someone launch a “very public” lawsuit against Jack Lew and the Administrators? It wouldn’t really matter whether or not the suit is won….the benefit would be in educating the public to the truth.

D>

I like David’s idea.

John,

Can you extend today’s topic to include an analysis of the WSJ article 3/24/2011 where a judge has linked Medicare participation to Social Security benefits – if you opt out of Medicare you lose Social Security.Many of us oldsters may want to get out of Medicare.

You need to take that one step further, all payroll tax revenues were spent hours, days, months before they were received by the U.S. Treasury.

John:

One of the 20 or so trust funds is the one that pays for the federal employees’ retirement.

I have an actual quote from a reputable governmant agency which says very similar things that you posted about the other trust funds.

It actually says the federal employees’ pension plan is not operated as a pension plan!

As some of you know, the federal employees’ pension plan is considered an exchange transaction by the FASAB (the federal government’s accounting advisor). The employee voluntarily lowered his salary for a future benefit.

This is an actual liability of over $5 trilliun, which is listed on the federal government’s balance sheet, along with debt held by the public.

In contrast, Social Security taxes are a nonexchange transaction.

That meams you were compelled to pay in taxes, yet the govermnment is not compelled to pay you back, except for the next year.

Again, I have excrpts and links from reputable government agencies to support my statements.

Don Levit

It is hard to believe that our elected officials want to stay in power so badly that they will lie to us on such a huge scale. Anything to keep power. To hell with the citizens of the future.

John,

Get over it!

Dunk,

What citizens of the future?

Try this: walk around your office and see what the fertility rate is. (Based on what you know. Don’t be rude now.) Then, compare it to the national rate.

The contributors are mostly immigrants, so unless you work with them, your office rate is probably below average.

Gosh, talk about an inconvenient truth.

I wrote an editorial on this years ago.

Small point: even if the trust fund bought real bonds that were already in circulation, the con still works because the number of bonds is not fixed. Only when the number of bonds is fixed can one, in good conscience, make the fungibility argument.

-David C. Rose

How about comparing it to an even bigger Ponzi scheme–the US fiat money system??

Dr. Goodman is right. The three components of the tax yield are the tax base multiplied by the tax rate which equals the tax liability. Since FICA, disability insurance, and hospital insurance (payroll taxes) are tied to a paycheck, high unemployment reduces the tax base. Thus, with no change in the rate the total yield is down. How one can think this program is perpetually solvent under current parameters is more mindboggling that the smoke and mirror accounting principles.

I recently read a report that stated GE paid absolutely no income taxes to our federal government in 2010. I can only assume that many other huge, multi-national corporarations have found the very same loopholes and are also enjoying a tax-free operation here in this country. More taxes on people? Whom income taxes were never meant to be paid by? I don’t think our government can squeeze us any harder than it already is. It would like getting blood from turnips. That is, unless you are extremely wealthy and powerful, like corporations, and can find a way around it.

I wonder how much debt we would have or would continue to accumulate if the debt makers (Congress and the President) had to sign a contract to be personally responsible for the obligations they are creating.

It sounds like many of us are creeping up to the overriding reality with respect to paying for public benefits. At the end of the day each individual must be financially responsible for his or her own life. The present system of imposing taxes is just a diversion. No corporation, partnership, public entity or any other non-human ever bears the cost of a tax. Those are just pass through transactions which are ultimately born by the end consumer, a sentient person. The fact that the US has chosen a system that taxes so many things other than only consumption by the end user makes for an impossibly complicated and irrational mess. All politicians are predisposed to spend other peoples money. Our tax system only makes the confusion and senseless allocation of money easier for them to manipulate. Any meaningful reform of government spending must include a more transparent and efficient tax system.

@Jennie Fielder

Apparently the New York Times was wrong once again. Fortune is reporting that GE did, in fact, pay taxes in 2010.

This is a fine article.

-Larry

Social security is a ponzi scheme (it fits the exact definition), and medicare is one as well, but the health care industry as a whole, currently looks like a bubble, fueled in large part by the unsustainable growth of medicare.

It never seems to end.

-Bill

What’s a Monday without discussion of government Ponzi schemes? Great post.

John:

I hate to agree with you, as you know, but your description of the Ponzi scheme is on the mark. It has been so ever since we started the nefarious unified budget of the US government, which lumps the trust funds in with the rest of the federal budget.I believe that started in the 1960s or 70s, and every President and Congress since has loved this Ponzi scheme.

The American people either acquiesced or where too ignorant to appreciate it. After all, they voted for the Ponzi schemers.

But look at the bright side, John: the Ponzi scheme helped finance the huge tax cuts we all enjoyed so much in the last decade. It was like a corporation raiding the employees’ pension fund to pay a dividend — and we all loved it, did we not?

I like the idea of jail terms. But you’d have to build a big new jail to hld al the culprits. Why just poor Jack Lew?

Uwe

@ David Lanihan

Interesting idea. Put them all on trial.

@ Uwe Reinhardt

Yes, the drawback with David’s idea. There isn’t enough prison space.

@ John Harries

Agree. That was an unfortunate decision.

@ Seamus Muldoon, MD

Point taken. The money is spent before it arrives.

@ Don Levit

I believe you.

@ David Rose

Good point. The government could always sell more bonds to the market to be resold to the trust fund. But then the trust fund would have a real asset it could sell back to the market.

@ Morris Bryant, MD

“if the debt makers (Congress and the President) had to sign a contract to be personally responsible for the obligations they are creating” what would happen? We would have far fewer people running for office.

@ David Alexander

“Any meaningful reform of government spending must include a more transparent and efficient tax system.”

Amen.

Please allow me to add my thanks for this essay. On the mark, as usual.

We need to go long and loud with the message that Congress is a collective Bernie Madoff……

That’s a very good piece.

-Mary Kohler