Political Control of Obamacare Insurance Pricing Harms Those with Lower Incomes

When Obamacare kicked off, Colorado State government had grouped its ski resort counties into a single rating area. This makes sense geographically. But everything is more expensive in the ski resort counties, and under Obamacare pricing rules resort county residents ended up with the highest health insurance exchange premiums in the country. The resulting town meetings were spirited, county commissioners threatened to sue, and Colorado Insurance Commissioner Marguerite Salazar began looking for ways to redraw the rating areas to lower the political angst.

Before Obamacare, someone in the mountain towns might economize on health costs by buying a high deductible health insurance policy and making regular contributions to an HSA. He might use a local physician, hospital, or clinic. He could also save money with in-state medical tourism. A few hours of driving would let him seek lower priced care in Denver’s more competitive health care market.

According to a study of Colorado health care migration patterns by the actuarial firm Miller & Newberg, members of resort area health plans incurred 64.3 percent of their total health care costs in the resort area and 30.1 percent of their total costs in Denver. For comparison, members of Denver area health plans incurred 93.5 percent of total costs in Denver and 0.7 percent in the resort area. Members of Grand Junction area plans incurred 89.3 percent of their health care costs in Grand Junction, 6.3 percent in Denver, and 2.7 percent in the resort area. Grand Junction is the largest city in Colorado west of the Continental Divide. It is in Mesa County near the Utah border.

Widespread in-state medical tourism fueled by cash payment and higher deductibles may have helped hold down resort area health insurance premiums. Before Obamacare, insurers used claims experience to price policies. If people were willing to seek out better deals, claims might have been lower, and premiums would have reflected that.

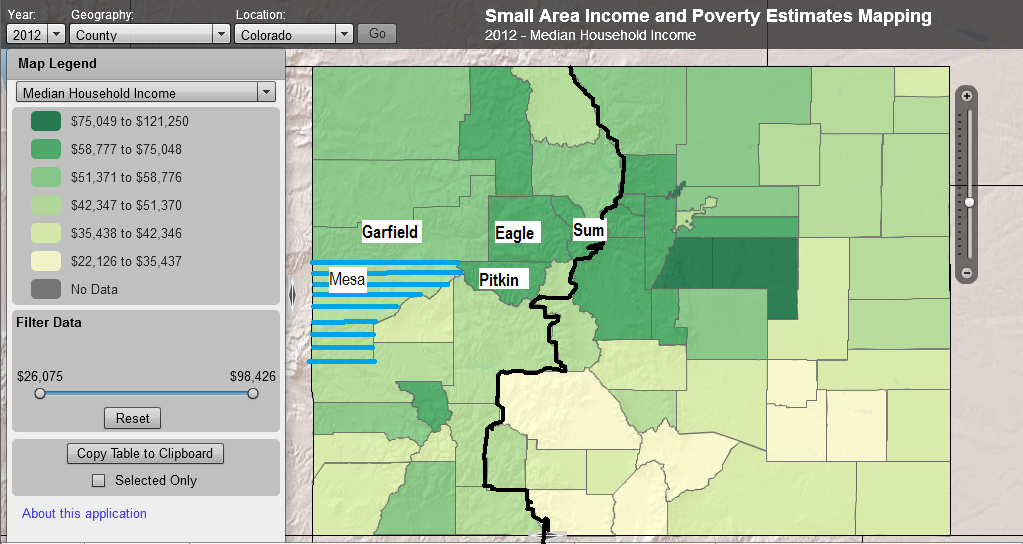

To give people in the resort counties who were flattened by Obamacare premium increases a break, state officials ultimately decided to move the resort group, Garfield, Pitkin, Eagle, and Summit counties, into a rating area that included all of the western counties except Mesa County. Moving the resort county group to the western group lowered the premiums for the resort counties and raised them in the western counties. On the map below, the western group is everything west of the black line with the exception of Mesa County, in blue stripes.

Unfortunately, the majority of the counties in the western group had lower estimated household incomes than the counties in the resort group according to 2012 Census estimates for average county household incomes. As the Census map shows, counties with lower average household incomes will have their premiums go up so that people with higher average household incomes can have their premiums go down.

In Colorado, at least, Obamacare is such bad policy that it encourages politicians to take from the relatively poor and give to the relatively rich.

Of course there are very wealthy in the resort areas, but there are also those service workers that are very low on the pay scale living in the same areas. Goods are expensive enough as is, and higher insurance costs are not doing any favors for these lower income workers.

There are consequences to “Equality”.

Perry, Blue Cross has no competition on the exchange in Aspen and they don’t care about your so-called “Equality”.

Blue Cross wrote the law to restrict competition.

Simply hilarious!

Doesn’t the Colorado Exchange offer Bronze Level Plans matched to HSA’s? California does. Sounds like the state officials messed up.

In Pitkin County (Aspen) Blue Cross has an HSA, of course. What they don’t have is competition. Remember, competition is critical in free and open markets to keep prices low.

Linda, you are thinking creatively , but you may have stretched too far on this one:

a. Do people with high deductibles and low wages make use of medical tourism?

I am skeptical. I have helped people use medical tourism. Everyone I helped had a big HSA or just a big bank account. This does mean I am right but gives me ground to doubt.

b. Do insurance companies lower premiums if more of their policy holders use medical tourism?

Again I am skeptical.

I think the term “medical tourism” is being misused. Driving from Aspen to Denver isn’t a hardship.

Unless it’s winter and the road is icy, of course.

Minus the odd rock slide, driving from Denver to Aspen is like driving from New York to Boston. Whether or not it is a hardship depends upon one’s viewpoint.

Actually, I’ve done a lot of winter driving, including Denver to Vail (not Aspen). I’ve always enjoyed it!

As for the drive from Vancouver to Whistler, if the police closed the road in Squamish we’d hole up in the Tim Horton’s – soon to be owned by Burger King. Things will never be the same.

Bob, you said, “This does mean I am right but gives me ground to doubt.”

TIME Insurance is world wide coverage. If a surgery costs $250,000 in the USA, like my son’s last March, and only cost $15,000 in India (his surgeon was Indian anyway), what do you think?

I say the answer is yes. But my son didn’t go to India because his deductible would have been $6,000 either way. Plus, he would have travel expenses.

If TIME would have told my son, hey, if you go to India we will pay for your flight and put you up at the Taj Mahal, with limo service, waive your deductible, and give you $25,000 cash, he might have went. TIME would have saved big bucks. But, the IRS and the HSA Police would question his HSA deposit because his deductible was waived.

Guy I know worked summers in Denver fixing lawn sprinklers. He had an HSA and a high deductible policy. When summer was over, he holed up in a cabin in the mountains. Not a high wage worker, at least in the winter.

When he hurt his arm, he got it fixed (for cash) in Denver, not in a mountain town. There is a lot of traffic on I-70 and not all of it is tourists, trucks, and skiers.

Thanks Ron.

The actual cost of the surgery is probably $15,000 in both America and India. The difference is that American hospitals are vastly over built and overstaffed, and are always looking for opportunities to overcharge insurers.

They put out a price like $250,000 because some insurer or Saudi prince might be stupid enough to pay it.

Agreed. Our hospitals are out-of-control institutions of cost-plus pricing – with the emphasis on the “plus”.

“Before Obamacare, someone in the mountain towns might economize on health costs by buying a high deductible health insurance policy… …driving would let him seek lower priced care in Denver’s more competitive health care market.”

People who live out in the hinterland do many things that the elites in the state capitol would never dream of. People who work in tourist resorts find ways to economize. I doubt if many hotel maids or restaurant waiters, or shop workers live in Breckenridge or Vail, where 1-bedroom condos often list for $350,000 to $500,000. They often live in less expensive communities and commute to work (there’s rush hour traffic on highway 9 out of Breckenridge everyday around 5:00). They likely shop at less costly stores and would prefer to pay premiums that don’t reflect the higher cost of living in the resort communities.

I grew up in a rural community. It was normal to trek 85 miles away to larger cities to stock up on groceries, Christmas shop and for an office visit to a specialist. Any major surgery would be performed in a hospital anywhere from 35 miles to 350 miles away.

Devon, my very 1st sale in health insurance was in Vail in 1987. I was so scared but when I got there this guy had a beautiful spread and health insurance with a maximum benefit of $100,000, and we were about 1/2 price.

He looked at me and said, “Well this isn’t very good is it?” I said, “No.”

Driving back home to Denver I was thinking that this health insurance sales thing is pretty easy.

I invite the readers of this blog to increase their donations to NCPA so that we can have a conference in Vail to hash out the details of what is going on out there.