Medicaid’s Perverse Financing Merry-Go-Round

Medicaid, which provides health-related welfare benefits to low-income individuals, is jointly financed by the federal and state governments. Before Obamacare, the split was 50/50 for rich states, but low-income states got more dollars. This mechanism is called the Federal Medicaid Assistance Percentage (FMAP). So, if California spent $50 on Medicaid, the federal taxpayer would chip in $50. However, for West Virginia, the split is 28.65/71.35. That is, for every hundred dollars spent on Medicaid, only $28.65 is spent by the state, and $71.35 comes from federal taxpayers. These dollars are not appropriated by Congress: They just roll out on auto-pilot, as calculated by the FMAP.

Medicaid, which provides health-related welfare benefits to low-income individuals, is jointly financed by the federal and state governments. Before Obamacare, the split was 50/50 for rich states, but low-income states got more dollars. This mechanism is called the Federal Medicaid Assistance Percentage (FMAP). So, if California spent $50 on Medicaid, the federal taxpayer would chip in $50. However, for West Virginia, the split is 28.65/71.35. That is, for every hundred dollars spent on Medicaid, only $28.65 is spent by the state, and $71.35 comes from federal taxpayers. These dollars are not appropriated by Congress: They just roll out on auto-pilot, as calculated by the FMAP.

Just think of the perverse incentives this gives state politicians and bureaucrats. Every policy that lifts people out of poverty, and dependence on Medicaid, causes the state to lose federal funds. That is why so many right-thinking people want to change the federal financing of Medicaid into a block-grant program. Could the incentive be even worse? Of course! There is an “enhanced” FMAP for children. This eFMAP is up to 30 percentage points greater than the regular FMAP. California only has to spend $35 to draw down $65 of federal funds, for a total of $100. For West Virginia, the figures are $20.05 and $79.95. Is it any wonder that advocates of expansion tend to focus on health care “for the children”?

Hospitals, who lobby consistently for expanded Medicaid dependency, are part of the problem. They long ago figured out that if they lobbied states to tax them, more than enough money would flow back to the hospital. It works like this: The state taxes the hospital, then that money goes back to the hospital in Medicaid payments, and it picks up federal dollars on the way back. Hospitals are the only businesses that lobby for tax increases on themselves!

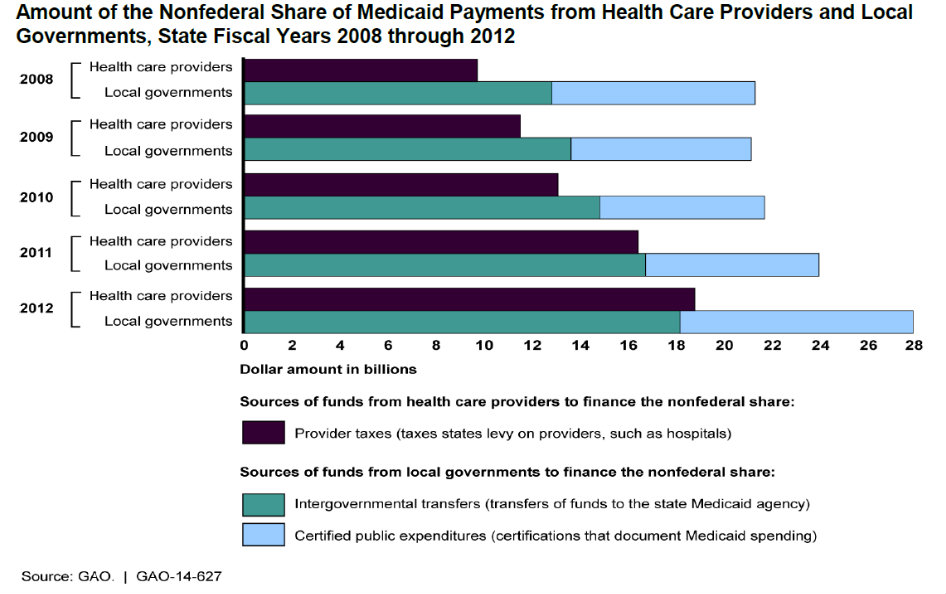

A new report from the Government Accountability Office has quantified how much this drives up Medicaid costs: From about $10 billion in 2008, these “provider taxes” rose to about $19 billion in 2012. GAO’s conclusion:

Nationally, states increasingly relied on funds from providers and local governments in recent years to finance the nonfederal share, based on GAO’s analysis (see figure). In the three selected states this increase resulted in cost shifts to the federal government. While the total amount of funds from all sources, including state funds, increased during state fiscal years 2008 through 2012, funds from providers and local governments increased as a percentage of the nonfederal share, while state funds decreased. GAO’s review of selected financing arrangements in California, Illinois, and New York illustrates how the use of funds from providers and local governments can shift costs to the federal government. For example, in Illinois, a $220 million payment increase for nursing facilities funded by a tax on nursing facilities resulted in an estimated $110 million increase in federal matching funds and no increase in state general funds, and a net payment increase to the facilities, after paying the taxes, of $105 million.

Interesting. But it makes you wonder whether states would purposefully be “poorer” just so they could get more federal dollars for Medicaid.

I certainly do not think that is out of the realm of possibilities…

Frank, I do not think that government of any state has control over the average taxable income of its citizens. (in order to get a higher Medicaid share)

The incomes of citizens in West Virginia or anywhere else depend on the presence or absence of labor unions, the presence or absence of immigrants, the presence or absence of high wage employers, et al et al.

What I find depressing — and I know that some readers of this blog will disagree with me — is that the states with relatively small outlays for Medicaid have generally fought tooth and nail to avoid paying even those small outlays.

The history of Medicaid in the South and the West is filled with insultingly low thresholds to get on the program (like $8000 income a year), and/ or the outright exclusion of unmarried adults.

This was done to avoid installing a state income tax, or raising a tax if there was one.

If any supporters of the South can convince me that this is from anything other than racial bigotry or deep stinginess, I welcome their comments.

“Hospitals are the only businesses that lobby for tax increases on themselves!”

Hospitals are lobbying to be taxed more. What a noble gesture!

“Every policy that lifts people out of poverty, and dependence on Medicaid, causes the state to lose federal funds.”

That’s why they want to keep everyone in the poverty levels. They expand Medicaid and reliance on Medicaid just to get a paycheck from the federal government. There are perverse incentives abound!

But it’s for the children!

Kevin Williamson at the National Review has some harrowing stories about poor parents rejecting therapy for their children, so that Social Security disability checks would keep coming.

However, Buddy, I do not think that state governments try to keep people in poverty. A lack of jobs and a preoponderance of low wage employers keep people in poverty.

Thank you but that invites the question: Why is there a lack of jobs and employers who pay low wages? Lots of reasons, many linked to government policies.

Going back to Kevin Williamson’s Appalachia, he notes that this area has had a lack of jobs plus low wages since oh, about the Civil War. The problem cannot be blamed on current state government, nor can it be blamed on liberal government policies (which might apply to places like Michigan.)

Just for the heck of it, let’s look at some places which used to be poor but are movin on up.

Atlanta area — air conditioning plus large corporate headquarters moving there

Eastern North Carolina — excellent universities

Virginia — federal government employment and military bases

North Dakota and Houston — energy production

Montana — rich retirees

It is shall we say a complex picture. Not all progress is due to old fashioned small government and free enterprise.