Obamacare’s Premium Hikes Are Much Bigger Than You’ve Been Told

![]() (A version of this Health Alert was published by Forbes.)

(A version of this Health Alert was published by Forbes.)

Yesterday was the last date for open enrollment in Obamacare’s third season. Since October, at least six independent and credible sources have confirmed rate increases will be in the double digits. However, these are gross premium hikes. Net premium hikes paid by enrollees are distorted by tax credits paid to insurers. These badly designed tax credits have a number of perverse consequences. It is widely understood that they impose disincentives to work.

What is less well understood is that the tax credits are so badly designed that they impose a ratchet effect causing net premium hikes greater than the gross premium hikes. According to new research published by the National Center for Policy Analysis, this effect is concentrated among Obamacare enrollees in the lowest income brackets.

Plans offered on Obamacare exchanges are classified by metallic tiers: Bronze, Silver, Gold, or Platinum. Plans must cover a number of “essential benefits” (as defined by the Affordable Care Act, which established Obamacare). Insurers estimate how much it will cost to provide these benefits (“actuarial value”). Bronze plans cover 60 percent of actuarial value, while Silver plans cover 70 percent, Gold plans cover 80 percent, and Platinum plans cover 90 percent. Most analyses focus on Silver plans because tax credits are based on the premium of the Silver plan with the second lowest premium in a rating region.

This has significant implications for the actual rate increases experience by the majority of enrollees who stay with their 2015 plans in 2016. Tax credits are determined by an enrollee’s income and the benchmark (second-least expensive Silver) plan in his rating region. This introduces a ratchet effect, which can increase the net premium by a significantly higher percentage than the increase in gross premium.

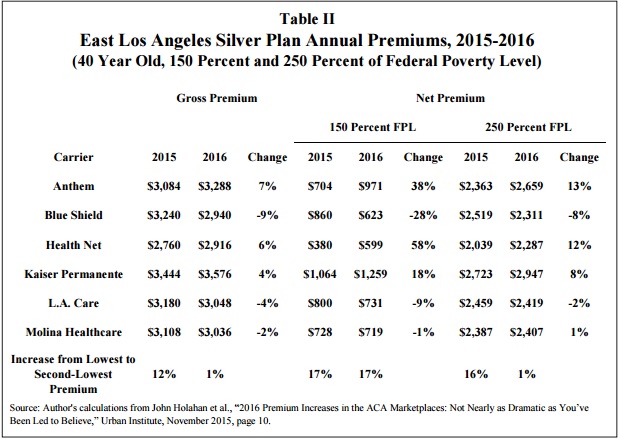

Here is an actual example to further illustrate the problem, which emphasizes how volatile and unstable net premium changes are. Covered California, a state exchange not operated by the federal government, has six insurers offering Silver policies in the East Los Angeles rating region. In 2015, the gross annual premium for a 40-year old buying the lowest cost Silver plan was $2,760, offered by Health Net. The second-lowest cost Silver plan cost $3,084, offered by Anthem. It cost 12 percent more than Health Net’s plan. However, the 40-year old earning 150 percent of the FPL only paid $380 net premium for Health Net or $704 for Anthem. If he had chosen the most expensive Silver plan, offered by Kaiser Permanente, he would have paid a net premium of $1,064. For a 40-year old earning 250 percent of the FPL, the premiums would have been $2,039 for Health Net, $2,363 for Anthem, or $2,723 for Kaiser Permanente (See Table II).

For 2016, the lowest cost plan remains Health Net. However, the Health Net subscriber earning 150 percent of FPL sees a premium hike of 58 percent! This is because the second-lowest cost plan switches to Blue Shield, which had been the second-highest cost plan in 2015. (Anthem now takes that position, having increased its premium by 6.6 percent.) Blue Shield actually dropped its premium by 9.3 percent. By shrinking the gap between the lowest cost and second-lowest cost plan from 12 percent to just one percent, Blue Shield has also shrunk the relative value of the tax credit (which is based on the second-lowest cost Silver plan) when applied to the lowest cost plan.

Further, because of leverage introduced by the tax credit, the Anthem enrollee earning 150 percent of the FPL sees a net premium hike of 38 percent, while the enrollee earning 250 percent of FPL sees a net premium hike of 13 percent. Because of the design of the tax credits, the lower an enrollee’s income, the worse the ratchet effect.

Of course, the Blue Shield subscriber greatly benefits from this leverage. If he stays with Blue Shield, his premium goes down significantly. However, Blue Shield had previously been the second-highest cost plan. Few people enrolled in Silver plans with initially high premiums. Instead, 65 percent of 2014 enrollees signed up for the lowest or second-lowest cost plan. The number of people who benefit from having enrolled in an initially high cost plan that drops its premium will be much smaller than those who experience a significant premium increase for an initially low cost plan.

This previously unexamined ratchet effect explains why Obamacare enrollees are even more frustrated by their experience than most policy experts can explain. Any replacement or amendment to Obamacare will have to fix the way tax credits are allocated, if it is to win popular support.

Interesting analysis

If the low cost plans in year 3 become the high cost plans in year 4 it seems like the migration away from the original low cost plans would be significant

This is so complicated! It is evident that it would be far less complicated for a person to avoid enrolling in Obamacare altogether and deal with the simpler task of adjusting his withholding so as to leave no funds on the IRS table at year’s end, effectively taking all the bite out of the tax penalty. This tactic would have to be repeated every year until retirement, since the IRS get a bite out of any funds left at year’s end in all subsequent years. And the unpaid balance grows at a rate of 3% per annum.

Far simpler for him to simply emigrate to a freer country, as I did at age 26.

Jimbino

I understand the IRS will not actively try to collect the taxes

I have heard they could collect only from a surplus of taxes paid in but have not seen it in writing

Don, maybe this will help.

[excerpt]. “For most unpaid taxes, there are a variety of ways that the IRS can recoup their money. But the text of the ACA is very clear in stating that taxpayers who don’t pay their ACA penalty are not subject to levies, liens, or criminal prosecution.”

Whole article here:

https://www.healthinsurance.org/faqs/ive-heard-that-the-government-wont-really-be-able-to-enforce-the-penalty-for-not-having-health-insurance-is-this-true/

Thanks John

Very helpful

I wonder how that works out in the real world. Money owned to the government is sort of fungible. How is a person able to specify which taxes are being paid?

Does it mean, for sake of argument, that you can calculate your tax bill, detail how much of the bill is the penalty, and attach a letter specifically stating you are paying all of your taxes owed except for the penalty? What’s to keep the IRS from crediting the $2,000 penalty as paid but claiming you still owe $2,000 for FICA and income taxes on wage income? Furthermore, in future years will the unpaid Obamacare penalty accumulate?