Myth Busters #4: The Death of Health Planning

One of the most serious consequences of Roemer’s Law was the creation of national health planning.

The National Health Planning and Resources Development Act was enacted in 1974 to require states to establish elaborate bureaucracies to control the growth of hospitals and other health care facilities. These agencies included Health Systems Agencies (HSAs), State Health Planning and Development Agencies (SHPDAs), Statewide Health Coordinating Councils (SHCCs), and a host of other committees and agencies. These efforts were designed to implement Certificate of Need (CON) programs, through which hospitals and other facilities that wished to make capital outlays would have to get prior approval from the agencies.

This law was enacted out of recognition that “the massive infusion of Federal funds into the existing health care system (contributed to) inflationary increases in the cost of health care.” Indeed, the enactment of Medicare and Medicaid in 1965 resulted in a vast increase of federal spending in the health care system:

-

- In 1965, state and local governments spent $4.3 billion on health care, while the federal government spent only $2.9 billion.

- Two years later, state and local spending rose 28 percent to $5.5 billion, but federal spending went up 234 percent to $9.7 billion.

- By 1970, state expenditures would rise to $9.9 billion, and federal spending would reach $17.7 billion — over six times what had been spent five years earlier.

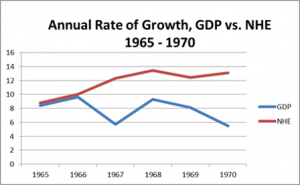

This, naturally, resulted in enormous health care inflation. The rate of annual increase in health care spending was very close to the increase in Gross Domestic Product in 1965 and 1966, but immediately it began to rise at double the rate.

Rate of Increase in Gross Domestic Product and National Health Expenditures as a percentage from previous year, 1965 – 1970

Source: Katherine R. Levit, et.al., “National Health Expenditures, 1990,” Health Care Financing Review, Fall, 1991.

The panic among the health policy community was stark. The then-HCFA administrator, Stuart Altman, who oversaw the Medicare and Medicaid programs, was interviewed in 2001, as saying:

When I was 32 years old, I became the chief regulator in this country for health care. At that point, we were spending about 7.5 percent of our GDP on health care. The prevailing wisdom was that we were spending too much, and that if we hit 8 percent, our system would collapse. (Stuart Altman, interviewed by Andrew Osterland in CFO Magazine, June, 2001, p.75.)

Two other scholars were equally agitated. Kenneth Friedman and Stuart Rakoff wrote:

The thrust towards greater government regulation of health services arises primarily from a single source; astronomical increases in cost. Total expenditures for health services have more than tripled since 1965, exceeding $118 billion in FY 1975. The proportion of GNP devoted to health care has grown from 5.9 to 8.3 percent. (Kenneth Friedman & Stuart H. Rakoff, Toward a National Health Policy, Lexington Books, Lexington, MA, 1977, p. 108)

So, we have a massive infusion of new money into the health care system, which raised demand for services, which resulted in an astonishing increase in prices. And how do the dunces in health policy respond? They enacted a massive and mandatory health planning system, which is intended to reduce the supply of services — precisely the wrong reaction at a time of high inflation due to rising demand.

But Roemer’s law says that demand is irrelevant. The only thing that counts is supply. So, even with all this new money, it would argue, demand is constant. Inflation in health care is caused solely by providers “inducing” demand to enrich themselves. Reduce the number of suppliers, and you reduce the costs of health care.

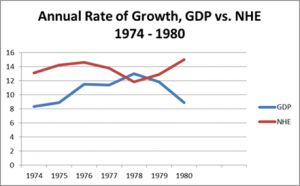

Not surprisingly, this approach did not work and health inflation continued unabated. In fact, the year before Health Planning was adopted, the Gross Domestic Product grew faster than health spending (in 1973, the GDP rose 11.7% while NHE rose 10.9%). After it was adopted in 1974, health spending was back on a rampage with the exception of one year.

Rate of Increase in Gross Domestic Product and National Health Expenditures as a percentage from previous year, 1974 – 1982

(Katherine R. Levit, et.al., “National Health Expenditures, 1990,” Health Care Financing Review, Fall, 1991.)

The main law was repealed in 1982, but billions of dollars and years of effort were wasted on an idea that never made any sense in the first place. And no one was ever held to account.

I read an article by a physician who was practicing in the early years of Medicare. He said the first full year he participated, physician income climbed by about 25%. It’s hard to fathom that nobody saw this coming.

I think this is correct. Health planning just adds another layer of regulation onto an industry that is already one of the most regulated in the country.

Health planning isn’t dead. Today it’s called Obama Care.

This is precisely the Quebec model. Limit qualified providers. Fewer providers means fewer services billed. Fewer billings means cost control. Presto!

Vermont is alas lurching down the same foolish road.

Greg, great post and quite informative in putting things together.

Perhaps one day you might wish to provide an extensive list of substantial laws that failed to reduce health care costs and thus were repealed. The federal repeal of the CON law (1982) you are dealing with is a prime example.

Interesting. Back then the medical share of GDP stood at 7.5% and the prevailing wisdom was that if it hit 8% the system would collapse.

Today, may years later, the medical share of GDP is twice that and the system has not collapsed. Yet the prevailing wisdom is that when it hits 20% the system will collapse.

I think having 20% of your GDP in one basket is unwise and perhaps a bit dangerous, but I haven’t yet figured out how any certain percentage threshold alone can credibly translate into a prediction of collapse.

Anyone have any ideas?

Paul,

Health is the only sector of the economy where it is even an issue. No one gives a damn or even knows how much of the GDP is taken up by food, housing, education, transportation, or any thing else. Why should that be? I think it is a totally manufactured concern designed to keep health economists employed.

Al,

Stay tuned for my next post on hospital rate setting systems 🙂

I think I’m about to define “Graham’s law”: Any example of Roemer’s law can be debunked by Scandlen on Goodman’s blog!

But seriously, as Greg Scandlen notes, nobody cares how much share of GDP we spend on any other item of personal consumption than health care, because we have not artificially socialized those things (except education).

Ass Prof. Goodman and the NCPA team have pointed out, when you compare the growth in health spending using hard currency (adjusted for purchasing power parity), the rate of growth of spending in the U.S. is similar (or even slower) than in other countries with socialized medicine.

Another problem with worrying about health spending as a share of GDP is that both the numerator and denominator are changing over time, and each of them is comprised of both prices and quantities. Without decomposing and interpreting these components, the ratio alone tells us little.

Nevertheless, when looking at just one country, over a short period (five or so years), and you see such a big change, you have to find an answer, as Greg Scandlen has done.

Paul, the subprime mortgage debacle was a direct consequence of an inevitable tightening of an easy money policy that produced a real estate bubble seemingly impervious to gravity.

The Federal capacity to provide easy money to subsidize nearly free health care for all was gone long ago, but like the real estate bubble and the internet bubble before it, human nature unfortunately seems destined to driving most lemmings go over the cliff before they collectively realize the desperate need for a course correction.

We continued to further max out our credit cards to subsidize this and other entitlements, now to the point where even the dullest amoungst us realize that the money just isn’t there.

Yes, the coming inflation, rise in interest rates and ongoing dollar devaluation may make it seem like the money is still there, but the loss in social welfare will be immense. Not sure what a “callapse” is supposed to look like, but many lives have been destroyed by other bubbles bursting, and with health care being such a large portion of the economy, the evolving health care bubble-burst is likely to materially harm the vast majority, especially the most vulnerable.

Since Prof. Uwe Reinhardt seems to read these blogs at times, I re-urge him to explain a quote attributed to him in Medical Economics ( from many years ago) that seems relevant here:

“Why is it good when Americans buy cars, but bad when they buy healthcare?”

We need to get the federal government out of the social welfare business entirely and put that job back at the local level where it used to be before FDR and where it belongs. Then states and counties would be competing with each other as before. Think through what that would do. Right now if you don’t like the system all you can do is leave the country.

Before FDR and LBJ launched what turned out to be an unsustainable escalation of social welfare from the feds, states and counties then supplying those services to the poor only walked a fine line. If they made benefits too liberal shiftless people would move in and replace productive taxpayers who would depart that county or state for a more favorable environment. Thus the cost of it all was kept down by competition and people were free to move around. Same was true of business regulatory environment. Now so much of it comes from feds and it is so oppressive that there is no place to go but out of the country so wealth and industry are fleeing the USA very fast to Mexico, Brazil, etc for example.

Eisenhower warned of the “military industrial complex”. We have to stop fighting useless wars that do not involve our vital interests. And when we do fight we have to be smarter and more surgical.

The Tea Party is the only political movement right now saying these things and willing to stick to it’s principles. That is what is happening right now in DC. The conversation is changing.

I spoke to an old Liberal antagonist at a block party last night. He is British but now a US citizen and a liberal Democrat (also a Delta 747 captain). I was flabbergasted to discover that he agrees with ALL I said above. Even liberals on reflection can see the benefits of moving welfare locally including health care. Look at San Francisco. The people that live there LIKE socialism and stay and work for their poor neighbors voluntarily. But if you don’t like that kind of extended family life you just move to some conservative city, county or state.

Democrats and moderate Republicans and social coservatives don’t get it. Some one said that with the Democrats you get more of the same and with the Republicans you get a little less of the same, but we need a whole new conversation to save this country from the fate of Rome and Athens.