Myth Buster #20: Third-Party Payment

No term is as widely misunderstood as “third-party payment.” Most health policy people hear that expression and automatically think “insurance coverage.” “My goodness,” they think, “critics of third-party payment want to abolish all insurance! It’s not even worth talking to them.”

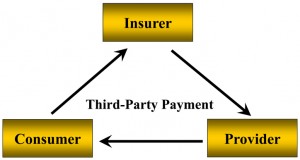

But this attitude is wrong. Third-Party Payment (TPP) has a specific and precise meaning. It is a form of coverage in which the payer (third party) pays a provider (second party) to deliver a service to a patient (first party).

By contrast, most forms of insurance consist of a two-party contract. The first party (the consumer) buys a policy from the second party (the insurer). When the insured incurs a “loss” the insurer pays a benefit to the insured.

Third-party payment never existed until it was created by BlueCross in the 1930s. BlueCross was actually invented by the hospitals that were concerned about their financial condition during the Depression. The prototype was launched by Baylor Hospital in Dallas in 1929, and soon replicated by other hospitals around the country. The whole movement was endorsed by the American Hospital Association (AHA) in 1932.

For many years BlueCross (and later BlueShield) insisted it was not “insurance,” but “prepaid hospital (or medical) service organizations.” They were organized, not under state insurance laws, but under special enabling legislation in the states that provided them with special tax-exempt status and immunity from many of the regulations that apply to insurance companies. For instance, they were exempt from insurance reserve requirements because their hospital members guaranteed their solvency. They were set up as not-for-profit organizations and had Boards of Directors that were controlled by their hospital members. This would have been a flagrant antitrust violation but for the “state action” doctrine, which exempts state-regulated companies from anti-trust law.

BlueCross strictly avoided insurance terminology, calling its customers “subscribers,” rather than insureds, who paid “subscription fees” rather than premiums and received “service benefits,” rather than a payment upon a loss.

Because its priority was hospital finances, it paid hospitals directly for services rather than trusting its customers to pay for the care they received.

Because of its many regulatory advantages, BlueCross quickly dominated the market for hospital financing, so other insurers learned how to replicate its third-party payment model, by using “assignment of benefits” and “participating provider” networks.

So, what difference does any of this make? It is enormous, especially in accountability and transparency

In a two-party contract there is direct accountability. I pay you for a service. I know what I paid you and what you are supposed to do. If you don’t deliver the service or do a poor job I can sue you, or yell at you, or punch you in the nose. It is between you and me, and you do not want to make me angry.

In a three-party payment system there is no accountability. I go to the doctor and he does what he wants and somebody pays him. I don’t know what he was paid or whether he did what he was supposed to do. But, importantly, the payer doesn’t know, either! The payer may know what they paid, but they don’t know what transpired between the doctor and me. The doctor doesn’t know what my arrangement is with the insurer, either. He may not even know if what I want is a covered service or not.

Nobody knows anything. And so we spend way too much time trying to figure out what we don’t know. The insurance company is very interested in what transpired, so they spend a lot of time getting the doctor to fill out forms and getting me to complete surveys. The doctor hires clerks to try to find out what is covered and for how much.

And I am simply baffled by the whole thing and annoyed about it all. I figure I can’t trust any of these jokers because none of them cares about my well-being in spite of all the money I (or my employer) shovels into their bank accounts.

There is no way this arrangement can ever be made to work well. Yet our system is fundamentally based on it. In fact, it has become so fundamental that most people cannot imagine any other way of doing it. And that is where the conversation usually stops.

Greg, this is an interesting explanation on how third-party payment differs from insurance. If a team of actuaries, economists and health care providers were tasked with the job of designing a system that would grow health care as a percent of GDP, this is the system they would likely design. It makes me wonder if hospitals knew what they were doing? Or if they merely wanted a way to ensure hospitals would be paid and were unaware of the law of unintended consequences?

Greg, it’s an old subject for those who like you have been in the trenches for so long, but it bears repeating; so many people just don’t get it. I think even almost all of the Republican reforms don’t address this problem except possibly in the deductible. I think I need to edit my plan in order to make it more encouraging of these sorts of “insurance” policies. More indemnity-like policies.

It’s too bad policy makers didn’t think about saving for health care similar to saving for retirement. The message is relatively simple: ensure against the unexpected. Save for the future when expenditures will be higher. And pay for your normal medical care out of pocket or a FSA/HSA.

Great points on the accountability issues concerning third-party. Hadn’t thought of it that way.

You are right Bob, most of the folks on our side don’t get it (probably including Gov. Romney). I think they are starting to get it, but much slower than need be. It makes it hard for them to distinguish the conservative approach vs. the leftists and Obamacare. They don’t understand that they have to rethink the basic concept of health insurance in order to make effective change. In short, they don’t understand that third party (top down) managed care is bad regardless of whether it is the government or insurance carriers doing it.

Greg, you noted that Blue Cross would have been busted for anti-trust violations due to the fact that hospital administrators were the board members of Blue Cross (if not for the “state action” doctrine”. How is it that Blue Cross, UHC and Aetna are immune from the same anti-trust violations when they effectively control the providers of service, the rates paid to those providers to the exclusion of competitors (other carriers), and the premiums charged to their insureds who are coerced into using those particular providers?

It seems that some eager beaver in the Justice department (or that rare non-puppet honest congressperson) should be able to smell this one all the way from Washington.

Buster,funny you should raise that. I have been thinking a lot lately about how Social Security and Medicare are different. SS just pays people the money they have coming to them. It doesn’t care at all how we spend that money. If SS worked like Medicare it wouldn’t trust us to spend the money. Instead it would directly pay for our mortgage, our utilities, our grocery bills, our gasoline, etc. If it thought we were spending too much on any of those, it would “negotiate discounts.” If that didn’t work it would make us buy hamburger when we wanted a steak.

Frank, really excellent question. Seems like pretty clear restraint of trade. Even though McCarran/Ferguson exempts insurers from most federal anti-trust laws, they are still subject to state snti-trust, and if you have ever been to a meeting of the companies they always start out with an attorney reading a warning against doing or saying anything that smacks of price fixing or market collusion.

Devon, I think the hospitals just wanted to ensure some cash flow. They didn’t give a moment’s thought to consequences either intended or not. As it turns out they were successful beyond imagination.

Greg

Would you please tell us which country relies on a two party contract as the basis for its health policy. Is Medicare a two party contract?

Universal coverage undoubtedly must include third party contracts. Certainly, we must hold third parties accountable and assure that consumers are well engaged in both the financial and care delivery aspects of our health system.

I suggest that you focus your analysis on how to make all components of an effective system accountable.

Greg, Devon makes a good point, because 10 years after Blue Cross was invented to pay hospital bills, Blue Shield was invented to pay doctor bills. The same motivation they had in common was to ensure they got paid better. The dirty little secret no one knows is that they need to prevent transparency because if they didn’t, then individuals would start to realize that they had more negotiating power than the third party payers.

John,

You still don’t explain why all private health insurance is third party. Why hasn’t any health insurer tried getting rid of it? What is the SPECIFIC government intervention that causes third party payment to be all of private health insurance?

What is the absolute lease amount of deregulation that would need to be done get third party payment to erode?

Sounds like BlueCross found some nice semantics to hide behind.

The rules keep changing, especially since anti-competitive regulations were relaxed. The Blues even in the eighties were still non-profits that offered private plans to the uninsurables – those with serious pre-existing illness. There was a time when the govt and Blue Cross would sit down with a hospital like my alma mater, non-profit Columbia Presbyterian and write checks to make whole the hospital finances not based on any individual patient item-by-item charges.

Then there are some rules that never change. . . the unpredictability of each patient’s case. A couple comes in for the delivery of their baby – and were quoted $700 for the delivery. Totally unpredictably, the baby ends up in the Neonatal ICU for months. . . costing millions of dollars. The reality is that no one gives this potential medical catastrophe scenario to new parents – forget the itemized costs, which cannot be self-insured. You’re advised that you’ll be thrown out of lamaze classes if you’ve been through this with a previous pregnancy and mention it. And predicting charges is impossible even in controlled outpatient scenarios. An allergy patient comes in for ‘routine’ skin tests advised there is a certain approximated monthly cost. The initial tests are not consistent. The differential diagnosis includes cancer,and indeed the patient is redirected abruptly to surgery, chemo, radiation. . . with no possible way for the oncologist to predict all the costs because each case takes different twists and turns.

Greg, the mantra should be “Minimize third parties, maximumize insurance.” This would lead to expanding cagtastrophic insurance (more insurance) and more account based plans(minimizes 3rd parties).

Ron +1