Improper Payments Up 18 Percent, Mostly Medicare & Medicaid

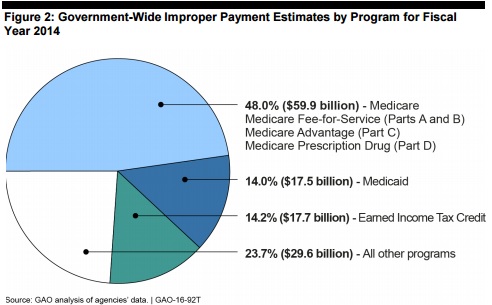

The Government Accountability Office (GAO) has just reported that “improper payments” (that is fraud and abuse) are up to $124. 7 billion in 2014 from $105.8 billion in 2013. Most of this is Medicare and Medicaid:

The almost $19 billion increase was primarily due to the Medicare, Medicaid, and Earned Income Tax Credit programs, which account for over 75 percent of the government-wide improper payment estimate. Federal spending in Medicare and Medicaid is expected to significantly increase, so it is critical that actions are taken to reduce improper payments in these programs.

I have previously suggested that a solution to Medicare and Medicaid overpayments is to give patients more control of the dollars spent on their behalf, and share savings with them.

With respect to the Earned Income Tax Credit, those improper payments are often used as evidence that a more general tax credit to finance individuals’ health spending would be similarly problematic. That is likely true for Obamacare tax credits, which are a very confusing calculation. However, a universal, refundable tax credit would be easier to govern.

It is inaccurate on your part to say “fraud and abuse” equals “improper payments.” The GAO report clearly explains

“It is important to note that while all fraud involving a federal payment is considered an improper

payment, not all improper payments are fraud. Improper payment estimates are not intended to measure fraud in a particular program.”

In most cases “improper payments” are not even wasteful spending (but many bills paid properly by the government are wasteful). Many payments are improper because they paid out too little. Most of it is probably due to paperwork problems

I most wholeheartedly agree with Dennis. I would surmise the vast majority of this so called “fraud and abuse” is simple paperwork issues that commission based recovery contractors hold providers to in order to get a part of those extrapolated recoupments. “Improper payments” don’t prove their is fraud or even lack of medical necessity, it just shows that the provider didn’t meet every element of the overly burdensome documentation requirements that are put forth by CMS. It would be as if the IRS audited Everones taxes with each auditor paid on commission for what they discover wrong and found you didn’t keep a receipt from 5 years ago – and then calls that fraud and abuse. The only abuse is the GAO and CMS calling simple billing mistakes and poor documentation from an underpaid and overworked billing clerk as fraud.