Health Spending Increasing Share of GDP

Last week’s third estimate of Gross Domestic Product for the second quarter confirms that growth in health spending might be moderating somewhat from its initial Obamacare fueled rush. Unfortunately, it is not a clear break in the trend of health spending consuming an increasing share of our national income.

Last week’s third estimate of Gross Domestic Product for the second quarter confirms that growth in health spending might be moderating somewhat from its initial Obamacare fueled rush. Unfortunately, it is not a clear break in the trend of health spending consuming an increasing share of our national income.

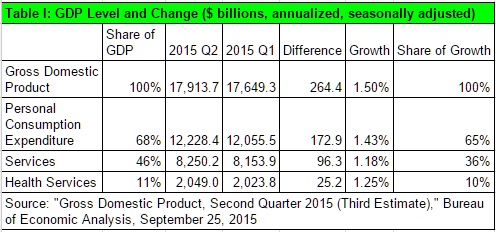

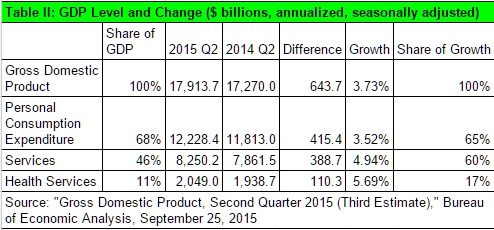

Current GDP grew $264.4 billion, or 1.5 percent, from Q1 (Table I). One tenth of this, $25.2 billion was health services. At this rate, health services grow in line with their share of GDP. However, if we look over the entire year from 2014, Q1, we note a trend that seems to be persisting, despite last quarter’s moderate grow (Table II). At $110.13, health services spending accounted for 17 percent of GDP growth over the four quarters. The rate of growth was 5.69 percent, in excess of current GDP growth.

The GDP estimates corroborate other estimates discussed in this blog that indicate health spending has resumed its upward trajectory.

Technical note: When I discuss health services in these quarterly GDP releases, I mean only health services. I do not include purchases of medical equipment, or facilities construction. While I include Medicare and Medicaid, I do not include Veterans Health Administration or other government benefits. So, these dollar figures undercount the amount of our economy consumed by the government-health complex.

(See: Measuring the Economy: A Primer on the GDP and the National Income and Product Accounts, Bureau of Economic Analysis, October 2014, pages 5-2 and 5-3; Micah B. Hartman, et al., “A Reconciliation of Health Care Expenditures in the National Health Expenditures Accounts and in Gross Domestic Product,” Research Spotlight, Survey of Current Business, September 2010, pages 42-52.)

So, it has been a long time since I took ECON 101 – Macro. 40 years ago, I was taught that you could calculate GNP (not GDP) one of two ways – measuring expenditures (consumer spending plus private investment plus net exports, plus government spending), or measuring income (wages, plus rental income, plus interest income, plus business profits, plus corporate profits plus indirect business taxes, foreign income and depreciation).

As health spending is > 17% of GDP, that means that it is much greater than 17% of wages. Note that the average cost of single coverage in the 2015 Kaiser report was $6,251 – that would be 17% of $36,770. And, of course, wage earners are funding Medicaid spending, Part B and Part D of Medicare, as well as taxpayer subsidies for public exchange coverage, all in addition to their contributions, the employer’s contributions, and their out of pocket spend.

So, my question is why are Americans always surprised about the ever increasing cost of health coverage, why don’t they expect it to eat 17+% of their wages?

Just as importantly, why do Americans focus almost exclusively on the cost of health coverage and services, and not the “return on their investment”?

I don’t think they focus on return on investment for two reasons. First, they have no idea how to measure it. Second, when they’re not feeling well and find themselves in a hospital emergency room, the last thing they want at that time is a lesson in economics and return on investment. They just want someone to fix or at least treat their medical problem.

Good points Benefit Jack on percentage of income spent on health care

At 17 percent of income we are already past a reasonable threshold

Don Levit

Return here is often qualitative – not some econometric or statistical determination. My mom had a massive heart attack in 1989, and after surgery and treatment, she lived to 2001. The $200,000 or so cost in medical services over those twelve years, mostly paid by taxpayers as part of medicare, seems very low cost compared to her enjoyment (and ours) over the following 12 years.

Jack

I know those extra years can mean a lot in which dollars seem irrelevant

But on a community wide basis they are relevant

People who can envision the effects beyond their immediate families are generally much happier people

Let us assume her prognosis was 12 extra years of quality life

Would the decision have been different if the prognosis was 6 months to a year?

Don Levit

It was her decision to make. So, I don’t know. I do know that even through her date of death, she never seemed ready give up the fight. Hard to tell what decision she would have made – but actually, I don’t recall any prognosis, quality of life assessment, nor estimate of life expectancy incorporated in the process.

But this I know for sure. If 17% of GDP is the price we pay for the medical services/coverage we receive, even if the cost of coverage could be halved by taking away the decision on medical services from individuals and their physicians/medical professionals (vesting it in NICE, or IPAB, perhaps using some algorithm that attempts to apply what you mean when you say considerations “beyond their immediate families”), then my vote is for 17% of GDP spend.

From my perspective, the problem was, is, continues to be a lack of appreciation for the cost of medical services (often hidden by third party insurance – Medicare, Medicaid, public exchanges, employer sponsored plans), and a lack of appreciation for the results – even though nothing is ever guaranteed.

I cringe when I hear weenies talk about a “war on women” being waged by people who criticize the political decision incorporated in PPACA that mandates health plans make available contraceptives at no out of pocket cost to individuals (something that is almost always budgetable or available from clinics). Obviously, that’s not the place where we should be spending our next dollar. Such spending should not be “insured” or “socialized” any more than my son’s decision to have Lasix surgery.

And, when people assert that we spend too much, that medical services cost too much, that medical services are unaffordable, they often lie by supporting their affordability claims claiming that 50% of the personal bankruptcies in America are so-called “medical bankruptcies”. All studies show that a substantial portion of individuals who suffer a so-called “medical bankruptcies” had medical coverage in place. One such frequently cited academic study showed that “medical bankruptcies” had unpaid medical bills that averaged just under $5,000 out of a total discharged indebtedness of just over $44,000+. Tell me, if the only debt was the $5,000, would they still have declared bankruptcy? Or, if the debt was only the $39,000 from non-medical spending, would they NOT have declared bankruptcy? The other issues and mistakes in these studies are too numerous to mention.

Our health insurance/coverage system, including Medicare, Medicaid, the public exchanges, and even employer-sponsored plans reminds me of a famous quote by Margeret Thatcher, “Socialism works only until you run out of other people’s money.” Or, if you prefer, one from former senator Russell Long: “Don’t tax you, don’t tax me, tax that guy behind the tree.”

Bottom line, until each of us, individually, is willing to individually pay (much more than 17+% of our own wages/incomes) what we are already doing as a society (17+% of GDP), there is no effective solution. I learned this first hand in 2003 in a focus group sponsored by HHS (Health Care That Works for All Americans) where people in attendance confirmed “I want the best health care and coverage YOUR money will buy”.

“I learned this first hand in 2003 in a focus group sponsored by HHS (Health Care That Works for All Americans) where people in attendance confirmed “I want the best health care and coverage YOUR money will buy”

As head of benefits for a national employer with HQs in NY i was invited to the NYC focus group, and came away with the same general impressions as you.

Physicians and academics dominated our discussion. Physicians felt entitled to charge what they wished without interference from insurers. Academics felt people are entitled to full coverage. Charlie Rangel showed up to agree. As a result, the consensus insurance plan designed by the partipants reimbursed almost everything 100%. It was the proverbial horse designed by a committee. There were no trade-offs. An economic Alice-in-Wonderland experience.

No one wanted to talk about the principal barrier to getting medical care – its high cost. No one wanted to hear that the cost of medical care drives the cost of insurance. No one wanted to accept that insurance is a symptom of the cost problem; that the disease is the cost of medical care. No one wanted to face the cost implication of higher subsidies of medical care thru “insurance”. In short, the group ended up trying to solve a medical cost problem using insurance tactics. That mistake is the same mistake made a few years later by the authors of ACA.

I was somewhat encouraged to learn that the findings of those focus groups were basically filed away and never seen again. Sorta like the ending to “Raiders of the Lost Ark”. Unfortunately, the basic mistake was not lost, and lives on today in ACA.

Benefit Jack and John

Thanks for your comments

It is a good analogy as BJ suggested for us to ask “are you as a family willing to spend 17 percent of your income towards medical expenses?”

And John you are correct that insursnce is part of the problem when one partner psys 100

Percent and the other partner pays zero

With maximum out of pockets even stop

Loss insurers can only guess how to price unlimited benefits

The bottom line is that we have to be willing to limit the benefits ourselves even if they are covered

A payment to the heirs in lieu of medical payments may be a fair response

Don Levit

A relative of mine who works for one of the government agencies has a Blue Cross PPO for which the government nominally pays 75% of the premium and he pays 25%. The combined annual premium for this family coverage is approximately $15,500. He also has dental insurance which costs another $800 per year or so. That adds up to close to 17% of income based on a salary of a bit under $100K and that’s before deductibles and coinsurance.

Anyone in the public sector with comprehensive insurance potentially subject to the new Cadillac tax pays well above 17% of income for health insurance whether they realize it or not as most economists agree that the premium nominally paid by the employer is actually paid by the employee in the form of lower wages than he or she would otherwise be paid. The same is true for the old line industrial union members with very comprehensive coverage. Again, that’s before any deductibles and coinsurance.

Thanks to one of the less publicized provisions of the ACA which requires employers to include in Box 12 of the annual W-2 tax form how much they pay for health insurance on each employee’s behalf, more employees are starting to see these numbers in black and white whereas many had no clue before. Given the growing bipartisan pressure in congress to repeal the Cadillac tax, it suggests that people with health coverage generous enough to be subject to the tax are comfortable paying significantly more than 17% of income for family coverage. I suspect that sentiment might be different if it weren’t for the longstanding tax preference that applies to employer provided health insurance.

Separately, anyone paying for long term care with their own money is paying way more than 17% of income for health care. They are likely depleting assets and will have to spend down to almost nothing before they can qualify for Medicaid.

Barry, I like the way people here talk about healthcare costing 17% of income when it clearly is much more for some people. I met this 4th grade school teacher named Ginger who is earning $39,000 a year and paying $1,401 a month to add her 29-year-old husband and child to the school’s Blue Cross PPO health insurance. The insurance has a $250 deductible then pays 80 – 20% of the next $17,500 ($2,750) for a total Out-Of-Pocket of $3,000 per person. The school is paying another $6,000 a year for her coverage for a total of $6,000 + $16,812 = $22,812 in premiums per year. This looks like over 50% of her income is spent on just premiums.

Of course she is spending on Medicare Tax on every dollar earned so fat cat millionaires can set on their boats here in Tampa Bay and scarf down free drugs on Medicare. What a country we live in.

If BenefitJack was correct and the $22,812 – just on insurance – was 17% of income this 4th grade school teacher would have to earn $130,000 a year. She is just about $100,000 a year short.

Barry and Ron, you both focus on family coverage costs. I wanted to note that this is an area likely to see the greatest amount of change over the next 10 years – encouraged by provisions in Health Reform.

I would encourage you to consider why family coverage is so expensive in your examples. Let’s take five people, each performing the same job, each with the same level of job performance, all in the same location, each earning $40,000 a year, each with a spouse and two children. The cost of single coverage is $6,000 a year, of which the individual pays 25%, the employer 75% ($1,500, $4,500). If the individual elects to cover only the children, the cost is $10,000 a year, if the individual elects to cover only the spouse, the cost is $12,000 a year, where if the individual covers the spouse and children, full family, the cost is $16,000 a year. What is the appropriate level of employer financial support where the individual elects to cover family members? According to PPACA’s definition of “affordable”, what President Obama and the Democrats who voted for the law, the employer need not spend 1 penny more. But, let’s say the employer is old school, and pays 75% of the cost of coverage regardless of the tier elected. So, you would have the following result:

Employee election Employer spend

Waive, cover under spouse’s employer’s plan $0

Single $4.500

EE & Children $7,500

EE & Sp $9,000

Full Family $12,000

Why?

Why should the first employee receive no incremental amount of employer financial support – she has the same family structure and is in the same situation as the individual who elected full family coverage, who got a total rewards bump of 30%!

Bottom line, expect to see fewer and fewer employers spend added money where the individual elects to cover her/his spouse/dependents. To that point, Ron’s example, Ginger, the grade school teacher, will likely become the “mode” at some date in the future (assuming the basic structure in PPACA remains unchanged).

Ron – It must be a different world down there in FL vs. up here in NJ and NY. Before Chris Christie was elected governor of NJ in 2009, most NJ teachers and police officers contributed nothing at all toward their health insurance premiums while the benefits package was extremely generous. After some legislative reforms Christie got through after becoming governor, these folks now pay 1.5% of their gross income toward the cost of their premiums which is still a relative pittance. In NYC, many of the city’s 300,000+ employees still pay nothing toward their health insurance premiums. I guess this is something that varies quite a lot around the country and partly accounts for why state and local taxes are so high in this area.

BenefitJack – I think most employers just don’t think along the lines you suggest. They don’t really care about equalizing compensation for similar employees but with different health insurance requirements. At my former employer, if you were covered under a spouse’s plan and waived participation in the company’s insurance plan, you received an extra $80 per month in your paycheck in exchange for waiving a benefit that would have cost the company at least $15K less about $1,500 in employee contributions. It makes no sense.

I wouldn’t be surprised to see more movement toward private exchanges, at least among large employers. Give employees a menu of choices from either one carrier or several carriers, provide a defined contribution which may be enough to cover the cost of the least expensive plan, and let them choose coverage that works best for them which may include adding their own funds to buy a more comprehensive plan or a broader network plan.

BenefitJack, Ginger is already the “mode” for school teachers coast to coast. Other county workers in Pasco County FL can get coverage on 2 children and the employee for “0” monthly premiums. Of course the taxpayers are paying through the nose to “non-profit” Blue Cross. The problem with the teachers is that there are too many of them. Ginger has to pay $16,812 to add 2 children to her PPO plan at school. Other Pasco County employees are still on the gravy train:

Employee + Child(ren) $0

https://fl-pascocounty.civicplus.com/DocumentCenter/View/17616

If Ginger was a teacher at the capital in Tallahassee her prices would be even more. The teacher is charged $2,768 annually for her coverage and $18,186.48 for her family plus the taxpayer is paying too.

http://flaglerschools.com/sites/default/files/attachments/1922/n2015-2016newinstructional22deductionsview.pdf#overlay-context=district/human-resources/benefits

If Ginger wanted to switch to the Exchange and get no tax benefits but much less premiums, she can’t because it’s not Open Enrollment. Don’t expect the newspapers to report that Blue Cross raised their premiums 22% on the teachers because the newspapers will NEVER report on their big non-profit advertiser – Blue Cross.

Blue Cross owns the Republican Party in Florida and they don’t really want to replace Obamacare because Blue Cross is raking in the dough.

Why should these large self funded plans get 100% tax write off when other Americans are being scammed? Then when an employee gets too sick to work these self funded plans just terminate their coverage and laugh all the way to the bank.

We should make employer-based health insurance illegal.

Ron, you state: “BenefitJack, Ginger is already the “mode” for school teachers coast to coast.” I recently completed consulting assignments in nearly half the states, and I can confirm that Florida is the exception, not the “mode” when it comes to teachers. Barry is much closer. Look, for example at the high profile stink caused in Wisconsin by Scott Walker – all about asking teachers to pay a modest portion of their health coverage costs.

Barry, you state: “BenefitJack – I think most employers just don’t think along the lines you suggest. They don’t really care about equalizing compensation for similar employees but with different health insurance requirements.” I agree that is not the norm today. But, the current structure and thought process dates back 30+ years – back to when health coverage was only a fraction of the total rewards cost it is today. At some point, this will become a burning platform – particularly once the Cadillac Tax starts to apply. The opt out incentive you mention is available only at a minority of employers – and, because of how PPACA prices affordability, expect to see such opt out financial incentives decline, not increase.

Barry, you also stated: “I wouldn’t be surprised to see more movement toward private exchanges, at least among large employers.” No, I don’t think so. Most jumbo employers have already experimented with multiple carriers – the private exchange concept only adds value in terms of decision-making, the employee’s selection of coverage. The trend you should expect is already starting – full replacement with HSA-qualifying “High Deductible” health plans, now available to almost 25% of larger employers even though it was only added to the tax code late in 2003. So, yes, the employer will target this plan for determining the cost sharing, but, the employees will be encouraged to accumulate assets to defray out of pocket expenses – versus a “buy up” to a lower deductible.

My former employer, an old line conservative company that is slow to change, moved it’s non-union people into a high deductible plan coupled with an HSA at the start of 2015. The union people, who account for 80% of the employees, are still resisting giving up their traditional very comprehensive, high cost coverage.

I think the minimum deductible that can be paired with an HSA is $1,300 for an individual under current IRS rules.

Barry, the example I listed with employees of El Paso County in Colorado have the employees with a $2,000 deductible with maximum Out-Of-Pocket of $8,000 for single coverage. This is larger than Obamacare allows.

Also, it says that the deductible counts towards the Out-Of-Pocket limit but the co-pays do not. So, an employee who spends some time in the hospital could end up paying more than $8,000! Somebody should bee line it to Colorado and tell these people they need to follow Federal Law!

Colorado people don’t follow the “Weed Law” either and it has the New Jersey Governor upset. Maybe the New Jersey Governor should say he will enforce Obamacare in Colorado if he becomes President, just to be consistent.

BenefitsJack, you can’t just dismiss these teacher costs by saying that this is only in Florida. Let’s go to Colorado and see what is happening to teachers there. In El Paso County Colorado the county employees pay $335 a month to insure their family:

http://adm.elpasoco.com/EmploymentBenefitsMedicalServices/Documents/2015%20Documents/2015%20Benefits%20Brochure.pdf

Now lets look at the teachers cost in the same COLORADO county. Teachers pay $1086 a month to add their families. Now don’t try and say that Colorado is an exception like Florida.

https://www.episd.org/benefits/docs/rates/2015-16_30_40_hour_assignment_rate_sheet.pdf

This is government employees charging their employees this much. America’s businesses are doing it too no matter what you are telling people in your travels. I talk to these poor citizens that are paying through the nose so I’m not as easy to convince that employers are paying the cost but an itty bitty little 1 1/2%

Ron, you state: “BenefitsJack, you can’t just dismiss these teacher costs by saying that this is only in Florida.” No, I was saying that in the 25 or so states where I have done benefits consulting for public school teachers, Florida is out of the mainstream. And, I fully understand the process – my wife is a school teacher.

Barry, right, $1,300 in 2015 and 2016, double that for other than self only tiers.

Ron, is the health plan in Colorado grandfathered? If it is, then the PPACA out of pocket expense maximum does not apply. Or as you state, they may not be in compliance. Or, the other option I have seen self-insured employers deploy is to leave the coverage unchanged, but, add a separate out of pocket expense maximum as required under PPACA – then apply the lower of the two amounts. Lots of twists and turns in PPACA.