Health Costs in Canada Increased 2.85 Times Faster Than Inflation in the Last Decade

New research from The Fraser Institute shows that health costs in Canada increased 53.3 percent since 2014. During the same period, consumer price inflation increased 18.7 percent and cash incomes rose only 34.7 percent. And the taxes taken to fund the single-payer system have risen significantly:

Health care in Canada is not “free.” Canadians often misunderstand the true cost of our public health care system. This occurs partly because Canadians do not incur direct expenses for their use of health care, and partly because Canadians cannot readily determine the value of their contribution to public health care insurance because there is no “dedicated” health insurance tax.

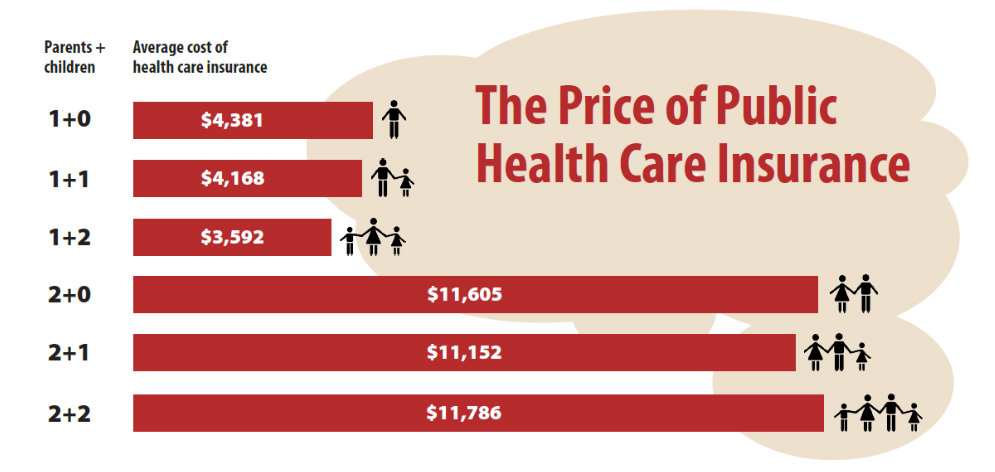

In 2014, the estimated average payment for public health care insurance ranges from $3,592 to $11,786 for six common Canadian family types, depending on the type of family. For the average Canadian family, between 2004 and 2014, the cost of public health care insurance increased about 1.5 times faster than average income, 1.3 times as fast as the cost of shelter, 1.6 times as fast as clothing, and more than three times as fast as food. The 10 percent of Canadian families with the lowest incomes will pay an average of about $523 for public health care insurance in 2014. The 10 percent of Canadian families who earn an average income of $57,818 will pay an average of $5,522 for public health care insurance and the families among the top 10 percent of income earners in Canada will pay $37,239.

“Canadians cannot readily determine the value of their contribution to public health care insurance because there is no “dedicated” health insurance tax.”

That’s definitely an issue. How can you just not know how much something is costing you?

That definitely seems problematic, to say the least.

“…the cost of public health care insurance increased about 1.5 times faster than average income, 1.3 times as fast as the cost of shelter, 1.6 times as fast as clothing, and more than three times as fast as food”

That sounds awful. But I wonder how it compares to the costs in the U.S.

We should have a post on that later today!

We have the same problem in the U.S. of a dedicated tax.

The term is irrelevant for taxes are paid in to the general fund of the Treasury.

They are dedicated only by virtue of an accounting entry in various trust funds.

This is why health insurance must be privatized, for real premiums go to real insurers who accumulate real reserves.

Don Levit

I think we here in the US often think of socialist healthcare systems as somehow being “free” as well. I mean we hear this all the time from single-payer apologists all the time. But, of course, Milton Friedman said there is no such thing as a free lunch.

Indeed, the people of Canada, the UK, and other countries with government-run healthcare pay for what they get, and pay dearly. Not only do they pay in taxes as this blog notes, but they also pay in longer wait times and poorer quality.

Here I thought Canada was getting a better deal than us…maybe not.

Why is health insurance more expensive for two people than two people with a child? Kids are expensive.

That is odd. Maybe it’s a weird incentive to have kids?

You see a big difference with one parent with two children as well. It just seems odd.

It’s probably some part of their safety net, especially the difference between one and two-parent households.

Especially since they are all exactly the same age, huh?

Health care will never be “free.” It’s just not going to happen. Less expensive, maybe. But there’s always a cost.

Does the 34.7 percent income increase reflect the income after-tax to pay for the healthcare?

You can see why Canada’s health care system is still very popular amongst most workers, and increasingly unpopular among the wealthier sector of the population.

Per the last sentence of the article, the top 10% of taxpayers in Canada pay $37,000 in taxes for health care.

In the USA, the top ten percent of taxpayers starts at an annual income of $113,799 (2010 numbers).

I can promise you with some confidence that almost no American taxpayer with a $114,000 annual income pays that much for health care.

A wealthy American pays at least half of the Medicare payroll tax, (if they are still working),

and another 5% of his income for Medicaid and Medicare Part II (through the federal income tax.)

That takes us to 8% of income or $9,103 a year for the Americans at the top.

The majority of persons with that kind of income either get employer coverage or are on Medicare.

So they are not paying anywhere NEAR $37,000 a year for health care.

Thanks for the post, John.

A fraction of wealthy taxpahyers

I think this is a problem in any democracy: The natural political momentum is to get the few to pay for the many. Then it becomes very hard to reform in the absence of crisis.

Too bad for Canadians: so close to the USSA and so far from Mexico, where good health care can be had for 1/3 the price Amerikans pay and where cash-paying customers don’t have to risk dying waiting for treatment.

This web site certainly has all of the info I wanted about this subject and didn’t know who to ask.

Feel free to surf to my web site; best online loans (http://paydayloans4usa.com)