GPS Tracker for Grandma

I was perusing a health news website and ran across an advertisement for SmartSole, a GPS insole tracking device. It’s developed for Alzheimer’s patients and those with cognitive impairment who make be at risk of wondering away from their caregivers.

I was perusing a health news website and ran across an advertisement for SmartSole, a GPS insole tracking device. It’s developed for Alzheimer’s patients and those with cognitive impairment who make be at risk of wondering away from their caregivers.

This is an example of the way technology can be harnessed to lower cost. Some nursing homes refuse to accept patients who are at high risk of running or wondering away. The alternative is locked-down, secure facilities that are more expensive and less convenient for family members. This type of technology could even be used in the future to help mom and dad could live independently while being monitored remotely.

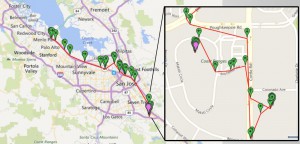

SmartSole allows someone to track the movements of Mom or Dad and have text messages sent if a predetermine parameter is met (like moving away from a given location by a specified distance). You can also pin point someone’s location and track their movements using a smart phone [see figure I]. The insole insert (similar to an orthopedic insole) is $299, while the ability to track the insole runs another $35 per month or $75 per quarter.

Come to think of it, I could have used one for an Airedale Terrier we used to own. Sadie McGee was a runner. Any open door or gate she would take off and go exploring on her own. One Saturday we were getting ready for an evening event while the dog was lounging outside. Then a perfect stranger – albeit a women from the neighborhood – walked right into our house with our dog on a leash. Our dog Sadie had found where I had left a gate unlocked and took off for a pond half a mile away. The neighbor lady had found Sadie ‘walking herself’ on a busy residential street.

Come to think of it, I could have used one for an Airedale Terrier we used to own. Sadie McGee was a runner. Any open door or gate she would take off and go exploring on her own. One Saturday we were getting ready for an evening event while the dog was lounging outside. Then a perfect stranger – albeit a women from the neighborhood – walked right into our house with our dog on a leash. Our dog Sadie had found where I had left a gate unlocked and took off for a pond half a mile away. The neighbor lady had found Sadie ‘walking herself’ on a busy residential street.

I’m thinking my wife might want to order one to track me when I wonder off while we’re at the grocery store and I get bored with her prolonged shopping in the produce aisle. Or maybe we can both have one for our next trip to Yosemite and she takes the wrong turn on the hiking path and we wind up lost after dark!

My father-in-law could not figure out which house was ours if he went outside. May he RIP.

My congressman Gus is on the health sub-committee which oversees Obamacare replacement. I met his health care aid on Saturday and blew him away with the POSITIVE way to explain Republican Health Care Reform with age-based tax credits. We have another town hall this Saturday and I have a time this Thursday to talk with the aid again before the town hall meeting.

I told the aid if one Republican politician could explain Republican Reform the rest of the sub-committee would repeat his stuff like a mockingbird. Stuff like age-based tax credits will lower the cost of Medicaid on healthy broke people.

Devon, if you have any suggestions let me know before Thursday at 11 AM.

I have already gave the aid this after Saturday’s meeting with 300 screaming Bernie supporters screaming Medicare for all:

A 50-year-old male in Tampa Bay can get the low-cost Short-Term-Medical (STM) PPO option with a $5,000 deductible then 100% coverage for just $194 a month. Medical underwriting is required.

I support Republican Reforms including age-based tax credits for the purchase of personal, portable and permanent Individual Medical (IM) insurance. A 50-year-old would get a $3,000 tax credit per year which would pay 100% of the cost for the above 50-year-old person. Unused tax credit is deposited into a tax-free HSA VISA card for 1st dollar coverage for medical, vision or dental expenses. In this example the HSA balance would be $672. Republican Health Care Reform will lift the cost of health insurance off the backs of American employers so the economy would soar. Republican Reform will make America great again!

What– by the amount of the tax credit? The same taxpayers will be paying either way. Except they would also be paying for healthy non-broke people.

Bart, you disappoint me. A $3,000 tax credit is cheaper than Medicaid which costs $5,000 more.

Bart, you say, “Except they would also be paying for healthy non-broke people.”

Bart, didn’t you know that multi-millionaires like healthy Megyn Kelly is not paying taxes on her health insurance? She isn’t paying income tax (36%) or payroll tax (15.3%) or a total of 51.3%. Trust me, a $3,000 tax credit is cheaper than the $15,000 that Kelly is getting now.

Bart, see why you disappoint me with your goofy answer? This is the NCPA where we have exclusive, in-depth analysis of health care policy.

How can you be so wrong Bart?

Do you really think a $3000 tax credit is going to replace Medicaid?

You don’t know what Kelly or any other employee is receiving in health insurance. You may know an employer’s average cost per employee, but that’s not even a good approximation of the value of any given individual employee’s benefit package. Assuming she is healthy, then half of that $15K is going to pay for Roger Ailes’s COBRA.

Bart, you are always wrong. Now you say, “You don’t know what Kelly or any other employee is receiving in health insurance.”

Here is a link to the cost of Pasco County school teachers’ insurance cost, $1,899 a month or $22,788 a year for the Blue Cross PPO.

I assume Megyn Kelly’s cost is more being in NYC with NBC.

read’em and weep

http://www.pasco.k12.fl.us/library/ebarm/benefits/rate_chart.pdf

Again, all this shows is the per-employee allocation that they call a “premium”. It’s community rated, and not even age-banded. It’s an accounting fiction that is meaningless when applied to any particular employee.

The only real premium is the aggregate value that the employer pays to the insurer (or to itself). Dividing it by the number of employees produces a figure that might be useful when comparing employers with differing numbers of “average” employees, but it’s meaningless as a measure of the value of a particular employee’s compensation package.

aggregate huh? So these teachers paying $1,350 a month out of their check is – as you say – meaningless.

That’s not their REAL premium? u think only aggregate premiums count?

u r a hoot Bart

Most of the pay deductions are for dependent coverage, which is a different story. For the employees themselves, most of the cost is not a payroll deduction.

…still, even with dependents, what they pay for out of payroll deductions and what they actually receive are two different things. An employee with healthy dependents might see $600 deducted from a paycheck for coverage he could find elsewhere for $350. If the tax break makes up the difference, it’s a wash. The remaining $250 taxpayer expense is not really going to this employee, it’s going to pay for some other employee’s premature infant.

We are able to track our cars and to some degree even our laundry. We are able to watch our homes no matter where in the world we are. We are now monitoring things and our health with smartphones and develping simple algorithms that tell us a lot of health information without much inconvenience. Alzheimer’s is the perfect place for this type of healthcare application. We could use a chip external or even internal to the body that can provide us with critical health information along with a location. One could even permit doors to automatically be locked or unlocked for those with such a chip. It could alert those in charge if such a patient end up outside of a certain parameter.

Think of how long ankle bracelets for prisoners have been used, ~30 years, and then consider why this use wasn’t extended to those with Alzheimers and the like long ago. That tells us that something is getting in the way of innovation.

Better yet, couple it with electronic dog collar functionality to keep them from wandering off in the first place.

Something I haven’t seen discussed is a virtual community. We have the technology to monitor people in the home. We could have cameras at certain places, a wristband, etc. But the one thing that is lacking is a sense of community. This is often a situation where there it is no longer a mom and dad. Rather, dad has died and mom is left behind. The adult offspring are too busy to have to be Mom’s entertainment for an hour every day. Facebook is fine. But there could be an app /web community that creates a virtual nursing home or retirement community of fellow shut-ins who want some camaraderie.

Devon, I think you are on the right path. What I noted from my practice was that government intervention seemed to make the families less reliant upon themselves and more reliant upon government which works out poorly.

About 10 years ago I attended a seminar in New York City about aging in place. A few years later there was a New York Times article that argued it would be cheaper (and better) for three people to move in together and hire around-the-clock home care than pay for a nursing home in New York State. It all made sense.

“less reliant upon themselves and more reliant upon government”

I think this probably explains what’s going on in people’s minds when they call 911 to complain about some store: e.g., calling 911 because McDonald’s didn’t get their order right, or their coffee isn’t hot enough.

https://www.youtube.com/watch?v=5Lgy3aquOrk

http://www.nbcnews.com/id/29498350/ns/us_news-weird_news/t/woman-has-meltdown-over-mcnuggets/

http://abcnews.go.com/US/story?id=7708146

https://www.reddit.com/r/AskReddit/comments/52to0o/911_operators_whats_the_dumbest_call_youve_ever/