Federal Health Reform and Stock Market Returns of Health Insurers

The major difference between the debate over health reform in 1993 and the one taking place over the last couple of years is the role of business interests in the health sector. In the 1993 debate over “Hillarycare,” a plurality of business interests collaborated to defeat President Clinton’s proposal. In 2009 and 2010, virtually every interest group rushed to get a seat at the table. Why? With the benefit of hindsight, the Patient Protection and Affordable Care Act (PPACA) signed in March 2010 was what soccer players call an “own goal,” a mistaken shot into one’s own net, which benefits the opposing team. Or maybe not: Evidence from the stock market suggests that health reform will benefit the health sector.

Let’s look at health insurers specifically. Currently, they are “suffering” from having to comply with effectively countless pages of new regulation generated by the March 2010 Patient Protection and Affordable Care Act (PPACA). However, in the years to come, they expect to benefit from many new covered lives, especially in the Health Benefits Exchanges that are scheduled to enroll people in 2014.

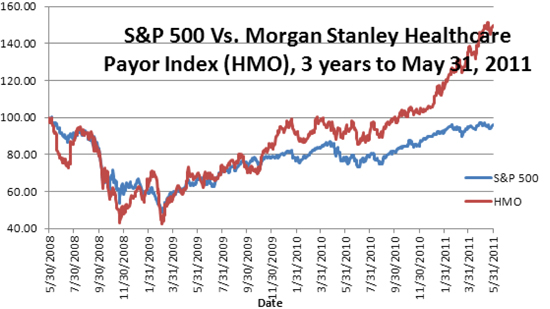

The figure graphs the level of Standard and Poor’s index of 500 stocks representative of the broad market (“S&P 500”) and the Morgan Stanley Healthcare Payors Index (“HMO”), an index of the 10 largest listed health plans, excluding dividends. Figure 1 covers the three years from the beginning of June 2008, to the end of May 2011, and includes two important dates: November 4, 2008 and November 2, 2010, the dates of the two most recent national elections.

Health insurers appear to have benefitted from PPACA. The total return of the S&P 500 over the three-year period was minus 4 percent versus plus 40 percent for HMO.

Table 1 shows measurements of performance for the entire period, as well as the three sub-periods defined by the two elections. The annualized return of the S&P 500 over the entire period was minus 1.34 percent versus plus 13.41 percent for the HMO index. When we look at the three sub-periods, the tale is even more discomforting. For the 110 trading days leading up to the 2008 election, HMO significantly underperformed the S&P 500: Minus 110 percent versus only minus 76 percent, annualized. The HMO index’s outperformance occurred subsequent to President Obama’s election.

During the two years between the two elections, the HMO index significantly outperformed the broader index: Plus 26 percent versus plus 9 percent, for an annualized outperformance of 17 percent. This was the period when President Obama’s faction was at the height of its power, driving the hyper-partisan PPACA through a Congress with a very weak opposition. For the period since the 2010 election, we see that HMO has continued to outperform at an even faster rate: 65 percent versus 21 percent, for an annualized outperformance of 44 percent.

Although HMO is slightly more volatile than the S&P 500, standard measures of portfolio performance make clear that HMO outperformed the S&P 500 for the entire period and the two latter periods on a risk-adjusted basis. (See here for an article describing the entire financial analysis.)

With respect to the post-2010 election period, it is hardly likely that the stock market is discounting the repeal of PPACA into stock prices. If that were the case, outperformance over the last six months would have been preceded by significant underperformance in the previous two years. Furthermore, none of these health plans is openly agitating for repeal of PPACA. The most likely explanation for health plans’ stock performance is that investors saw PPACA itself as a boon for health plans. Also, investors likely do not believe that Republicans will eventually repeal it, but instead exercise even less oversight and give health plans more favors than a single-party Democratic federal government would. In other words, investors likely expect that PPACA will evolve into a bipartisan reality that will increase health plans’ profits, despite current political rhetoric.

For PPACA’s opponents, this is sobering news.

Looks like they’re making out like bandits.

I cannot help but wonder what the index will look like after the guaranteed issue regulations go into effect.

McKinsey’s survey of employers suggests many understand that it will be advantageous to drop coverage. That would hurt some health insurance companies while benefiting other insurers. Still, it is interesting how the index so closely tracked the S&P 500 until just recently.

Ditto Ken.

I guess the stock market is telling us that the insurance companies gained from health reform. At least the HMOs. I think the fee-for-service companies are not going to make it.

Out of curiosity, how did the pharmaceutical companies do?

Guaranteed issue, community rating, employers dropping coverage, minimum loss ratios, added benefits — none of that matters a whit in this argument. Insurers are securing a government-sanctioned oligopoly with only 4 or 5 players maximum. Combine that with a requirement that people are mandated to buy what they sell and you have guaranteed profitability forever. It’s like buying T-bills but with a much greater rate of return. There is zero down-side risk.

Therefore investors will vehemently oppose repeal.