Employer-Based Health Insurance Costs Up 3 Percent, Share of Covered Workers in High-Deductible Health Plans Steady

The annual Kaiser Family Foundation/Health Research Education Trust Employer Health Benefits Survey has been released. As many expected, the increase in employer-based health costs from 2013 to 2014 was moderate:

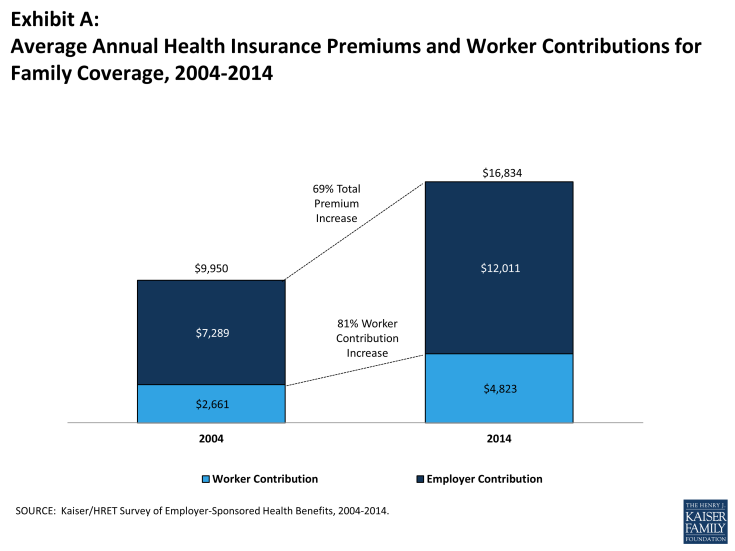

In 2014, the average annual premiums for employer-sponsored health insurance are $6,025 for single coverage and $16,834 for family coverage. The average family premium rose 3% over the 2013 average premium. Single coverage premiums rose 2% in 2014 but are not statistically different than the 2013 premium amounts. During the same period, workers’ wages increased 2.3% and inflation increased 2%. Over the last ten years, the average premium for family coverage has increased 69% (Exhibit A). Premiums have increased less quickly over the last five years (2009 to 2014), than the preceding five year period (2004 to 2009) (26% vs. 34%).

The moderate growth in premiums has continued for five years. Interestingly, that is within the period when high-deductible, consumer-driven health plans started to grab market share in employer-based plans. The share of covered workers in such plans rose rapidly from 4 percent in 2006 to 17 percent in 2011. However, update appears to have stalled at 20 percent in both 2013 and 2014. If consumer-drive plans can only penetrate 20 percent of the employer-based workforce, employers are missing a significant opportunity to allow workers a say in how they spend their health dollars.

When it comes to small firms, it is hard to tell whether Obamacare has yet caused the meltdown in employer-based coverage anticipated by many. Among firms with 3 to 9 employees, 50 percent offered benefits in 2008, the first full year of the Great Recession. The proportion jumped to 59 percent in 2010, but this looks like an outlier. It’s down to 44 percent in 2014. The degree to which that drop is due to Obamacare, versus the anemic recovery, cannot be determined (although other evidence suggests Obamacare has a big role to play.)

Further, this year’s survey breaks down premiums for private and government employers (exhibits 1.5 and 1.6). I have previously noted other evidence that government-workers’ benefits are much richer than private workers’, and this confirms it, but with a twist. Benefits at private non-profit firms are much more expensive than at government or for-profit employers. Family coverage private, non-profit employers costs $18,423 — 6 percent more than government employers’ benefits and 14 percent more than for-profit employers’ benefits.

I am unaware of an economic theory that predicts this. Readers know that I like to blame hospitals whenever I get a chance. So, I tentatively conclude that hospitals (and universities) dominate the private non-profit employers, and their employees also use medical services more than other workers do. Or, employees at hospitals and universities might simply prefer to take a higher share of their compensation as non-taxable health benefits rather than taxable wages. If they are more generally risk-averse than workers in the for-profit sector, that is a credible explanation.

Being up only 3% is good news. Of course, part of the reason is skimpier benefits. But, if the health plan is a high-deductible plan coupled with an HSA, that’s still good news. What people often don’t realize is that fringe benefits are merely in lieu of cash take-home pay. A health plan is part of total compensation. If a young, unionized manufacturing worker get a lavish health plan, he assumes it’s a good deal. What he fails to appreciate is that it directly reduces take-home pay. He (or she) is basically forgoing cash wages so his older coworkers get a cross-subsidy.

The employer tax break should offset much of the cross-subsidy.

With family costs at over $16,000 a year just for premiums, throw in co-pays, co-insurance, and deductibles, you could be looking at $20,000 in costs for the average family per year.

That could be a mortgage payment.

Relief will be coming soon, first in Texas, with many other states to follow.

Over time, these premiums will be significantly reduced.

Once we get to the Exchanges, so will those outlandish subsidies!

Don Levit,CLU,ChFC

Managing Partner

National Prosperity Life and health

Yes, we will start in Texas. The process has taken several weeks longer than they told us it would take after we first sat down with the Texas Dept. of Insurance.

We are waiting from the call from TDI to our actuary to say, “You are approved!”

Once we get Texas’ approval, many other states should follow in line as they all use similar NAIC guidelines.

I know that state and city employees have horrendous premiums.

Your data from the Exchanges was quite illuminating.

Only $4 a month for a 64 year old!

What that tells me is two things:

1. The premium is outlandishly low

2. The subsidy is outlandishly high.

These subsidies are probably higher than the employer tax exclusion for the average person.

We simply cannot afford everyone to exit to the Exchanges. The subsidies will seriously crimp our bloated budget.

I understand your opposition to group health insurance. It is only a temporary option. Our plan will have a conversion option in lieu of COBRA, saving the employer many claims dollars.

Don Levit

Ron, this does not detract from your arguments, but just for my education, how can a health plan cost $26,000 a year per family in a midwestern state?

I was once on a school board, and here is what drove our health insurance premiums that high: (also in the Midwest)

a. seniority systems — most employees were over 50 years old

b. cancer claims

c. keeping early retirees on the plan

d. paying for every drug known to man

I would have no problem with the whole faculty going onto the exchanges.

But that is not so easy to do with over 50 employees.

Comments welcome!

Ron this is all very interesting, but I don’t see where your comments about insurance are relevant to the high cost of medical care in the US.

I’ve felt for many years that medical insurance is expensive because medical care is expensive. . . and that medical insurance premiums rise because the cost of medical care rises.

If medical insurance is at the root of the cost problem, why has the cost of original Medicare (parts A and B) been rising? Original Medicare is not insured but self-funds it’s members’ benefits; it does not pay premiums to insurers, so how can “high insurance premiums” be driving original Medicare cost? (For that matter if “insurance” is the problem, why have life insurance premiums dropped by so much over the past 20 years or so?)

Seems to me “medical insurance” is means of makes it even more difficult to feel like an Australian,passing along medical costs, and not the source of medical costs. Insurance probably stimulates some medical cost by subsidizing it, but that’s still not the fundamental cost problem.

In fact that’s why I think Obama care is bound to fail – it’s a contraption that fiddles around with insurance subsidies while ignoring the underlying cost-driver which is medical care itself.

So i don’t see how your comments about insurance apply to the high cost of medical care in the US.

“Seems to me “medical insurance” is means of makes it even more difficult to feel like an Australian,passing along medical costs, and not the source of medical costs. Insurance probably stimulates some medical cost by subsidizing it, but that’s still not the fundamental cost problem.”

Well that’s gibberish.

Try this instead:

Seems to me “medical insurance” is a means of passing along medical costs, and not the source of medical costs. Insurance probably stimulates some medical cost by subsidizing it, but that’s not the fundamental reason that medical costs are high. Insurance probably stimulates some medical cost by subsidizing it, but that’s still not the fundamental cost problem.

“John, how much does health insurance cost in Australia”

I think my point is pretty clear – that medical costs drive medical insurance premiums. If I’m correct that would be true in the US or in Australia or wherever. Your response mystifies me – are you agreeing with me?

If so, thank you.

If not I don’t understand your latest Q above, and I still don’t understand your prior comments as I stated before.