Obamacare Coverage 10 Percent Less Expensive Than Job-Based Benefits

Scholars at the Urban Institute, staunch defenders of Obamacare, have previously struggled to find ways to report Obamacare’s good news by pointing out “there is no meaningful national average” of premium hikes. More recently, they have concluded that Obamacare coverage is 10 percent less expensive than employer-based coverage.

Scholars at the Urban Institute, staunch defenders of Obamacare, have previously struggled to find ways to report Obamacare’s good news by pointing out “there is no meaningful national average” of premium hikes. More recently, they have concluded that Obamacare coverage is 10 percent less expensive than employer-based coverage.

Comparing average employer-based premiums to the second-lowest cost Silver benchmark Obamacare plans, the Urban Institute scholars found lower Obamacare premiums in 38 states plus Washington, DC. These are the unsubsidized Obamacare premiums, adjusted for age, actuarial value, and utilization associated with actuarial value.

What to make of this finding?

“Actuarial value” and “utilization” refer to Obamacare plans indemnifying fewer costs than employer-based plans. They have higher premiums, co-insurance, and co-pays. Premiums will be lower for such plans because a higher share of costs are paid directly by patients and not third-party insurers. Further, those with higher direct spending will consume fewer health resources, are more likely to seek less expensive services, et cetera. So, the Urban Institute scholars grossed up Obamacare premiums by 18 percent to adjust for these effects.

After this adjustment, Obamacare premiums were 10 percent less expensive. Before praising the study, let me quibble with two issues. First, there needs to be another adjustment because comparing unsubsidized Obamacare premiums to actual employer-based premiums misses the fact that 85 percent of Obamacare beneficiaries receive tax credits subsidizing coverage while 100 percent of beneficiaries of employer-based plans pay premiums with pre-tax dollars, excluded from their household taxable income. These are two very different tax treatments. Net premiums after including these effects is more interesting than the gross premium before the tax benefits. However, such a comparison would be dauntingly hard to estimate.

Second (and related), there is an income effect that invites adjustment. The tax shield of employer-based benefits is biased towards high-earning employees with high marginal income-tax rates. So, many lower-earning employees have more health benefits than they would prefer. They would rather take home higher wages. However, the employer-based system denies them this choice.

Although Americans are right to criticize Obamacare, The Urban Institute’s latest study raises an important question about the status quo: Why do we allow employers to make our choice of health plan, which results in higher premiums?

Employer based benefits are part of an employees compensation package so in actuality employees are paying 100% of the cost. Why would an employee pay 100% of the cost of something they had no choice in designing and were only renting from the employer? Employer based benifits have been a drag on the U.S. Economy for decades.

Why didn’t NAFTA work. Well what other country in North America besides the U.S. Mandates Health insurance, FICA, Suda,Fuda, workmans comp all be paid through an employer? Let’s have U.S. Business start out with a $15,000 per employee labor cost deficit compared to other countries and compete with them in aglobal market. Pure genius!

To quote the next Clinton to be impeached “it’s about time businesses pay there fair share “

Trump is LIVE on TV here in Florida saying the FBI is ready to body slam crooked Hillary. Hillary’s jumpsuits will soon have prison stripes on them.

So Hillary is done — AMEN!

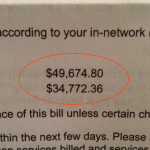

John, this is a perfect example on how over-priced employer-based health insurance is. It’s a crime. The system is rigged by tax law. The employer-based health insurance companies have killed their own industry because they will die when we repeal Obamacare.

The American economy will soar when we finally put employer-based health insurance down like the rabid dog that it is.

Long live President Trump!

100% less the tax exclusion, on average, so more like 50% if you include state taxes.

I’ve been arguing that young healthy employees are paying closer to 100% of the full value of their coverage– in some cases likely over 100%– while more expensive employees benefit from the effective tax subsidy as well as the cross-subsidy from low-cost employees. So relative to services received, high-cost employees may be paying 25% or less.

But one could argue that high-cost employees willingly settle for lower compensation in exchange for under-priced benefits, so effectively they are paying closer to 100%.

I’m sure this is partially true, but only partially. At the outer bounds, I don’t think it’s even possible for the highest-cost employees to pay 100%, even if they were to work for benefits only. On the other hand I doubt that healthy employees ever pay much less than 100%. I suppose this means that when all employees are healthy, the employer pockets most of the tax exclusion.

Team Trump has a new TV commercial featuring Crooked Hillary and Pervert Anthony Weiner – too funny!

30-seconds long – enjoy

https://www.youtube.com/watch?v=k-n102EAYPA&feature=youtu.be

Let me build on this article with a broad brush general picture of American health insurance.

1. Senior citizens are massively subsidized. They get essentially an $11,000 Medicare policy for $120 a montn, their cost for Part B unless they have a very high income.

2. The poor are massively subsidized. In 31 states,nearly all the poor get a $5,000 Medicaid policy for free. In 19 states, mothers on welfare get this policy, but not poor single adults.

3. Government employees are massively subsidized, with some still getting free health insurance, and some getting it after generous early retirement.

4. About 60 per cent of corporate employees are subsidized to varying degrees.

5. The working poor are massively subsidized inside the ACA.

This leaves one group of persons who are expected to pay their health insurance premiums in cold hard cash.

Namely the middle class and upper middle class who do not have employer coverage.

At this point, I am not opposed to giving this last group a break. Some Democrats have proposed a kind of ‘circuit breaker’ subsidy, where no one has to pay more than to 10 per cent of their income for health insurance.

In other words, a person making $60,000 would not have to pay more than $4,800 a year (8%) for health insurance. If the insurance company premium was $800 a month, which is happening at older ages now, this person would get a $400 monthly subsidy.

The Urban Institute thinks this would cost about $10 billion a year in extra subsidies. Gosh, we spend $10 billion every 5 days or so on Medicare, let’s give people under 65 a break.

Employer risk pools tend to be healthy because if you are healthy enough to work you are probably a better risk than those too unhealthy to work. Young, healthy employees cannot be charged more than older, less healthy workers. But in the individual insurance market, Obamacare is not trying to push the same cross subsidies employed in the employer market. This means people who are self employed are subsidizing people who are too sick to work. The notion that Obamacare costs more or less than employer coverage ignored both are managed by the same insurance companies. It all about who lands in your risk pool.