CPI: Health Insurance Premiums Jump Amid General Deflation

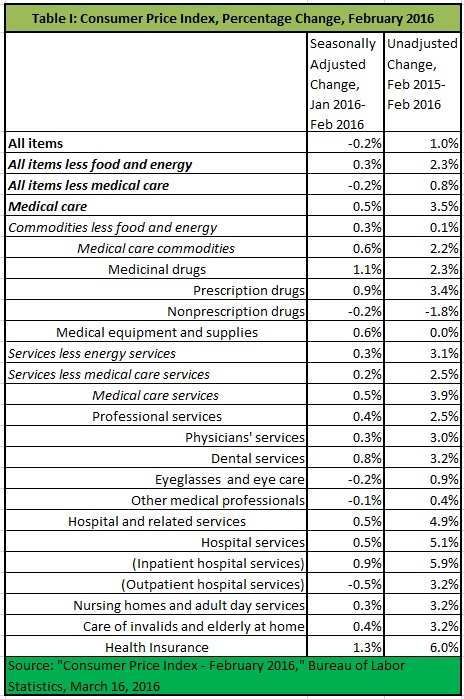

This morning’s Consumer Price Index corroborates yesterday’s Producer Price Index, which indicated health insurance and certain other health prices increased in a generally deflationary environment. While the CPI for all items dropped 0.2 percent in February, health insurance increased 1.3 percent. Over the last twelve months, CPI has increased just 1.0 percent, while health insurance has increased 6.0 percent.

This morning’s Consumer Price Index corroborates yesterday’s Producer Price Index, which indicated health insurance and certain other health prices increased in a generally deflationary environment. While the CPI for all items dropped 0.2 percent in February, health insurance increased 1.3 percent. Over the last twelve months, CPI has increased just 1.0 percent, while health insurance has increased 6.0 percent.

Prescription drugs continue to stand out, as well, having increased 0.9 percent last month and 3.4 percent over twelve months. However, the increase in prescription prices alone cannot explain the health insurance premium hikes.

Inpatient hospitals services also stand out, having increased 0.6 percent last month and 4.8 percent in the last twelve months. Outpatient services are only slightly better.

February’s CPI confirms that, while nominal increases in health prices are moderate, real price increases are quite high, because we are in a generally deflationary environment.

(See Table I below the fold.)

Of course, the increases alone don’t explain the premium rate increases. This is a static set of services. Increased utilization or change in mix of services is not considered. It has little correlation with premiums.

Thank you. In a normal market I would agree with you. But in a normal market price increases send a signal to consumers. Not so in health are.

John, here is an example this morning on employer-based health insurance terminating their cancer patients. This is a nurse who gets cancer:

—I was diagnosed [with cancer] on April 18 of 2014 and lost my insurance on April 30. It took me having to go on Obamacare to accept the diagnosis of cancer, and having to go on food stamps because cancer made me poor. I was very anti-Obama when he was elected, but I give him full credit for saving my life because of Obamacare.—

You are good with numbers John so you should estimate how many people have died because of employer-based health insurance in the USA since 1945 because their health insurance was terminated by their employer after they became too sick to work 30 hours per week.

Remember, one sick woman dying is a tragedy but millions dying is just a statistic.

http://www.cosmopolitan.com/politics/a55344/pro-life-abortion-nurse/

The limited information is confusing. Was she already on COBRA which expired on April 30?

Anyway, I agree: Employer-based benefits are for healthy people. It would be good research to make a statistically significant estimate of the question you raise.

John, help me out here and perhaps go into more detail. If I read you correctly you say that health insurance in February increased more than it should have and therefore there is no explanation for health insurance premium hikes. Health insurance covers an entire year and it seems that your numbers are only covering the month of February so I would think that insurers have to guess 12 months in advance. Would this unaccounted for difference tell us that healthcare costs are on the increase?

Maybe these insurers wait till after Jan, 31st to increase premiums because the consumer is trapped and cannot switch because they are out of Open Enrollment.

It’s like the government rides shotgun and protects these insurance companies as they take advantage of America’s consumers. The Godfather is in control of these politicians.

It’s FEBRUARY – it’s health insurance increase season!!

Well, health insurance is a bigger basket than just the plans we are usually thinking of. There is also short-term medical and other coverage. So, I cannot draw too precise a conclusion.

I don’t give much credibility to any of this month to month data but I do give more credibility to the longer term trends. For example, I’ve always thought that my own family’s spending excluding gifts to family members and charitable contributions tracked the CPI pretty well over time though the composition of spending has changed over time.

1974 was the first full year my wife and I lived in the house that we still live in. It was just the two of us living here then as it is now. From 1974 to the present, the general price level increased 4.81 times or to 481 as an index number vs. a base of 100 in 1974. We had a mortgage payment then but don’t now. Our 2015 spending expressed as an index vs. 1974 was as follows: Total spending excluding gifts to family members and charitable contributions which are strictly voluntary: 441; property taxes, 591; car insurance, 333 (estimated); electricity, 435; natural gas for heating and air conditioning; 290. Health insurance cost was zero in 1974 as my employer required no contribution at the time. In 2015, our total outlay for the standard Medicare Part B premium, our supplemental and Part D plans, the IRMAA surcharge and long term care insurance was 21% of our base spending yet total spending rose slightly less than general inflation over that 41 year period. Go figure.

With respect to health insurance premiums specifically, it should be noted that the 2017 premiums for ACA exchange plans will be set around the middle of 2016 as there is a long lead time for filing rates with regulators. So far, most insurers are losing money on exchange plans. We’ll have to wait and see how many insurers even offer to participate in the exchanges next year and what their premiums will be if they choose to stay in the market. We’ll know soon enough.

Barry, you say, “So far, most insurers are losing money on exchange plans.”

The cash cow for the insurance companies are their group plans and not the individual products in Obamacare. The goal with Obamacare was to increase the cost of Individual insurance so it would stop stripping employer-based plans of participants. Mission accomplished but it doesn’t stop there.

I heard someone saying that Blue Cross of Texas is paying below Medicare to medical providers on their Exchange plans. The problem with Obamacare consumers is — the sick ones. The insurance companies think that healthy people only care about price and not medical providers. They also know that sick people have been educated to know that a large list of medical providers is extremely important and not just price.

So, if you are an insurance company wanting only the healthy consumers the best idea is to have a smaller premium with very skinny networks to scare away the sick people. The poor citizens are caught in the middle and the quality of their health insurance is dropping like a rock.

YOU are correct Barry that when an insurance company gets a sick consumer the best way to deal with this liability is terrible customer service and very nice “navigators” to switch them to another company during the next Open Enrollment. This is what happens when we replace the rule of law and let corrupt central planners from DC call all of the shots. We are becoming a banana republic.

Carriers pricing a higher Rx trend for 2016 than expected in 2013-2014 is undoubtedly a factor. WRT to the exchange, we are seeing rational consumption. Group insurance (still the bread and butter for carriers) contributions (up to 100% for single enrollment at some employers, usually between 50-80) are the only proven way to create an insurance pool with healthy spread. Medical/Rx premiums (even min. value HDHPs) stripped of contributions: be it COBRA, the exchange or retail are not affordable products for working individuals. Individuals enrolled in those markets are not purchasing insurance, they are purchasing financial aid for the biggest expense in their life. “The problem with Obamacare consumers is — the sick ones.” because their consumption is rational. They win the P/L game that can only be won if you are – wait for it – sick. We may not be rational consumers when it comes to extra rounds of Candy Crush, but when you are dealing with premiums that can compete with a rent payment… I think we can go back to the fundamentals.

Thank you. In a normal market I would agree with you. But in a normal market price increases send a signal to consumers. plafar

Absolutely!