Consumer-Driven Plans Continue to Grow

Consumer-driven health plans seized five more points of market share in the employer-based benefits market, according to Mercer’s latest report:

- Mercer survey finds average total health benefit cost per employee rose 3.9% in 2014;

- Enrollment in high-deductible, consumer-directed health plans (CDHPs) jumps from 18% to 23% of all covered employees following a surge of new implementations;

- Nearly half of large employers (48%) now offer a CDHP, up from 39%;

- Private exchanges used by 3% of large employers, with 28% likely to make the shift within five years.

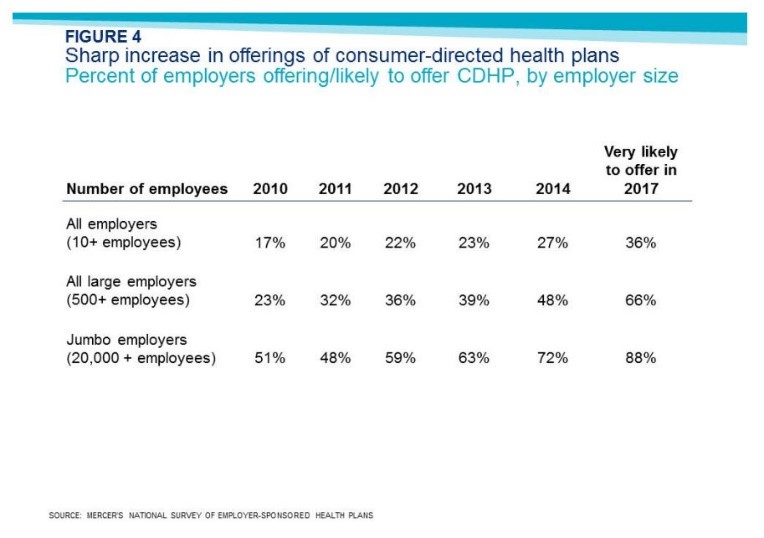

Figure 4 shows that consumer-driven plans are poised to continue their growth. The growth of private exchanges is also good news.

How much more participation do we need before there is sufficient critical mass to demand price and quality transparency to enable patients to identify the most cost-effective high quality providers in real time and direct their business to them?

Has anyone tried to get a binding estimate of even their out-of-pocket costs from a hospital lately?

Barry, the problem is people with high-deductibles aren’t asking tough questions inside the hospital. They ask about the cost of a CT scan or an MRI. They ask if they really need a costly lab test. They ask for a generic drug. But once inside the hospital they have long since blown through their deductible.

In California, CalPERS identified high-quality, lower-cost hospitals that performed joint replacements for $30,000. CalPERS set the reference price at $30,000. CalPERS (or maybe Wellpoint) communicated this fact to the doctors, hospitals and the enrollees that enrollees were responsible for costs above the reference price. This was a way to make patients price sensitive above their deductibles. But, it took the assistance of the health plan. More health plans now assist enrollees with pricing information. But health plans need to do more.

Perhaps the next thing will be a logarithmic copay schedule. So when your spending for the year passes $10,000, your copay for incremental expenditures is 10 percent. At $100K, the copay is 1 percent, and at $1M, 0.1 percent.

This would effectively replace the out-of-pocket cap, and would maintain skin-in-the-game regardless of medical costs.

On the one hand, patients have little discretion when they enter the hospital. On the other hand, we will never get a handle on high medical costs until we tackle hospital costs. When patients are on the hook for hospital bills, hospitals will bargain. When insurers are on the hook for hospital bills, hospitals will nickel and dime the payers to maximize revenue against the reimbursement formula. This is not bashing hospitals. It’s rational activity when the consumer of a service is insensitive to price; the payer is not the same entity as the consumer of a service.

When I was a baby I spent around two months in the hospital. My bill (back in the 1960s) was around $2,500. In today’s dollars that would be between $15,000 to $20,000. But, then again, today my charges would have been $15,000 to $20,000 per day (with better technology).

I can’t believe patients will be better bargainers than insurance companies. But both patients and insurers should be better than either alone.

My parents saved my appendectomy bill from 1964 — around $230. I still remember the smell of ether.

I’d rather have an apple in front of me than a frontal appendectomy!

“Frontal lobotomy” BTJ, not appendectomy.