Consumer Driven Health Care Gets Messy: That’s the Good News

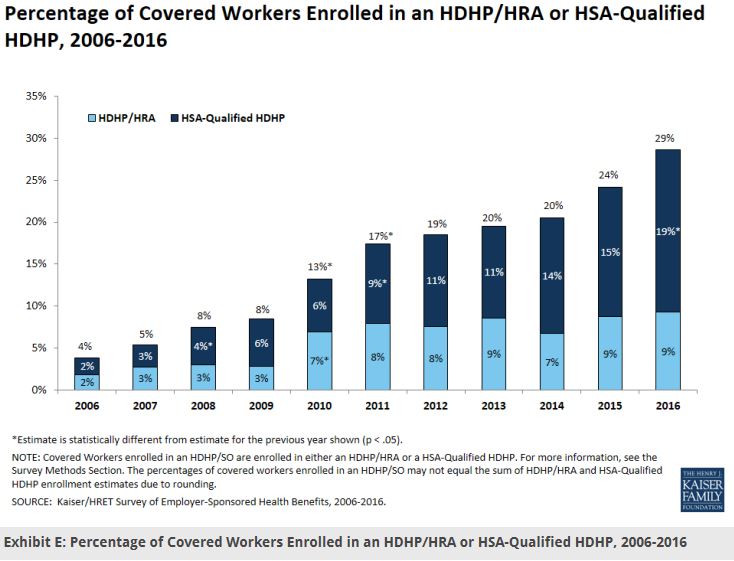

According to a new health benefits survey by the Kaiser Family Foundation, premiums for employer coverage rose only about 3% in 2016. The low increase was due to rising deductibles. A slight majority (51%) of workers have a deductible of $1,000 or more. Two-thirds of workers in small firms do, while slightly less than half of large firm workers (45%) are covered by $1,000 or higher deductible. About 10 years ago, only 4% of workers were enrolled in a high-deductible plan with a savings component. Now, nearly one-third are. [See the figure.]

An insurance executive claims premiums fall about 20 percent when employers move from a $200 deductible to a $1,000 deductible. That’s a huge savings. What especially makes it nice is families may have the potential to sock money away in a health savings account (HSA) if moving from, say, a $400 deductible to a $1,400 deductible. Under such an arrangement most families would be better off.

An insurance executive claims premiums fall about 20 percent when employers move from a $200 deductible to a $1,000 deductible. That’s a huge savings. What especially makes it nice is families may have the potential to sock money away in a health savings account (HSA) if moving from, say, a $400 deductible to a $1,400 deductible. Under such an arrangement most families would be better off.

Although many people lament the plight of workers who must cough up $1,000 or more before benefits kick in, the trend is actually good news. As a society, we will never be able to slow the rise in health costs until millions more people ask uncomfortable question of their doctor: “ Doctor, do I really need that MRI? What will that cost? Can we wait and see if I get better on my own?” As the New York Times adeptly pointed out:

“People who have to pay the full cost of magnetic resonance imaging on their knee, for example, might be more likely to shop around and pick the $500 one instead of the $3,000 one. Perhaps, they’ll decide to give their minor knee pain two weeks to see if it gets better on its own, and skip the M.R.I. The hospital offering the $3,000 M.R.I. might lose enough business that it will lower its price.”

Doctors are having to figure out how to collect from patients who don’t have an extra $1,000 in cash laying around collecting dust. According to Modern Healthcare, hospitals are adapting to life when many of their customers are becoming price sensitive because they have high deductible plans (e.g. Bronze plans).

“Some hospitals and health systems are starting to review and revise their prices to make themselves more attractive to individual consumers who increasingly experience sticker shock when they pay for services out of pocket under high-deductible health plans.”

“These efforts are at least partly driven by the growing prevalence of high-deductible plans, which prod consumers to shop around for the best price. Prices for office visits, diagnostic imaging, obstetric ultrasounds, colonoscopies and physical therapy — services that consumers increasingly must pay for themselves — especially are coming under the microscope.”

The stocks of for profit insurers are even taking a hit as customers who used to owe only a couple hundred are on the hook for the equivalent of a used car. As it turns out, doctors and hospitals are increasingly discovering, they are in the retail medical business rather than the wholesale business where they get paid for all the services they sell to price-insensitive customers.

This is what I sometime refer to as medical care in the Bronze Age. It is a necessary condition. Only when 150 million people with employer coverage (and another 150 million people with public coverage or individual coverage) begin asking tough questions and comparing prices for medical services will providers’ prices become transparent and doctors and hospitals begin to compete on price, quality and other amenities.

Devon, you write, “families may have the potential to sock money away in a health savings account (HAS) if moving from, say, a $400 deductible to a $1,400 deductible.”

We never had that problem with Medical Savings Accounts (MAS) if you remember. I kept getting prospects saying that the only information they could find was the Muslim Student Association (MSA).

People paying the premium are more realistic about deductibles. If you are paying the premium you would not pay $3,000 a year more in premium to lower your deductible $800 because that would be stupid. But, an employee who has their employer paying the premium will insist on the smaller deductible because they don’t care about premium.

Hillary said, “No, No, No, MSAs put too much money in the private sector!”

To be fair to your readers, you should indicate how much a consumer would save if his deductible were 100% (meaning no insurance at all). The fact that the “loss-ratio” under Obamacare is 80% implies that the uninsured could save 0.20 x $3444 (average annual premium for an individual) = $688 per year once Obamacare dies off. Of course, the young, healthy, single, childfree male could save a hell of a lot more.

For the average person paying the average premium, their savings from no insurance would probably amount to $3,000 or more. For that matter, that savings would apply to about 80% of the people. But a handful of people would lose $10,000 to $20,000.

As more people are exposed to higher deductibles, they will become more price sensitive at least for care that is shopable like imaging that can be scheduled in advance. Even more importantly, as these patients become a higher percentage of doctors’ patient panels, they will start to perceive knowing and caring about costs is now part of their job whereas they didn’t think it was in the past unless the patient specifically brought the subject up.

As for collecting patient deductibles and copays, one of my physician practices, which I’ve been going to for over 40 years, asked me for credit card information so they could have it on file. That’s the first time I’ve ever been asked for such information by any doctor I ever visited. As more patients can’t or won’t pay the part of the bill that they are responsible for, this seems like a reasonable strategy to reduce bad debt and uncompensated care.

I agree. I’ve had doctors help me save money when they discovered I have a high deductible plan. It was much appreciated. As more people ask about cost, cost will become an issue doctors are always aware of.

One of the links in my post discusses physician office strategies to collect fees. That is one of them. However, on some level I am a little uncomfortable with the idea of my doctor saying “hey, let me keep your credit card on file so I can charge it at will.” I don’t even like Amazon and other vendors to do that for security reasons. But also, very few other areas of commerce (except Amazon and online vendors) ask to retain my credit card. I’m expected to produce it at the time of service. Granted, some professionals require a retainer from which they draw for major projects. The end goal is to get to the point patients are price sensitive, and doctors compete for patients patronage by providing good value. I’m a little concerned that keeping a credit card on file is just another attempt to keep the status quo.

While I understand the motivation, I wasn’t happy or comfortable about providing the credit card information either.

I don’t think people are permitted to bill a credit card on file in advance. If you note Amazon asks what credit card you will be using. They are asking for permission first.

Some are not happy about providing their credit card information to a doctors office, but they will provide that same card everywhere else where it can be similarly and more often misused.

Maybe it is time for patients to pay for the service before it is given out since everyone has their opinion of how physicians ought to carry out their business affairs. If one walks out of Tiffany’s without paying for that 4 carrot diamond they are arrested at the door.

Instead of a credit card to oay deductibes with interest rates of 20 oercent or more, consider this

A $10,000 deductible is tough to pay at once

But paying 16 percent of $10,000 is much more doable

Doing so for 36 months means you pay 48 percent of the deductible and we pay 52 percent

That beats a $10,000 credit charge at 24 percent interest

Incredible what happens by breaking down an unmanageable obstacle into manageable parts – success!

Don, if the consumer paid 24% and you paid 76% would be much better than you only paying 48%, you tight-wad. Why do you want to keep so much money?

Incredible what happens by getting Don Levit to pay your deductible in his so-called manageable parts – MORE success!