Competition in Health Insurance: What Should Government Do?

Many Americans complain that there is too little competition between health plans. To some degree, this is true. Few of us are allowed to choose our own health insurance. Instead, we take whatever our employers offer us. However, we must not succumb to the natural temptation to call for more government intervention to reverse this problem. On the contrary, concentration among health plans has largely occurred subsequent to government action.

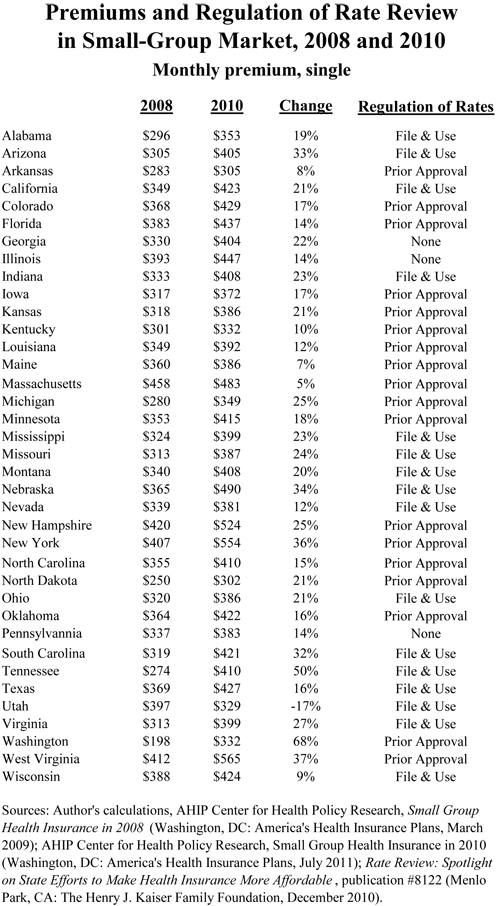

Signed in March 2010, ObamaCare has certainly had the opposite effect than that promoted by its advocates. The table below shows premiums in the small-group market in 2008 and 2010, for 37 states with available data.

In only one state, Utah, did premiums for single coverage in the small-group market drop — by 17 percent. However, the median increase in premiums was 20 percent — one fifth. And the biggest increase, 68 percent, took place in Washington State — a state where the Insurance Commissioner already enjoys the power of “prior approval” of rate increases encouraged by ObamaCare!

A previous study of mine showed that state markets for health insurance became more concentrated during the years from 2003 through 2008, according to the Herfindahl-Hirschman Index (HHI). The HHI measures market concentration as follows: If there are four competitors in a market, each with 25 percent share, the HHI= (25^2) + (25^2) + (25^2) + (25^2) = 2,500. If the shares are 50 percent, 25 percent, 15 percent, and 10 percent, the HHI = (50^2) + (25^2) + (15^2) + (10^2) = 3,450.

For the weighted average of health plans in the 41 states sampled in the previous study, the HHI increased 28 percent over the period, from 2,282 to 3,184. This conclusion, however, must be tempered by the observation that there is no evidence that concentration of health plans within states is significantly worse than concentration of insurers in other lines of business, generally speaking, as shown in my study.

Nevertheless, the HHI is the first place government regulators look when seeking excuses to interfere in markets. A recently released analysis calculates the HHI for 2010, in both individual and small-group markets. For the small-group market, the analysis calculates a national median HHI of 3,595, a slightly higher measure of concentration than estimated in my previous study (which combined the individual, small-group, and large-group markets). The state with the greatest concentration was Alabama, which a score of 9,175; and the least concentrated state was Pennsylvania, with a score of 1,579.

Counter intuitively, the states with the highest degree of concentration do not suffer the highest premiums. On the contrary, the correlation between the states’ HHIs reported here and the premiums reported for 2010 in Table one is negative 0.16! If federal and state regulators look to the HHI as their key measurement of competition in health insurance, it will lead them to do even more harmful interventions than they already have.

Interesting. But consistent with the view that you don’t need a lot of competitors to have robust competition.

Nice post.

The only thing that I want the government to do in order to make health insurance more comeptitive is to allow insurers to compete across state lines and require full disclosure of benefits.

The inability to compete across state lines does seem nonsensical. Can someone explain briefly why such a rule was implemented in the first place?

The part about Obamacare that I like is the creation of coops – 501(c)(29)s.

In order for a not-for profit to fully earn its tax-exempt status, it has to set itself apart from its for-profit competitors.

I have about 30 pages of IRS rulings and papers that attest to this fact.

This is true, whether the not-for-profit is a museum, a debt collection agency, or an insurer.

How this will work out with 501(c)(29)s, I would not even attempt to answer.

But, with 501(c)(3)s and 501(c)(4)s, as not-for-profit insurers, they must not offer insurance that is available commercially.

This is what is stated in IRC section 501(m), which stripped Blue Cross (and similar insurers) of their federal not-for-profit status.

The rise and flourishing of truly earned not-for profit insurers could see a wave of entities that really compete with the Aetnas and United Health Cares, but not on the commercial’s terms.

Rather, they will compete by distinguishing themselves from the for-profits, the Chosen Insurers, if you will.

Shalom,

Don Levit