Taxpayer Subsidized Coverage Rising

According to a new report by the Congressional Budget office health coverage paid for by U.S. taxpayers is expect to rise over the next 10 years.

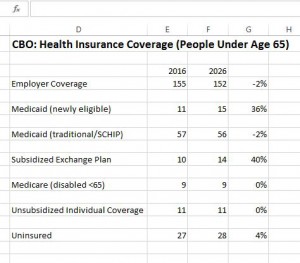

Families with employer coverage are expected to decline by 2% from 2016 through 2026. Unsubsidized individual medical coverage is not expected to change. Traditional Medicaid and SCHIP — those eligible for Medicaid prior to the Affordable Care Act (ACA) — is expected to decline slightly, while the uninsured is expected to increase slightly. All told, traditional Medicaid will fall by 1 million people while the uninsured will rise by 1 million people. The disabled with Medicare coverage is also not expected to change.

Where all the growth in health coverage will occur is subsidized plans. Individuals with subsidized coverage through the federal and state exchanges are expected to increase by 40%, while those newly eligible for Medicaid due to the ACA will increase by 36%.

I trust the CBO about as much as I trust Hillary because they are always wrong.

Here is an example—Three years ago, on the eve of Obamacare’s implementation, the Congressional Budget Office (CBO) projected that President Obama’s centerpiece legislation would result in an average of 201 million people having private health insurance in any given month of 2016. Now that 2016 is here, the CBO says that just 177 million people, on average, will have private health insurance in any given month of this year – a shortfall of 24 million people.—

Do you trust someone who is always wrong?

It’s not the actual numbers that bother me so much. It’s the fact that even of those that are insured, many are having a hard time affording it, as well as medical care. I’m willing to give them a break on the numbers, but the law darn sure hasn’t made anything to do with health care more affordable.

Ron, my understanding of the CBO is that they use the numbers they are told to use. Thus if the CBO believes there are other costs to the ACO they don’t incorporate those costs unless Congress permits them to do so.

That is how Obamacare was determined to be revenue neutral. A lot of revenue from taxes were added even if they would never exist and a lot of expenses weren’t included because they weren’t included in Congresses request.

Thus Obamacare was deemed revenue neutral even though it wasn’t and the 1 year cost was estimated based upon 10 years of Obamacare where the first 4 yrs had almost no payments but had revenue coming in.

While the CBO is non-partisan, it is often wrong as Ron notes. I remember back in 2009 CBO projected that Medicare spending would total 3.6% of GDP by 2015. The actual number came in at 3.0% of GDP, a difference of more than $100 billion. Vice President Biden would probably say that’s a big f*** deal.

My interpretation of the numbers Devon published is that before the ACA, just about everyone who wanted health insurance and could afford it already had it. Most of the new enrollees either now have Medicaid or a very heavily subsidized exchange plan. How to cover the pre-ACA uninsured then boils down to how do we subsidize them and by how much, should we increase the income eligibility limit for Medicaid and, if so, by how much, should we have high risk pools for those who can’t pass underwriting, and how do we pay for it all?

The pre-ACA uninsured totaled close to 50 million people or, perhaps, 40 million excluding the illegal immigrants. I estimate it would cost at least $200 billion per year to cover those 40 million people. I suspect relatively little of that sum could be extracted from that population even if more than half of them could be covered by relatively inexpensive underwritten private insurance. Raising taxes to cover this cost is where the rub is at the end of the day.

Remember that even within Medicare, in any given year the healthiest 50% of seniors only account about 4% of Medicare spending though they are, of course, not the same people from one year to the next.

Ohh thank god. I was worried for a secound. Based on the numbers above I don’t think we have anything to worry about. By 2026 we will be over 30trillion in debt, the U.S. Will file bankruptcy .we will have a Third World War and the world economy will have a reset.

We get to start completely over with a new fiat currency. The bright side is a car will only cost about 900 drakmas! 😄

You worry too much big Ham 🙂 When “relatively little of that sum could be extracted from that population” we can find another population to extract it from. Unfortunately “Raising taxes to cover this cost is where the rub is at the end of the day.” Darn… if only people wouldn’t object to raising taxes the problem could be solved. I guess that leaves borrow because we haven’t learned how to take money, invest it and create more money. We only know how to spend.

Here is the score. Some employers are going to drop employee health plans because the cost is rising. Or maybe people will seek out employers who don’t offer coverage but pay higher wages. About 1 million will remain uninsured because they cannot afford Obamacare and don’t qualify for subsidies or Medicaid. Taxpayers will bear the brunt of the cost. It’s not a good sign. IF costs rise to the degree they have so far, I suspect the uninsured will climb even higher and the number of people who qualify for subsidies will also rise.

Employer coverage -3 million

Medicaid (total) +3 million

Subsidized Obamacare +4 million

Uninsured +1 million

The CBO says that the employer penalty will be $30 billion in 2026. At $3,000 per employee that is 10,000,000 employees in companies over 50 full time employees. That is a high percentage in this group.

If the current $9,000 a year employer-based health insurance doubles to $18,000 a year, for single coverage, the itty-bitty $3,000 IRS penalty would be very appealing to employers and then their employees could get tens of thousands of federal tax credits each year to purchase individual insurance. If you keep their pay down.

The 2017 the deductibles will rise to $7,150. By 2016 the deductibles will be over $10,000 and single coverage will be $18,000 a year for employer-based health insurance.

Subsidized Obamacare +4 million (This is a joke)

We need much larger IRS penalties.

“We need much larger IRS penalties.”

No, we need the government out of health care and we need to have our freedoms returned so that IF we want to buy insurance we can, and if not, then that is okay, too. People cannot afford to pay $7,000- $10,000 per year in insurance and have $6,000-$12,600 in deductibles- which means insurance they cannot afford to ever use!

Up until this year, my husband and I have had Individual Insurance Premiums (since 1995) that have cost us over $120,000 in premiums and we have used maybe $10,000 in care. Had we invested those premium payments we would have still paid out the $10,000 and had a nice nest egg for our retirement.

In January of this year our premiums were set to jump up from $553.52 to $698.98 per month. This plan covered ONE doctor visit per year per person, had a $200 deductible for pharmaceuticals and then paid out up to $200 only, had a $2500 deductible per family and was a 70/30 plan. We obviously could not afford to use this plan very well as even a minor surgery would have set us back about $10,000 in bills. We were able to finally get a family plan (just the husband and I) for $404.00 per month, with a $6000 deductible, but we can go to the doctor when we need to and pay a co-pay (and I would not mind paying the doctor bill completely if they were not $200-$300 per visit), and we have a good pharmaceutical plan (we rarely use this as in maybe once every 5-7 years as we are not sick and use alternative herbal healthcare we do ourselves), and it is an 80/20 plan.

Not everyone has the employer option (we did not for 20 years) and then one is stuck with excessively high premiums with little to no care for the money one is paying out.

I have made it my mission to learn about herbs/food/non-food items for medical care so that we do not have to run to the doctor for simple items that are the bread and butter of many physician’s offices (rashes, pink eye, bronchitis/pleurisy, etc) as I have learned how to treat these and other ailments naturally. I also had 6 of my 8 kids at home, which saved us literally over $30,000 in medical care.

We only eat real food (as God created it) and nothing boxed (very little canned unless I have canned it), and raise some of our own food. We also buy grass-fed meats, farm eggs, local real maple syrup, and raw honey from a farm. We do not use ANY vegetable oils, only use real butter, virgin olive oil, pastured lard and tallow, virgin palm oil and coconut oils.

We avoid routine x-rays (medical and dental).

We work hard for our money and we want to be able to keep as much of it as we can.

Obamacare raised our premiums from $313.49 in 2010 to $698.98 in 2016. No change in the plan, just in amount we had to pay, and it was a lousy plan. We could not afford to change to another individual plan as ours was grandfathered in and did not have all the Obamacare mandates (birth control,/pregnancy, etc) which we do not need. It also would have raised our rates even higher.

Obamacare is bankrupting people and making them do without. Just because someone has insurance does not mean that they can afford to use the insurance or that they can in any way benefit from it unless they had a major issue like a heart attack, and then, because the coverage was so sketchy, one would have to file bankruptcy.

How is this good for America?

If America was a person today,

There Income would be $51,000 year.

There Expenses would be $$60,500 per Year.

There deficit Would be $9,500

There Current Debit would be $311,000

They would have a balloon payment(unfunded Liabilities) of $3,600,000

Would anyone loan this person money?

The Blues Association said premiums for MarketPlace plans are shooting up because people signing up are sicker. Those jumping on the bandwagon are more likely to be diabetics, have HIV and hepatitis C and other diseases caused by risky behaviors and bad habits. The bureaucrat solution is to make it harder to enroll after open enrollment has ended. Do they really think that will make a difference? By making the intravenous drug user with hepatitis C and HIV enroll earlier it’s gonna make the plans solvent? Good grief!